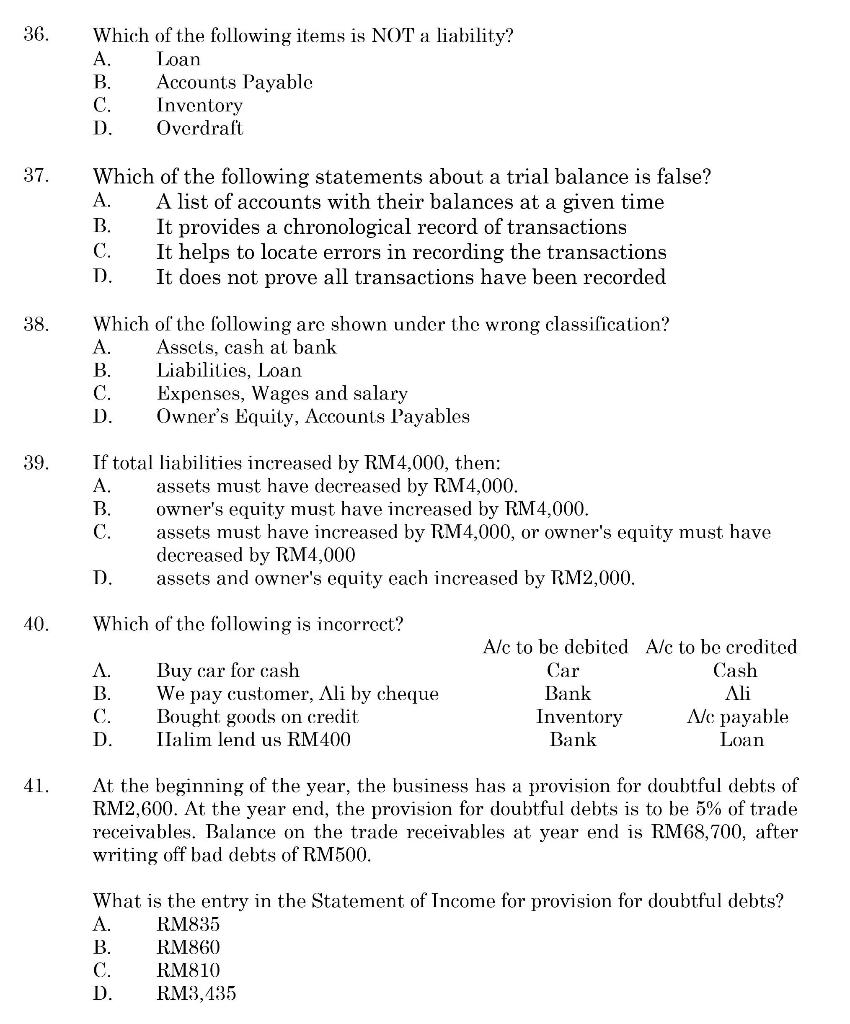

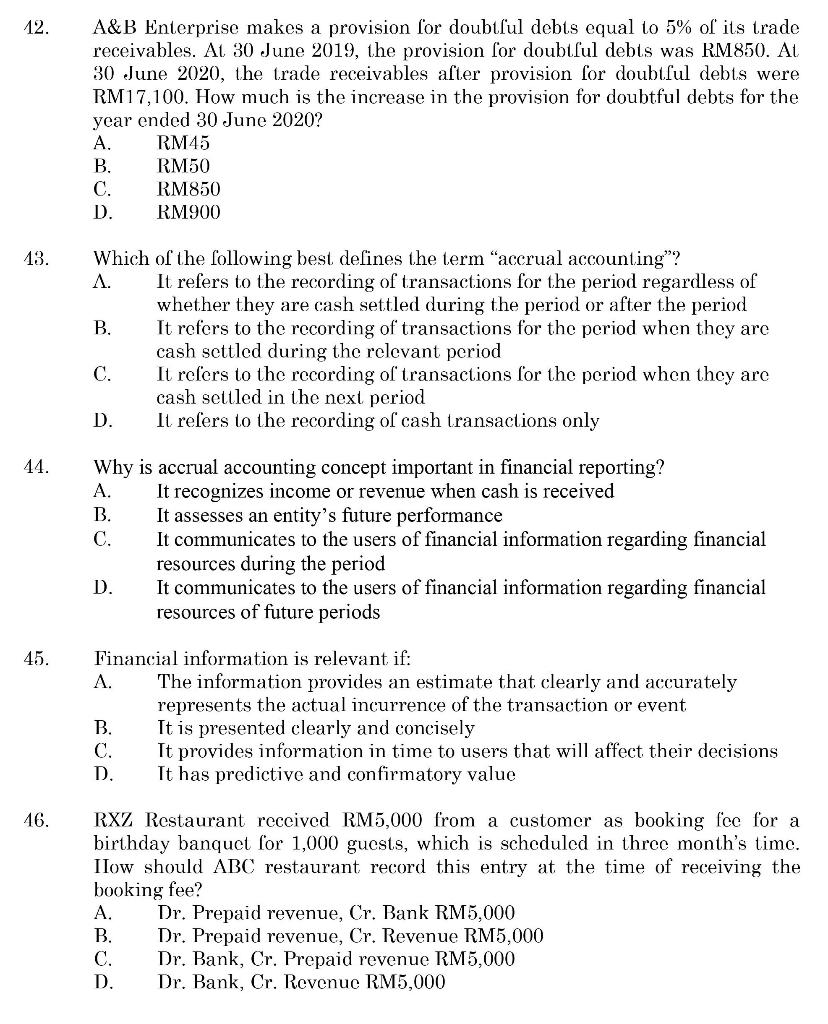

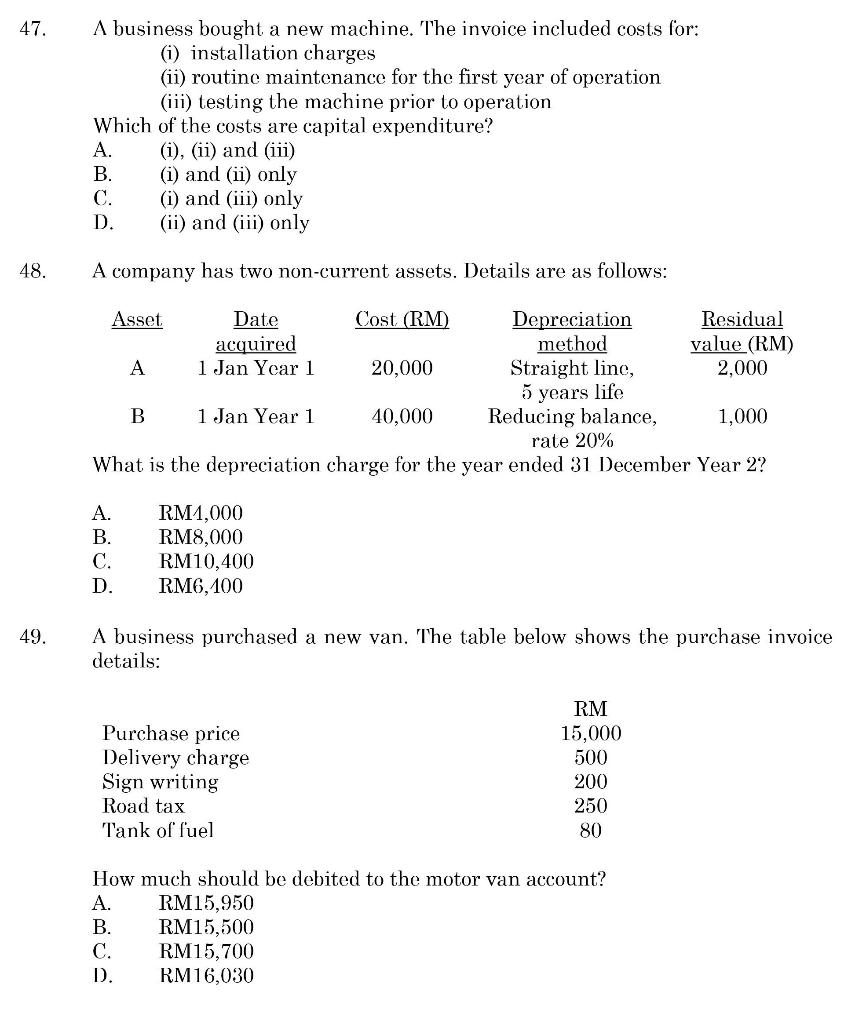

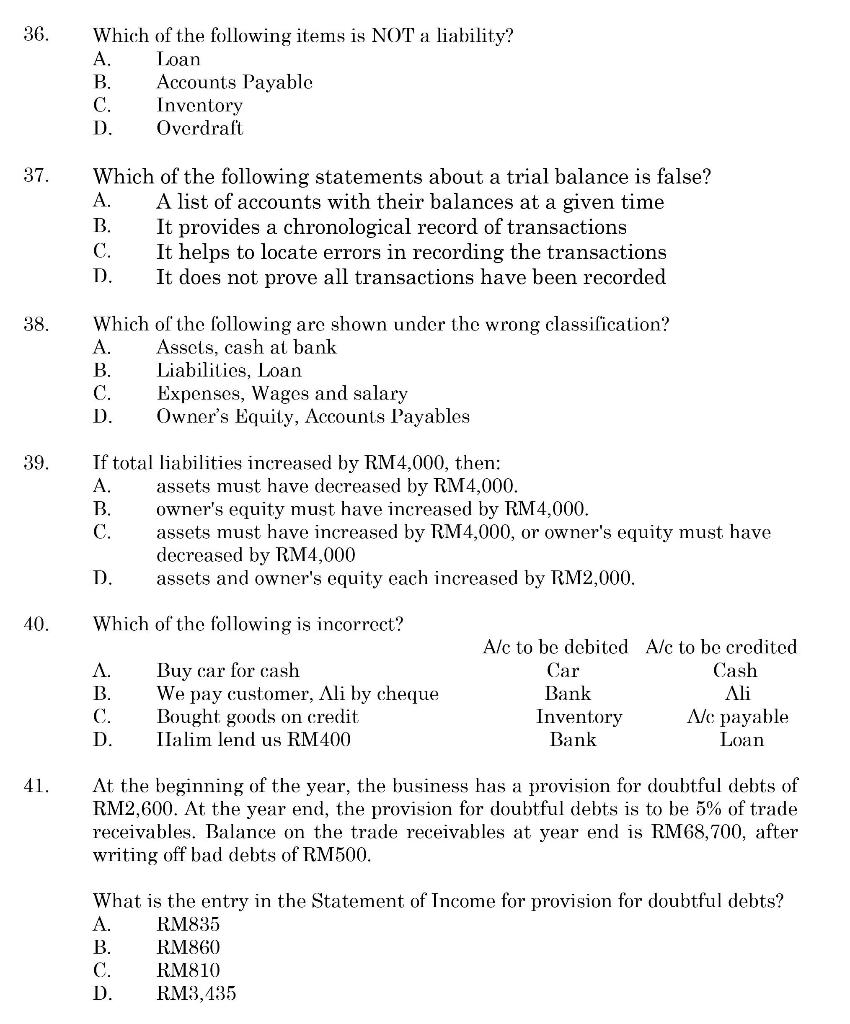

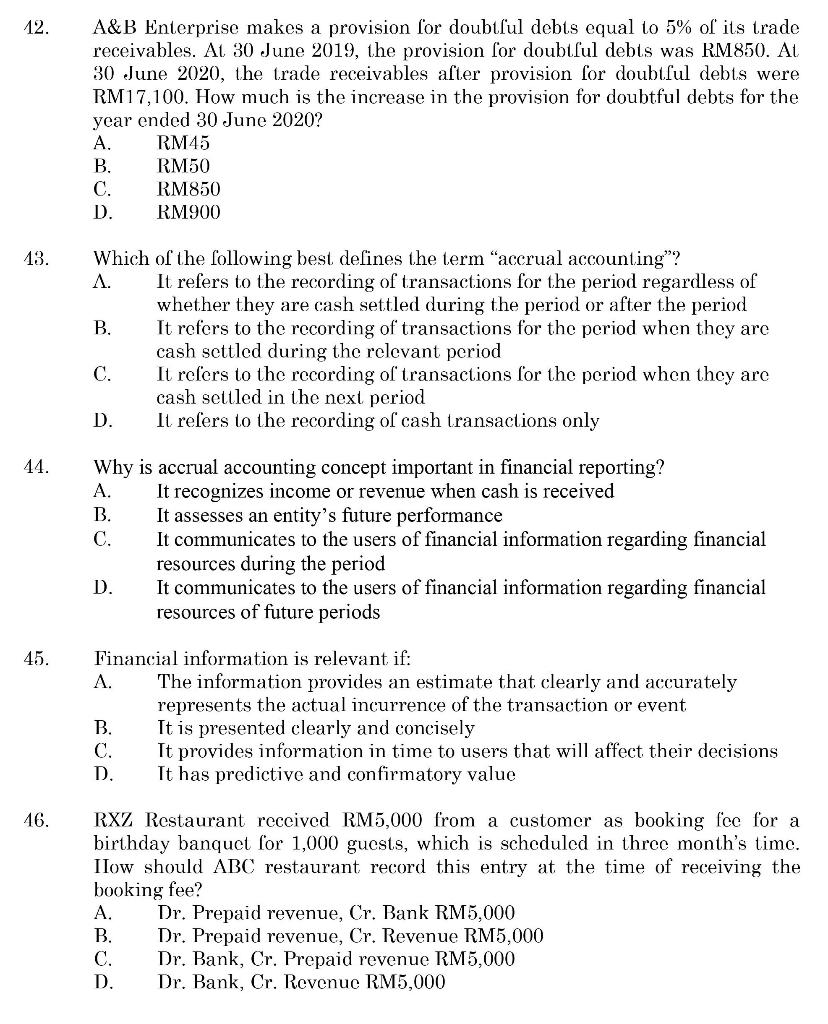

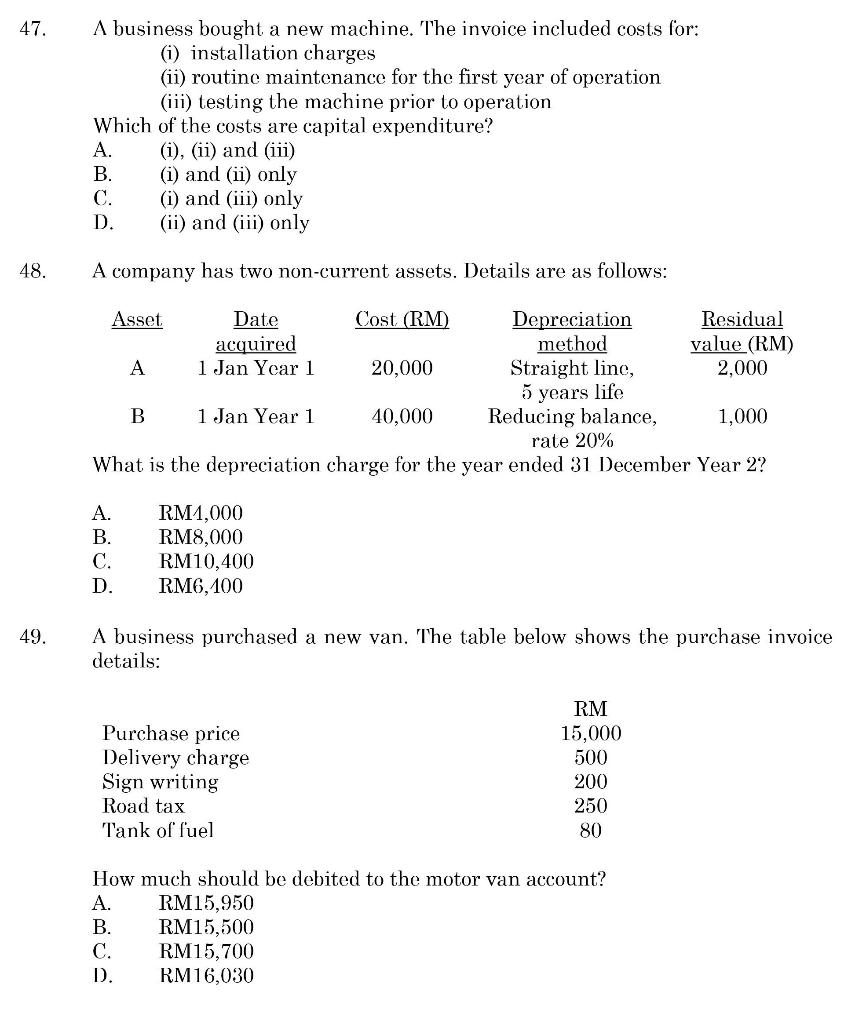

36. Which of the following items is NOT a liability? A. Loan B. Accounts Payable C. Inventory D. Overdraft 37. Which of the following statements about a trial balance is false? A. A list of accounts with their balances at a given time B. It provides a chronological record of transactions C. It helps to locate errors in recording the transactions D. It does not prove all transactions have been recorded 38. Which of the following are shown under the wrong classification? A. Assets, cash at bank B. Liabilities, Loan C. Expenses, Wages and salary D. Owner's Equity, Accounts Payables If total liabilities increased by RM4,000, en: A. assets must have decreased by RM4,000. B. owner's equity must have increased by RM4,000. C. assets must have increased by RM4,000, or owner's equity must have decreased by RM4,000 D. assets and owner's equity each increased by RM2,000. 40. Which of the following is incorrect? A. B. C. D. Ali Alc to be debited A/c to be credited Car Cash Bank Inventory Nc payable Bank Loan Buy car for cash We pay customer, Ali by cheque Bought goods on credit Ilalim lend us RM400 41. At the beginning of the year, the business has a provision for doubtful debts of RM2,600. At the year end, the provision for doubtful debts is to be 5% of trade receivables. Balance on the trade receivables at year end is RM68,700, after writing off bad debts of RM500. What is the entry in the Statement of Income for provision for doubtful debts? A. RM835 B. RM860 C. RM810 D. RM3,135 12. A&B Enterprise makes a provision for doubtul debts equal to 5% of its trade receivables. At 30 June 2019, the provision for doubtful debts was RM850. At 30 June 2020, the trade receivables after provision for doubtful debts were RM17,100. How much is the increase in the provision for doubtful debts for the year ended 30 June 2020? A. RM45 B. RM50 C. RM850 D. RM900 13. Which of the following best defines the term accrual accounting? A. It refers to the recording of transactions for the period regardless of whether they are cash settled during the period or after the period B. It refers to the recording of transactions for the period when they are cash settled during the relevant period C. It refers to the recording of transactions for the period when they are cash settled in the next period D. It refers to the recording of cash transactions only 44. Why is accrual accounting concept important in financial reporting? A. It recognizes income or revenue when cash is received B. It assesses an entity's future performance C. It communicates to the users of financial information regarding financial resources during the period D. It communicates to the users of financial information regarding financial resources of future periods 45. Financial information is relevant if: A. The information provides an estimate that clearly and accurately represents the actual incurrence of the transaction or event B. It is presented clearly and concisely C. It provides information in time to users that will affect their decisions D. It has predictive and confirmatory value 46. RXZ Restaurant received RM5,000 from a customer as booking fee for a birthday banquet for 1,000 guests, which is scheduled in three month's time. Ilow should ABC restaurant record this entry at the time of receiving the booking fee? A. Dr. Prepaid revenue, Cr. Bank RM5,000 B. Dr. Prepaid revenue, Cr. Revenue RM5,000 C. Dr. Bank, Cr. Prepaid revenue RM5,000 D. Dr. Bank, Cr. Revenue RM5,000 47. A business bought a new machine. The invoice included costs for: (i) installation charges (ii) routine maintenance for the first year of operation (iii) testing the machine prior to operation Which of the costs are capital expenditure? A. (i), (ii) and (iii) B. (i) and (ii) only C. (i) and (iii) only D. (ii) and (iii) only 48. A company has two non-current assets. Details are as follows: Asset Date Cost (RM) Depreciation Residual acquired method value (RM) A 1 Jan Year 1 20,000 Straight line, 2,000 5 years life B 1 Jan Year 1 40,000 Reducing balance, 1,000 rate 20% What is the depreciation charge for the year ended 31 December Year 2? A. B. C. D. RM4,000 RM8,000 RM10,400 RM6, 100 49. A business purchased a new van. The table below shows the purchase invoice details: Purchase price Delivery charge Sign writing Road tax Tank of fuel RM 15,000 500 200 250 80 How much should be debited to the motor van account? A. RM15,950 B. RM15,500 C. RM15,700 D. RM16,030