Answered step by step

Verified Expert Solution

Question

1 Approved Answer

37&38 will upvote Question 37 1 pts Assume that the firm ABC Inc. has the following information provide Sales, the timing of cash COLLECTIONS (RECEIPTS)

37&38 will upvote

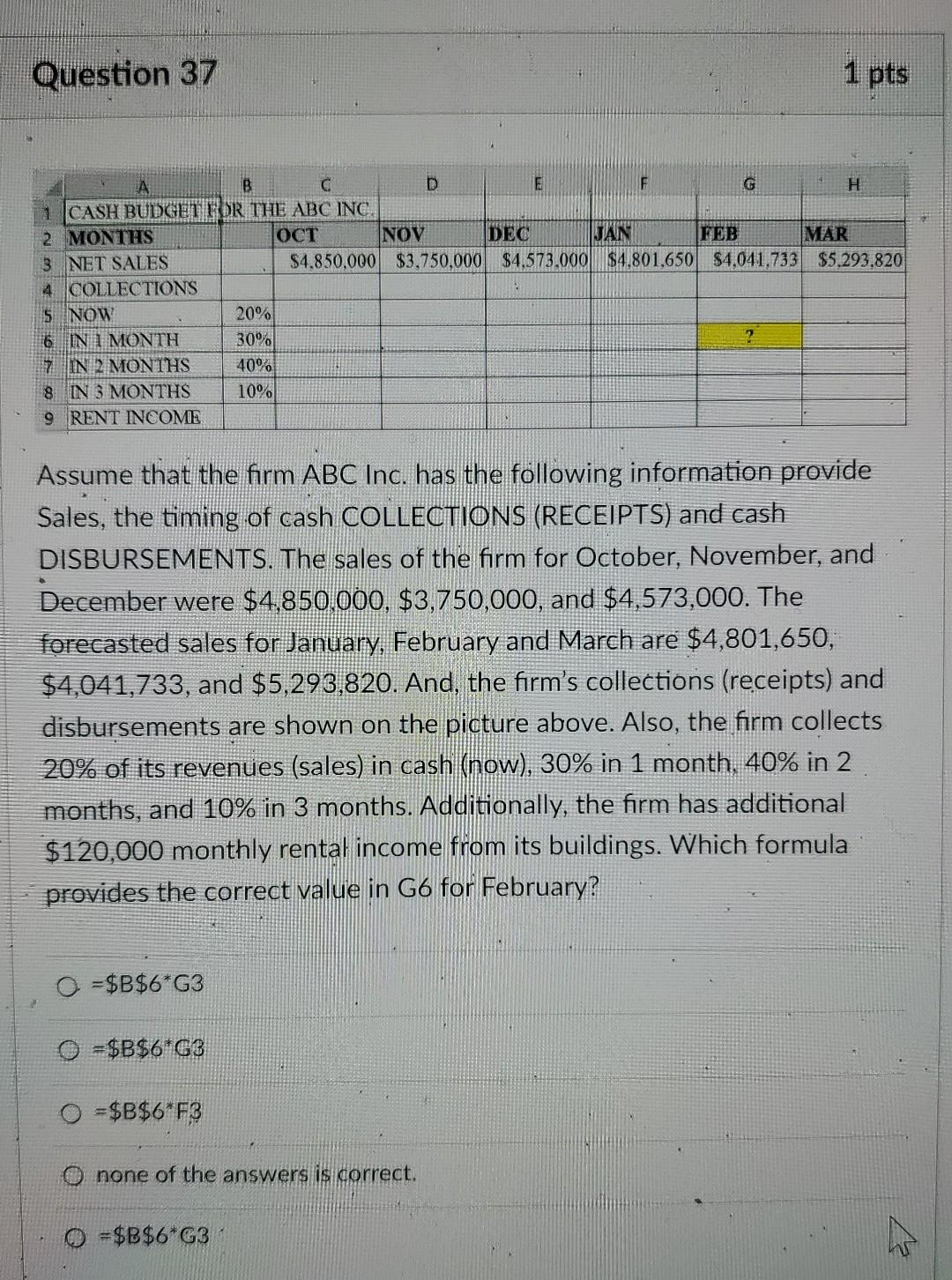

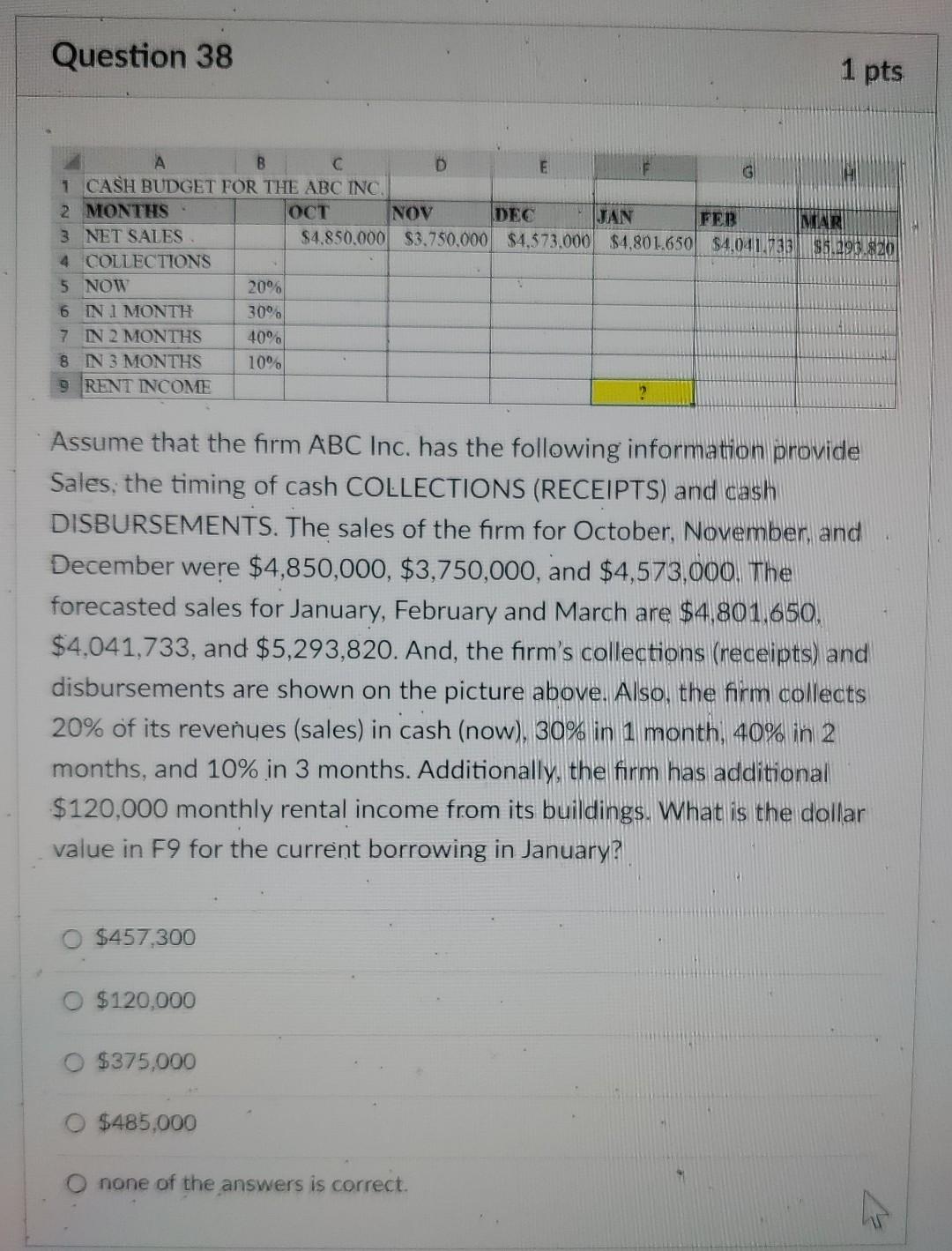

Question 37 1 pts Assume that the firm ABC Inc. has the following information provide Sales, the timing of cash COLLECTIONS (RECEIPTS) and cash DISBURSEMENTS. The sales of the firm for October, November, and December were $4,850,000,$3,750,000, and $4,573,000. The forecasted sales for January, February and March are $4,801,650, $4,041,733, and $5,293,820. And, the firm's collections (receipts) and disbursements are shown on the picture above. Also, the firm collects 20% of its revenues (sales) in cash (now), 30% in 1 month, 40% in 2 months, and 10% in 3 months. Additionally, the firm has additional $120,000 monthly rental income from its buildings. Which formula provides the correct value in G6 for February? =$B$6G3=$B$6G3=$B$6F3 none of the answers is correct. Question 38 Assume that the firm ABC Inc. has the following information provide Sales; the timing of cash COLLECTIONS (RECEIPTS) and cash DISBURSEMENTS. The sales of the firm for October, November, and December were $4,850,000,$3,750,000, and $4,573,000. The forecasted sales for January, February and March are $4,801,650. $4,041,733, and $5,293,820. And, the firm's collections (receipts) and disbursements are shown on the picture above. Also, the firm collects 20% of its revenues (sales) in cash (now), 30% in 1 month, 40% in 2 months, and 10% in 3 months. Additionally, the firm has additional $120,000 monthly rental income from its buildings. What is the dollar value in F9 for the current borrowing in January? $457,300 $120,000 $375,000 $485,000 none of the answers is correctStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started