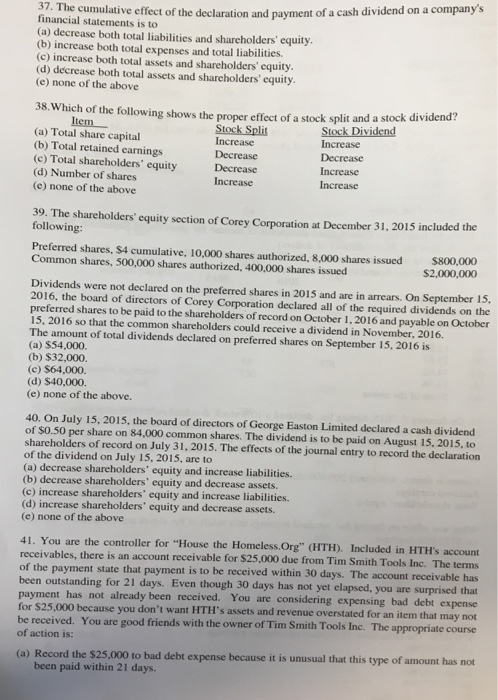

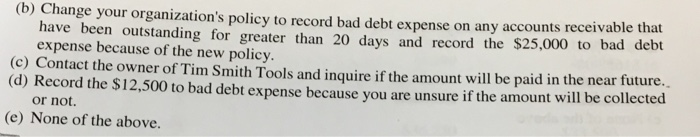

37. The cumulative effect of the declaration financial statements is to (a) decrease both total liabilities and shareholders' equity (b) increase both total expenses and total liabilities. (c) increase both total assets and shareholders' equity (d) decrease both total assets and shareholders' equity (e) none of the above and payment of a cash dividend on a company's 38 Which of the following shows the proper effect of a stock split and a stock dividend? Stock Dividend Increase Item Split (a) Total share capital (b) Total retained carnings (c) Total shareholders' equityDecrease (d) Number of shares (e) none of the above Increase Decrease Increase Increase In crease 39. The shareholders' equity section of Corey Corporation at December 31, 2015 included the following: Preferred shares, $4 cumulative, 10,000 shares authorized, 8,000 shares issued Common shares, 500,000 shares authorized, 400,000 shares issued 00,000 $2,000,000 $8 Dividends were not declared on the preferred shares in 2015 and are in arrears. On September 15. 2016, the board of directors of Corey Corporation declared all of the required dividends on the preferred shares to be paid to the shareholders of record on October 1,2016 and payable on October 15, 2016 so that the common shareholders could receive a dividend in November, 2016. The amount of total dividends declared on preferred shares on September 15, 2016 is (a) $54,000. (b) $32,000. (c) $64,000. (d) $40,000. (e) none of the above. 40. On July 15, 2015, the board of directors of George Easton Limited declared a cash dividend of $0.50 per share on 84,000 common shares. The dividend is to be paid on August 15. 2015, to shareholders of record on July 31, 2015. The effects of the journal entry to record the declaration of the dividend on July 15, 2015, are to (a) decrease shareholders' equity and increase liabilities. (b) decrease shareholders' equity and decrease assets. (c) increase shareholders' equity and increase liabilities. (d) increase shareholders' equity and decrease assets. (e) none of the above 41. You are the controller for "House the Homeless.Org" (HTH) Included in HTH's account receivables, there is an account receivable for $25,000 due from Tim Smith Tools Inc. The terms of the payment state that payment is to be received within 30 days. The account receivable has n outstanding for 21 days. Even though 30 days has not yet elapsed, you are surprised that payment has not already been received. You are considering expensing bad for $25,000 because you don't want HTH be received. You are good friends with the owner of Tim Smith Tools Inc. The appropriate course of action is: debt expense I's assets and revenue overstated for an item that may not (a) Record the $25.000 to bad debt expense because it is unusual that this type of amount has not been paid within 21 days