Question

41) G, H, and I invest P50,000, P35,000 and P20,000 respectively, in a partnership on June 30, 20x7. They agree to divide net income

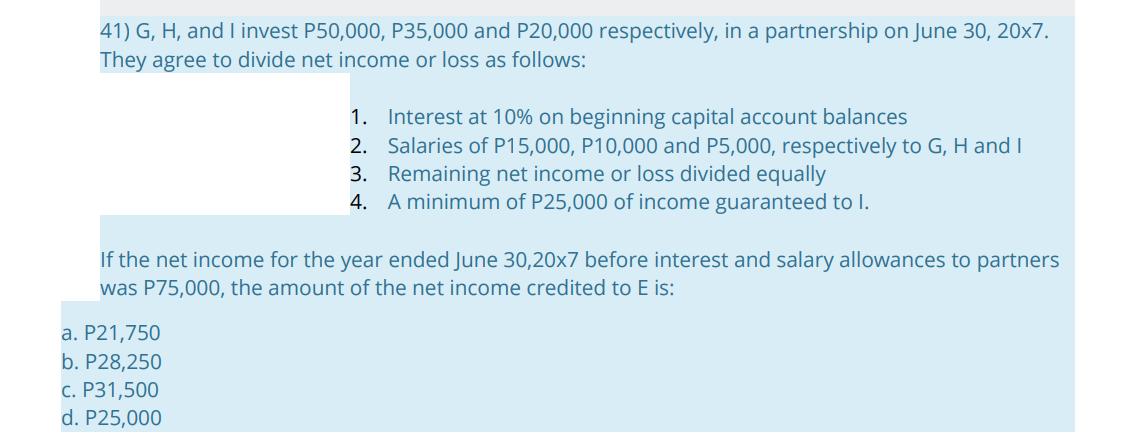

41) G, H, and I invest P50,000, P35,000 and P20,000 respectively, in a partnership on June 30, 20x7. They agree to divide net income or loss as follows: 1. Interest at 10% on beginning capital account balances 2. Salaries of P15,000, P10,000 and P5,000, respectively to G, H and I Remaining net income or loss divided equally 3. 4. A minimum of P25,000 of income guaranteed to I. If the net income for the year ended June 30,20x7 before interest and salary allowances to partners was P75,000, the amount of the net income credited to E is: a. P21,750 b. P28,250 c. P31,500 d. P25,000

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below optio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Glencoe Accounting First Year Course

Authors: Andrée Vary

1st Edition

978-0078688294, 0078688299

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App