Answered step by step

Verified Expert Solution

Question

1 Approved Answer

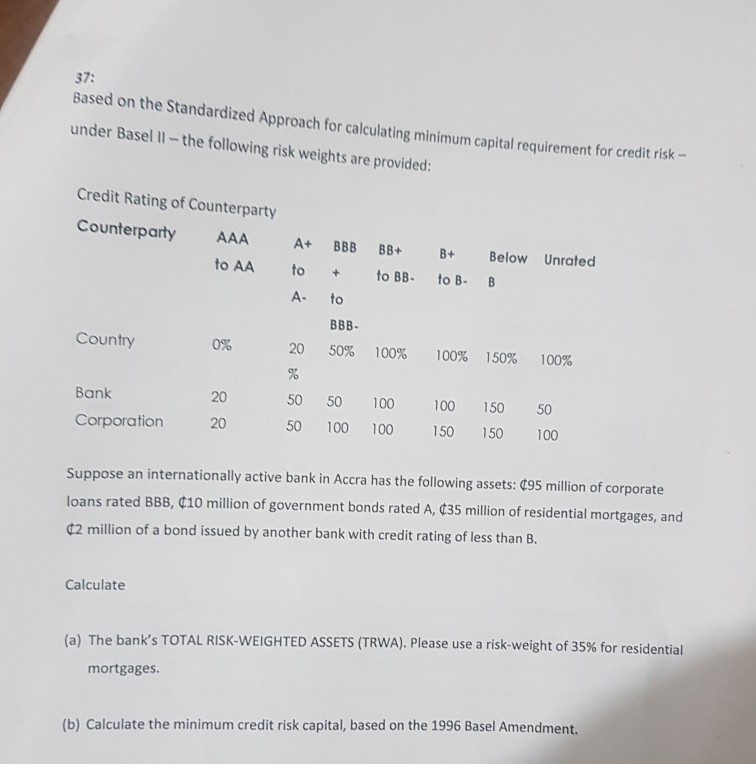

37: Based on the Standardized Approach for calculating minimum capital requirement for credit risk -- under Basel 1l - the following risk weights are provided:

37: Based on the Standardized Approach for calculating minimum capital requirement for credit risk -- under Basel 1l - the following risk weights are provided: Credit Rating of Counterparty Counterparty AAA to AA A+ BBB BB+ B+ Below Unrated to + to BB- to B- A. to BBB- Country 0% 20 50% 100% 100% 50% 100% % Bank 20 50 50 100 100 150 50 Corporation 20 50 100 100 150 150 100 Suppose an internationally active bank in Accra has the following assets: (95 million of corporate loans rated BBB, 410 million of government bonds rated A, (35 million of residential mortgages, and (2 million of a bond issued by another bank with credit rating of less than B. Calculate (a) The bank's TOTAL RISK-WEIGHTED ASSETS (TRWA). Please use a risk-weight of 35% for residential mortgages (b) Calculate the minimum credit risk capital, based on the 1996 Basel Amendment. 37: Based on the Standardized Approach for calculating minimum capital requirement for credit risk -- under Basel 1l - the following risk weights are provided: Credit Rating of Counterparty Counterparty AAA to AA A+ BBB BB+ B+ Below Unrated to + to BB- to B- A. to BBB- Country 0% 20 50% 100% 100% 50% 100% % Bank 20 50 50 100 100 150 50 Corporation 20 50 100 100 150 150 100 Suppose an internationally active bank in Accra has the following assets: (95 million of corporate loans rated BBB, 410 million of government bonds rated A, (35 million of residential mortgages, and (2 million of a bond issued by another bank with credit rating of less than B. Calculate (a) The bank's TOTAL RISK-WEIGHTED ASSETS (TRWA). Please use a risk-weight of 35% for residential mortgages (b) Calculate the minimum credit risk capital, based on the 1996 Basel Amendment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started