Answered step by step

Verified Expert Solution

Question

1 Approved Answer

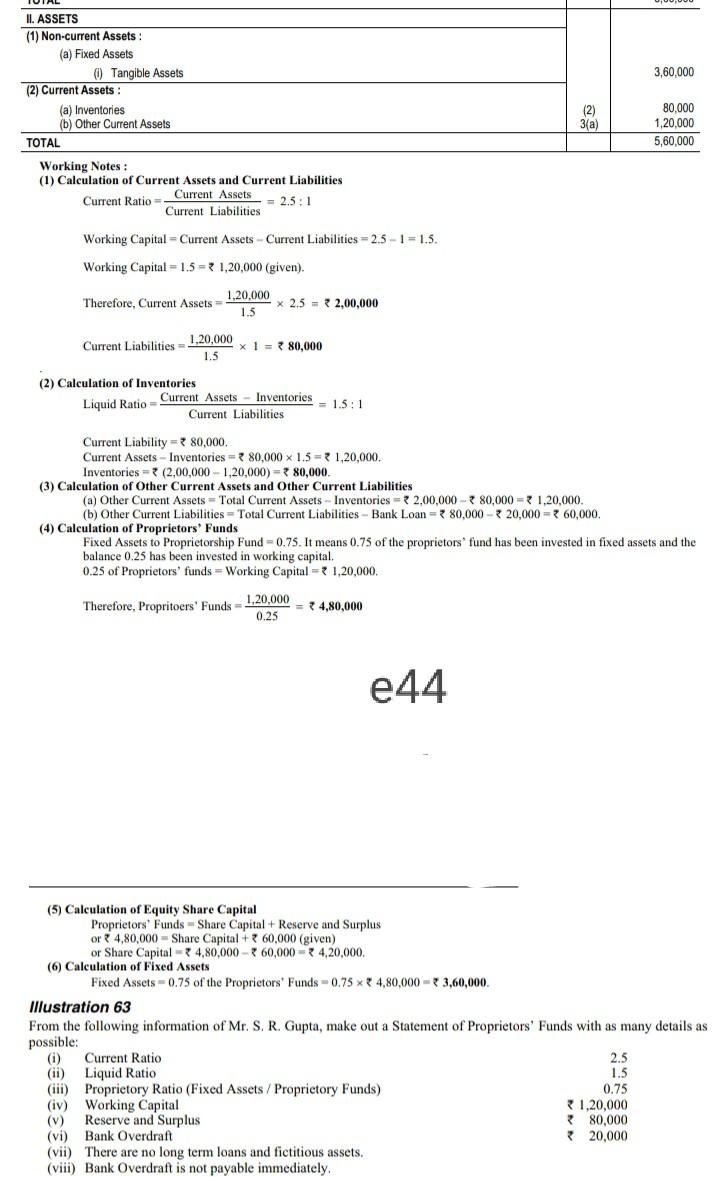

3,60,000 IL ASSETS (1) Non-current Assets : (a) Fixed Assets Tangible Assets (2) Current Assets : (a) Inventories (b) Other Current Assets TOTAL 3(a) 80,000

3,60,000 IL ASSETS (1) Non-current Assets : (a) Fixed Assets Tangible Assets (2) Current Assets : (a) Inventories (b) Other Current Assets TOTAL 3(a) 80,000 1,20,000 5,60,000 Working Notes: (1) Calculation of Current Assets and Current Liabilities Current Ratio Current Assets = 2.5: 1 Current Liabilities Working Capital = Current Assets - Current Liabilities=2.5 -1 = 1.5. Working Capital = 1,5 = 1,20,000 (given). Therefore, Current Assets 1,20,000 1.5 2.5 = 2,00,000 Current Liabilities 1,20,000 1.5 x1 = 380,000 (2) Calculation of Inventories Current Assets Inventories Liquid Ratio Current Liabilities = 1.5: 1 Current Liability = 80,000. Current Assets - Inventories = 380,000 x 1.5 = 1,20,000. Inventories=(2,00,000 -1,20,000) = 380,000. (3) Calculation of Other Current Assets and Other Current Liabilities (a) Other Current Assets = Total Current Assets - Inventories = 2,00,000 - 80,000 = 1,20,000. (b) Other Current Liabilities = Total Current Liabilities - Bank Loan = 380,000 - 20,000 = 60,000 (4) Calculation of Proprietors' Funds Fixed Assets to Proprietorship Fund 0.75. It means 0.75 of the proprietors' fund has been invested in fixed assets and the balance 0.25 has been invested in working capital 0.25 of Proprietors' funds Working Capital = 1,20,000 Therefore, Propritoers' Funds - 1,20,000 = 4,80,000 0.25 e44 (5) Calculation of Equity Share Capital Proprietors' Funds Share Capital + Reserve and Surplus or 4,80,000 - Share Capital + 60,000 (given) or Share Capital = 4,80,000 - 60,000 = 4,20,000, (6) Calculation of Fixed Assets Fixed Assets - 0.75 of the Proprietors' Funds -0.75 x 4,80,000 - 3,60,000. Illustration 63 From the following information of Mr. S. R. Gupta, make out a Statement of Proprietors' Funds with as many details as possible: (0) Current Ratio 2.5 (ii) Liquid Ratio 1.5 (iii) Proprietory Ratio (Fixed Assets / Proprietory Funds) 0.75 (iv) Working Capital 1,20,000 (v) Reserve and Surplus 80,000 (vi) Bank Overdraft 20,000 (vii) There are no long term loans and fictitious assets. (viii) Bank Overdraft is not payable immediately

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started