Answered step by step

Verified Expert Solution

Question

1 Approved Answer

37 > Question 37 (1 point) Marcy is a 17 year old dependent high school student with income from wages of $8,000 and $4,000 of

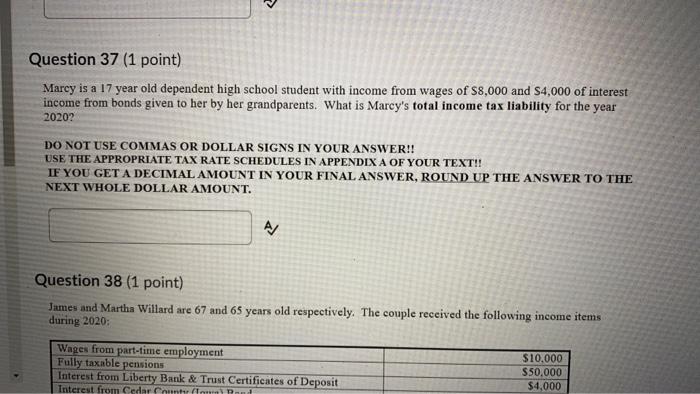

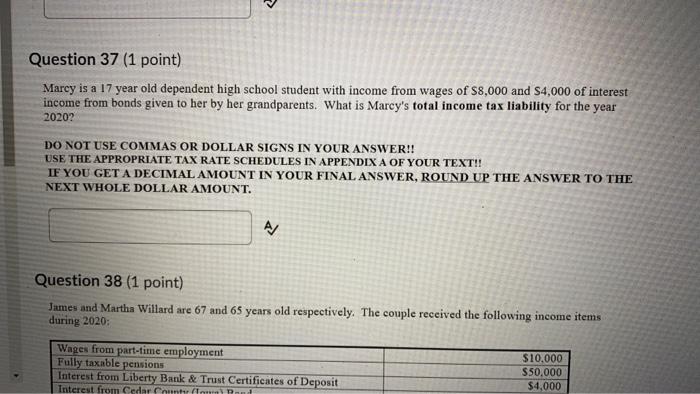

37  > Question 37 (1 point) Marcy is a 17 year old dependent high school student with income from wages of $8,000 and $4,000 of interest income from bonds given to her by her grandparents. What is Marcy's total income tax liability for the year 20202 DO NOT USE COMMAS OR DOLLAR SIGNS IN YOUR ANSWER!! USE THE APPROPRIATE TAX RATE SCHEDULES IN APPENDIX A OF YOUR TEXT!! IF YOU GET A DECIMAL AMOUNT IN YOUR FINAL ANSWER, ROUND UP THE ANSWER TO THE NEXT WHOLE DOLLAR AMOUNT. A/ Question 38 (1 point) James and Martha Willard are 67 and 65 years old respectively. The couple received the following income items during 2020: Wages from part-time employment Fully taxable pensions Interest from Liberty Bank & Trust Certificates of Deposit Interest from Cedar Chunt fimm Poud $10,000 $50,000 $4,000

> Question 37 (1 point) Marcy is a 17 year old dependent high school student with income from wages of $8,000 and $4,000 of interest income from bonds given to her by her grandparents. What is Marcy's total income tax liability for the year 20202 DO NOT USE COMMAS OR DOLLAR SIGNS IN YOUR ANSWER!! USE THE APPROPRIATE TAX RATE SCHEDULES IN APPENDIX A OF YOUR TEXT!! IF YOU GET A DECIMAL AMOUNT IN YOUR FINAL ANSWER, ROUND UP THE ANSWER TO THE NEXT WHOLE DOLLAR AMOUNT. A/ Question 38 (1 point) James and Martha Willard are 67 and 65 years old respectively. The couple received the following income items during 2020: Wages from part-time employment Fully taxable pensions Interest from Liberty Bank & Trust Certificates of Deposit Interest from Cedar Chunt fimm Poud $10,000 $50,000 $4,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started