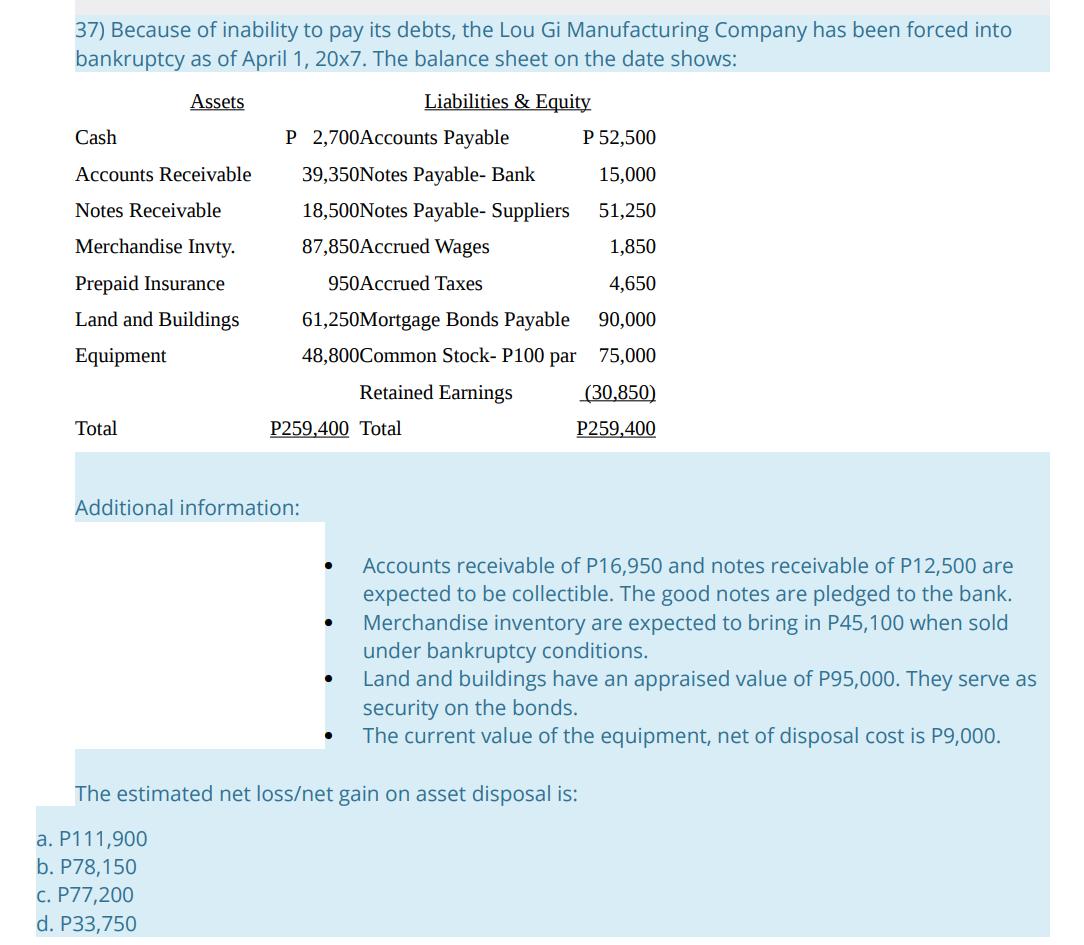

37) Because of inability to pay its debts, the Lou Gi Manufacturing Company has been forced into bankruptcy as of April 1, 20x7. The

37) Because of inability to pay its debts, the Lou Gi Manufacturing Company has been forced into bankruptcy as of April 1, 20x7. The balance sheet on the date shows: Assets Cash Accounts Receivable Notes Receivable Merchandise Invty. Prepaid Insurance Land and Buildings Equipment Total P 2,700Accounts Payable Liabilities & Equity 39,350Notes Payable- Bank 18,500Notes Payable- Suppliers Additional information: 87,850Accrued Wages 950Accrued Taxes P259,400 Total 61,250Mortgage Bonds Payable 48,800Common Stock- P100 par Retained Earnings P 52,500 15,000 51,250 1,850 4,650 90,000 75,000 (30,850) P259,400 Accounts receivable of P16,950 and notes receivable of P12,500 are expected to be collectible. The good notes are pledged to the bank. Merchandise inventory are expected to bring in P45,100 when sold under bankruptcy conditions. Land and buildings have an appraised value of P95,000. They serve as security on the bonds. The current value of the equipment, net of disposal cost is P9,000. The estimated net loss/net gain on asset disposal is: a. P111,900 b. P78,150 c. P77,200 d. P33,750

Step by Step Solution

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To find the estimated net loss or net gain on asset disposal for the Lou Gi Manufacturing ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards