Answered step by step

Verified Expert Solution

Question

1 Approved Answer

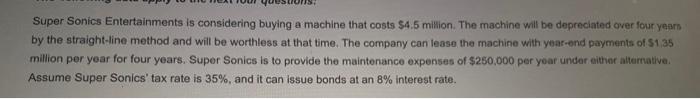

36 Super Sonics Entertainments is considering buying a machine that costs $4.5 million. The machine will be depreciated over four year by the straight-line method

36

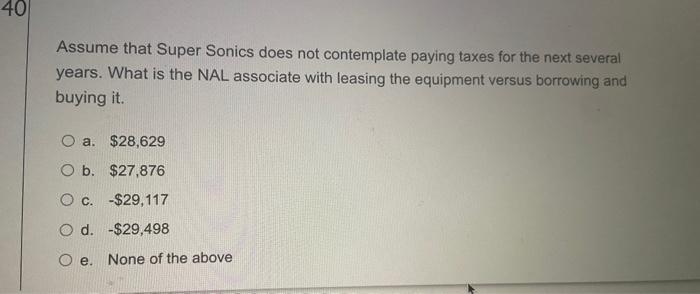

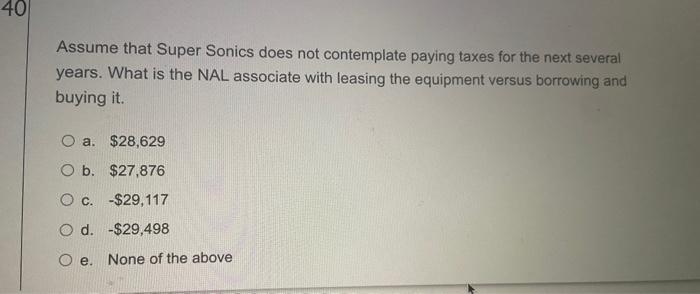

Super Sonics Entertainments is considering buying a machine that costs $4.5 million. The machine will be depreciated over four year by the straight-line method and will be worthless at that time. The company can lease the machine with year-end payments of $1,35 million per year for four years. Super Sonics is to provide the maintenance expenses of $250,000 per yoar under ethvee alternative Assume Super Sonics' tax rate is 35%, and it can issue bonds at an 8% interest rate. 40 Assume that Super Sonics does not contemplate paying taxes for the next several years. What is the NAL associate with leasing the equipment versus borrowing and buying it. O a. $28,629 O b. $27,876 Oc. -$29,117 O d. -$29,498 Oe. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started