Answered step by step

Verified Expert Solution

Question

1 Approved Answer

38. 39. 40. 41. 42. At the end of the manufacturing fiscal year, the balance in the factory overhead account is small. This balance

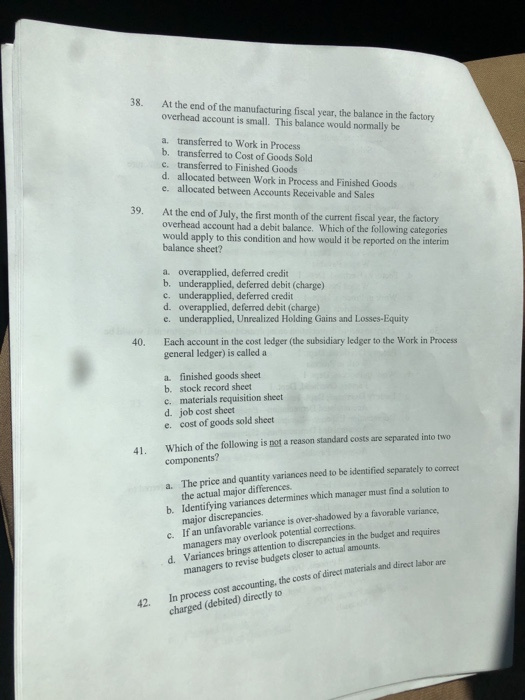

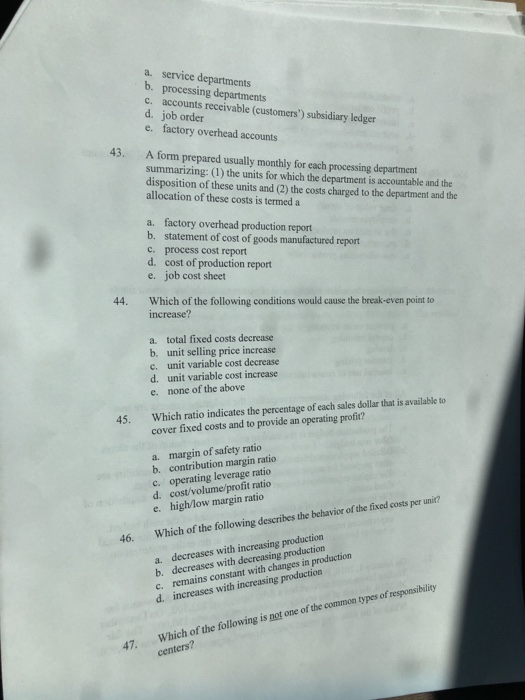

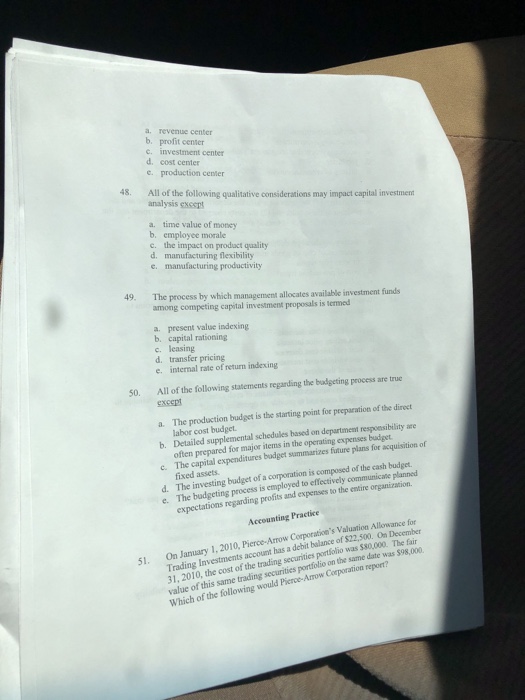

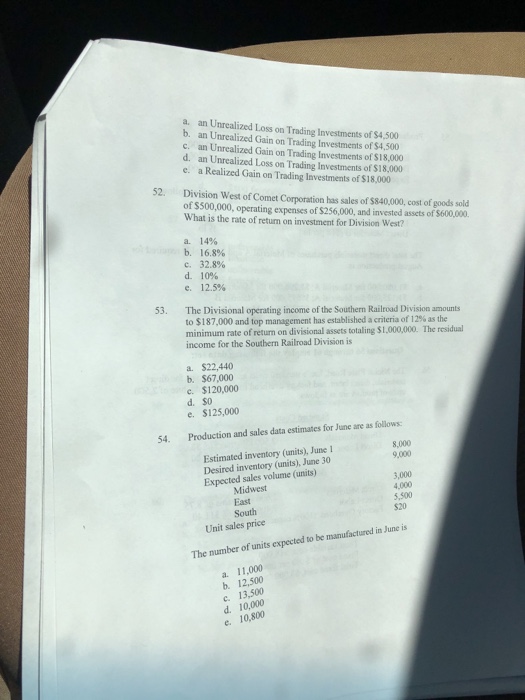

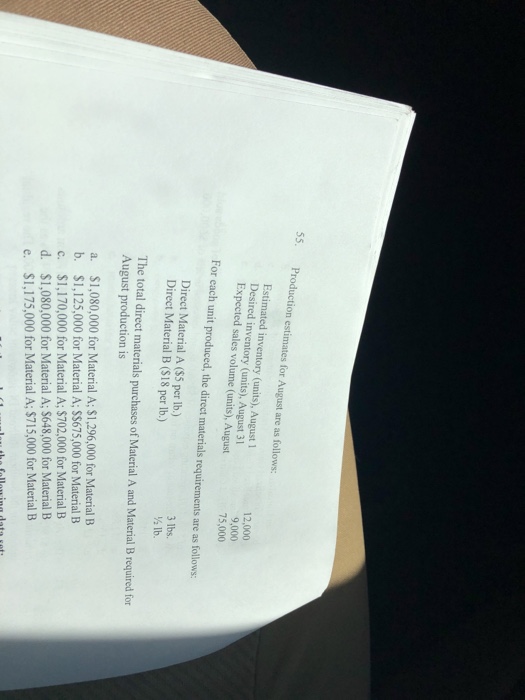

38. 39. 40. 41. 42. At the end of the manufacturing fiscal year, the balance in the factory overhead account is small. This balance would normally be a. transferred to Work in Process b. transferred to Cost of Goods Sold transferred to Finished Goods c. d. allocated between Work in Process and Finished Goods e. allocated between Accounts Receivable and Sales At the end of July, the first month of the current fiscal year, the factory overhead account had a debit balance. Which of the following categories would apply to this condition and how would it be reported on the interim balance sheet? a. overapplied, deferred credit b. underapplied, deferred debit (charge) c. underapplied, deferred credit d. overapplied, deferred debit (charge) e. underapplied, Unrealized Holding Gains and Losses-Equity Each account in the cost ledger (the subsidiary ledger to the Work in Process general ledger) is called a a. finished goods sheet. b. stock record sheet c. materials requisition sheet d. job cost sheet e. cost of goods sold sheet Which of the following is not a reason standard costs are separated into two components? a. The price and quantity variances need to be identified separately to correct the actual major differences. b. Identifying variances determines which manager must find a solution to major discrepancies. c. If an unfavorable variance is over-shadowed by a favorable variance, managers may overlook potential corrections d. Variances brings attention to discrepancies in the budget and requires managers to revise budgets closer to actual amounts In process cost accounting, the costs of direct materials and direct labor are charged (debited) directly to 43. 44. 45. 46. a. service departments b. processing departments c. accounts receivable (customers') subsidiary ledger d. job order e. factory overhead accounts A form prepared usually monthly for each processing department summarizing: (1) the units for which the department is accountable and the disposition of these units and (2) the costs charged to the department and the allocation of these costs is termed a a. factory overhead production report b. statement of cost of goods manufactured report c. process cost report d. cost of production report e. job cost sheet Which of the following conditions would cause the break-even point to increase? a. total fixed costs decrease b. unit selling price increase c. unit variable cost decrease d. unit variable cost increase e. none of the above Which ratio indicates the percentage of each sales dollar that is available to cover fixed costs and to provide an operating profit? a. margin of safety ratio b. contribution margin ratio c. operating leverage ratio d. cost/volume/profit ratio e. high/low margin ratio Which of the following describes the behavior of the fixed costs per unit? a. decreases with increasing production b. decreases with decreasing production c. remains constant with changes in production d. increases with increasing production Which of the following is not one of the common types of responsibility centers? 48. 49. 50. a. revenue center b. profit center c. investment center d. cost center e. production center All of the following qualitative considerations may impact capital investment analysis except 51. a. time value of money b. employee morale c. the impact on product quality d. manufacturing flexibility e. manufacturing productivity The process by which management allocates available investment funds among competing capital investment proposals is termedi a. present value indexing b. capital rationing c. leasing d. transfer pricing e. internal rate of return indexing All of the following statements regarding the budgeting process are true except a. The production budget is the starting point for preparation of the direct labor cost budget. b. Detailed supplemental schedules based on department responsibility are often prepared for major items in the operating expenses budget. c. The capital expenditures budget summarizes future plans for acquisition of fixed assets. d. The investing budget of a corporation is composed of the cash budget. e. The budgeting process is employed to effectively communicate planned expectations regarding profits and expenses to the entire organization. Accounting Practice On January 1, 2010, Pierce-Arrow Corporation's Valuation Allowance for Trading Investments account has a debit balance of $22,500. On December 31, 2010, the cost of the trading securities portfolio was $80,000. The fair value of this same trading securities portfolio on the same date was $98,000. Which of the following would Pierce-Arrow Corporation report? 52. 53. 54. a. an Unrealized Loss on Trading Investments of $4,500 b. an Unrealized Gain on Trading Investments of $4,500 c. an Unrealized Gain on Trading Investments of $18,000 d. an Unrealized Loss on Trading Investments of $18,000 e. a Realized Gain on Trading Investments of $18,000 Division West of Comet Corporation has sales of $840,000, cost of goods sold of $500,000, operating expenses of $256,000, and invested assets of $600,000. What is the rate of return on investment for Division West? a. 14% b. 16.8 % c. 32.8% d. 10% e. 12.5% The Divisional operating income of the Southern Railroad Division amounts to $187,000 and top management has established a criteria of 12% as the minimum rate of return on divisional assets totaling $1,000,000. The residual income for the Southern Railroad Division is a $22,440 b. $67,000 c. $120,000 d. $0 e. $125,000 Production and sales data estimates for June are as follows: Estimated inventory (units), June 11 Desired inventory (units), June 30 Expected sales volume (units) Midwest 3,000 4,000 5,500 $20 The number of units expected to be manufactured in June is East South Unit sales price a. 11,000 b. 12,500 8,000 9,000 c. 13,500 d. 10,000 e. 10,800 55. Production estimates for August are as follows: Estimated inventory (units), August 1 Desired inventory (units), August 31 Expected sales volume (units), August For each unit produced, the direct materials requirements are as follows: Direct Material A ($5 per lb.) 3 lbs. Direct Material B ($18 per lb.) lb. 12,000 9,000 75,000 The total direct materials purchases of Material A and Material B required for August production is a. $1,080,000 for Material A; $1,296,000 for Material B b. $1,125,000 for Material A; $$675,000 for Material B c. $1,170,000 for Material A; $702,000 for Material B d. $1,080,000 for Material A; $648,000 for Material B e. $1,175,000 for Material A; $715,000 for Material B

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started