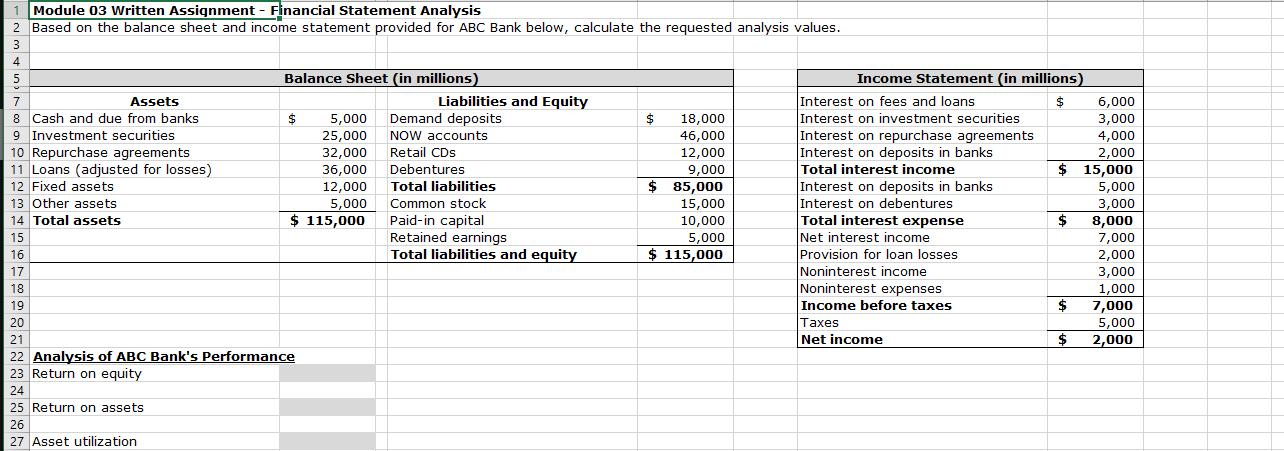

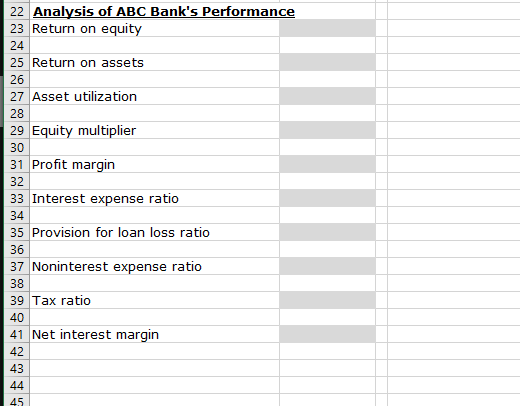

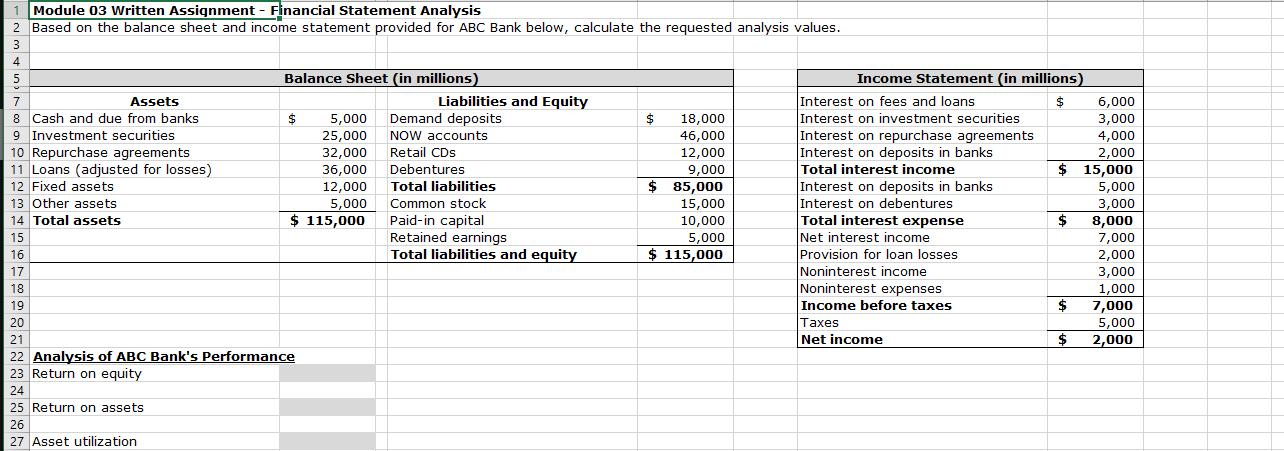

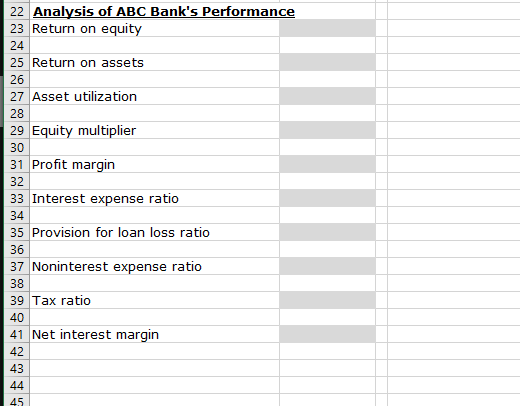

36,000 Module 03 Written Assignment - Financial Statement Analysis 2 Based on the balance sheet and income statement provided for ABC Bank below, calculate the requested analysis values. 3 4 Balance Sheet (in millions) Income Statement (in millions) 7 Assets Liabilities and Equity Interest on fees and loans $ 6,000 8 Cash and due from banks $ 5,000 Demand deposits $ 18,000 Interest on investment securities 3,000 9 Investment securities 25,000 NOW accounts 46,000 Interest on repurchase agreements 4,000 10 Repurchase agreements 32,000 Retail CDs 12,000 Interest on deposits in banks 2,000 11 Loans (adjusted for losses) Debentures 9,000 Total interest income $ 15,000 12 Fixed assets 12,000 Total liabilities $ 85,000 Interest on deposits in banks 5,000 13 Other assets 5,000 Common stock 15,000 Interest on debentures 3,000 14 Total assets $ 115,000 Paid-in capital 10,000 Total interest expense $ 8,000 15 Retained earnings 5,000 Net interest income 7,000 16 Total liabilities and equity $ 115,000 Provision for loan losses 2,000 17 Noninterest income 3,000 18 Noninterest expenses 1,000 19 Income before taxes $ 7,000 20 Taxes 5,000 21 Net income $ 2,000 22 Analysis of ABC Bank's Performance 23 Return on equity 24 25 Return on assets 26 27 Asset utilization 22 Analysis of ABC Bank's Performance 23 Return on equity 24 25 Return on assets 26 27 Asset utilization 28 29 Equity multiplier 30 31 Profit margin 32 33 Interest expense ratio 34 35 Provision for loan loss ratio 36 37 Noninterest expense ratio 38 39 Tax ratio 40 41 Net interest margin 42 43 44 45 36,000 Module 03 Written Assignment - Financial Statement Analysis 2 Based on the balance sheet and income statement provided for ABC Bank below, calculate the requested analysis values. 3 4 Balance Sheet (in millions) Income Statement (in millions) 7 Assets Liabilities and Equity Interest on fees and loans $ 6,000 8 Cash and due from banks $ 5,000 Demand deposits $ 18,000 Interest on investment securities 3,000 9 Investment securities 25,000 NOW accounts 46,000 Interest on repurchase agreements 4,000 10 Repurchase agreements 32,000 Retail CDs 12,000 Interest on deposits in banks 2,000 11 Loans (adjusted for losses) Debentures 9,000 Total interest income $ 15,000 12 Fixed assets 12,000 Total liabilities $ 85,000 Interest on deposits in banks 5,000 13 Other assets 5,000 Common stock 15,000 Interest on debentures 3,000 14 Total assets $ 115,000 Paid-in capital 10,000 Total interest expense $ 8,000 15 Retained earnings 5,000 Net interest income 7,000 16 Total liabilities and equity $ 115,000 Provision for loan losses 2,000 17 Noninterest income 3,000 18 Noninterest expenses 1,000 19 Income before taxes $ 7,000 20 Taxes 5,000 21 Net income $ 2,000 22 Analysis of ABC Bank's Performance 23 Return on equity 24 25 Return on assets 26 27 Asset utilization 22 Analysis of ABC Bank's Performance 23 Return on equity 24 25 Return on assets 26 27 Asset utilization 28 29 Equity multiplier 30 31 Profit margin 32 33 Interest expense ratio 34 35 Provision for loan loss ratio 36 37 Noninterest expense ratio 38 39 Tax ratio 40 41 Net interest margin 42 43 44 45