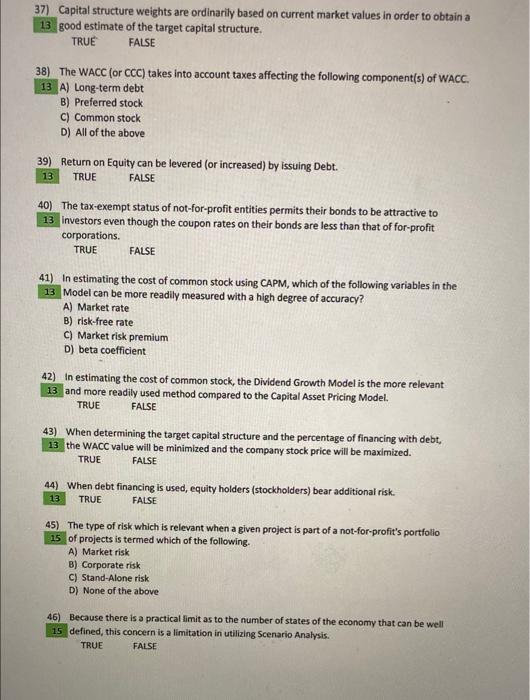

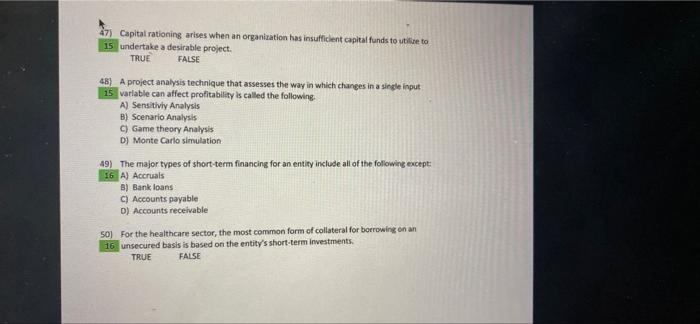

37) Capital structure weights are ordinarily based on current market values in order to obtain a 13. good estimate of the target capital structure. TRUE FALSE 38) The WACC (or CCC) takes into account taxes affecting the following component(s) of WACC. 13 A) Long-term debt B) Preferred stock C) Common stock D) All of the above 39) Return on Equity can be levered (or increased) by issuing Debt. 13 TRUE FALSE 40) The tax-exempt status of not-for-profit entities permits their bonds to be attractive to 13 investors even though the coupon rates on their bonds are less than that of for-profit corporations. TRUE FALSE 41) In estimating the cost of common stock using CAPM, which of the following variables in the 13 Model can be more readily measured with a high degree of accuracy? A) Market rate B) risk-free rate C) Market risk premium D) beta coefficient 42) In estimating the cost of common stock, the Dividend Growth Model is the more relevant 13 and more readily used method compared to the Capital Asset Pricing Model. TRUE FALSE 43) When determining the target capital structure and the percentage of financing with debt, 13 the WACC value will be minimized and the company stock price will be maximized. FALSE 44) When debt financing is used, equity holders (stockholders) bear additional risk FALSE TRUE 13 TRUE 45) The type of risk which is relevant when a given project is part of a not-for-profit's portfolio 15 of projects is termed which of the following. A) Market risk B) Corporate risk C) Stand-Alone risk D) None of the above 46) Because there is a practical limit as to the number of states of the economy that can be well 15 defined, this concern is a limitation in utilizing Scenario Analysis. TRUE FALSE 47) Capital rationing arises when an organization has insufficient capital funds to utilize to 15 undertake a desirable project TRUE FALSE 48) A project analysis technique that assesses the way in which changes in a single input 15 variable can affect profitability is called the following A) Sensitivly Analysis B) Scenario Analysis C) Game theory Analysis DJ Monte Carlo simulation 49. The major types of short-term financing for an entity include all of the following except: 16 A) Accruals B) Bank loans c) Accounts payable D) Accounts receivable 50] For the healthcare sector, the most common form of collateral for borrowing on an 16 unsecured basis is based on the entity's short-term investments TRUE FALSE