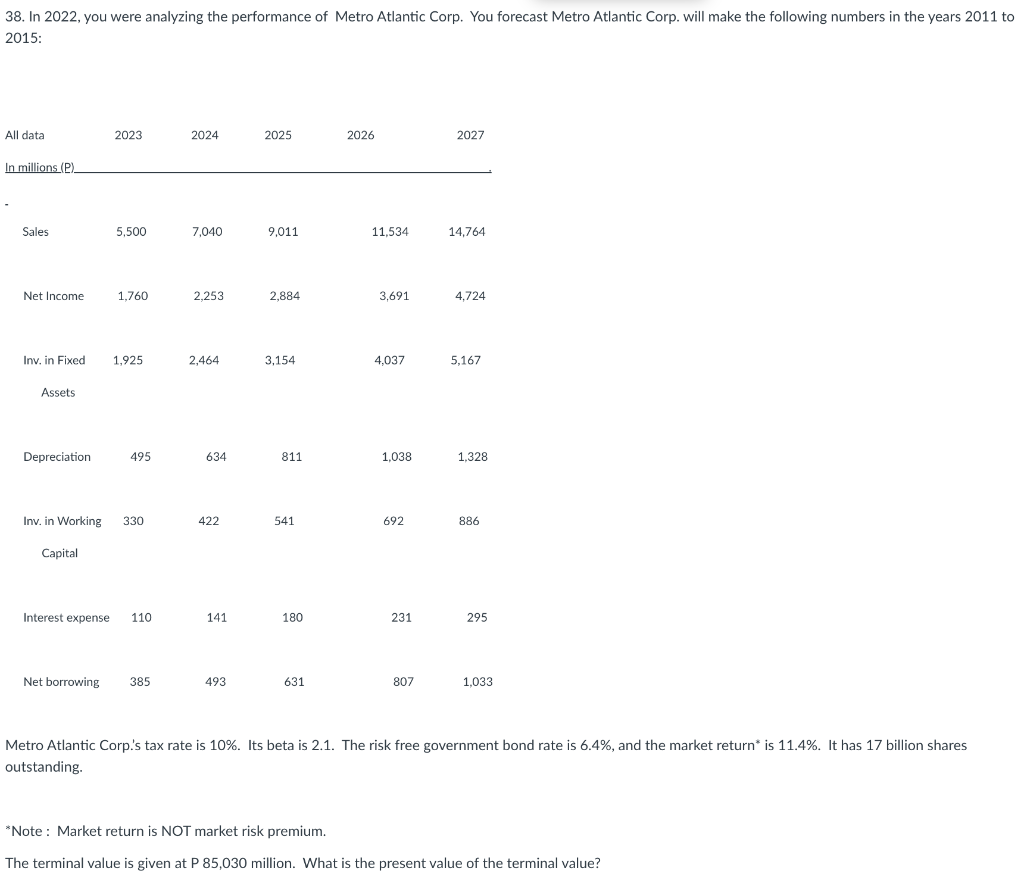

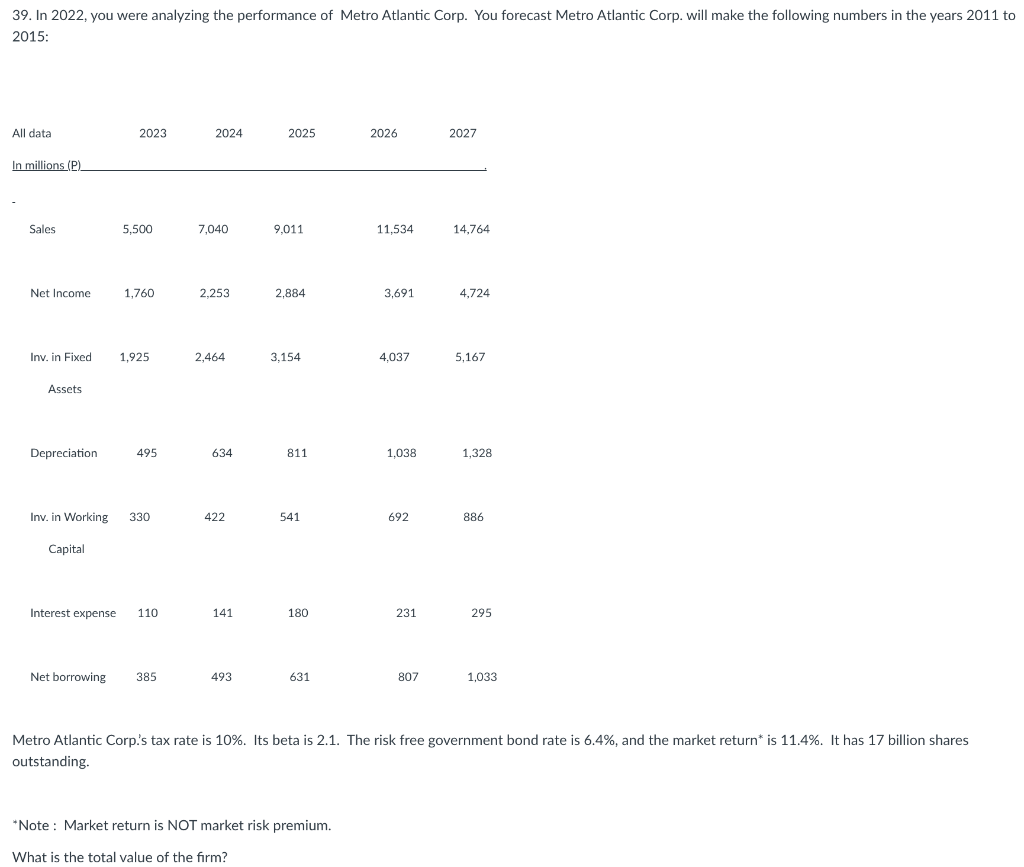

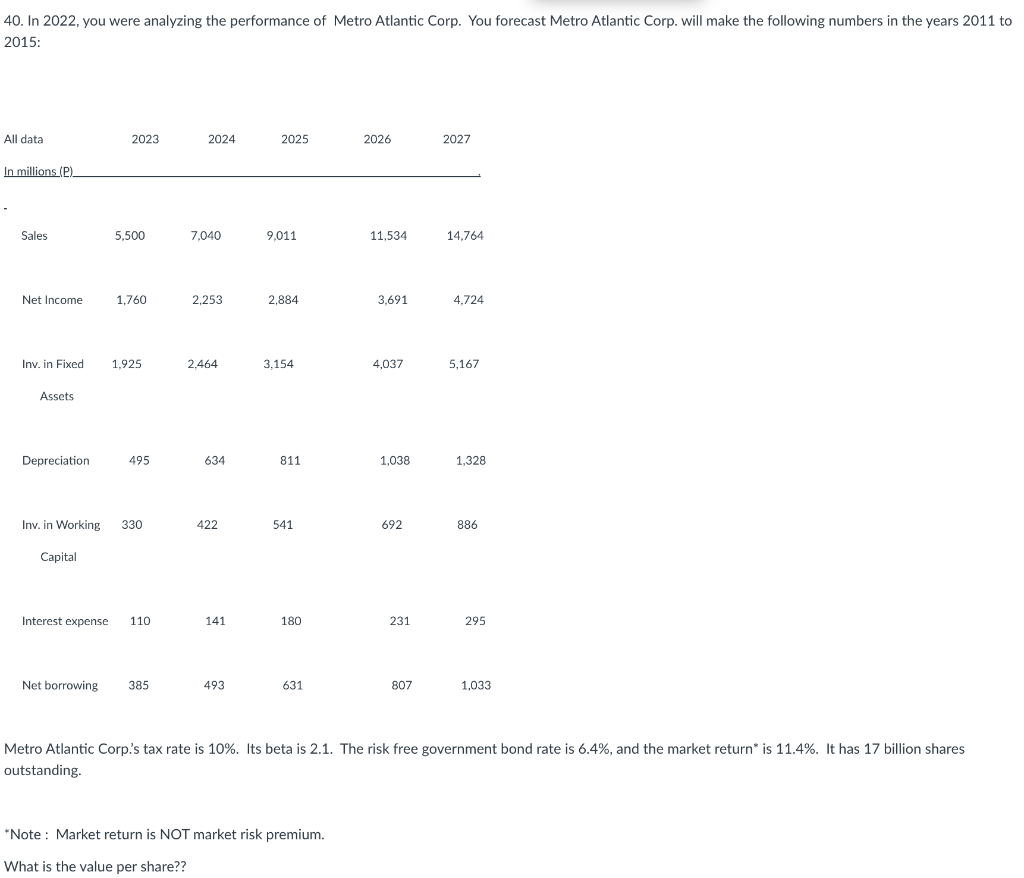

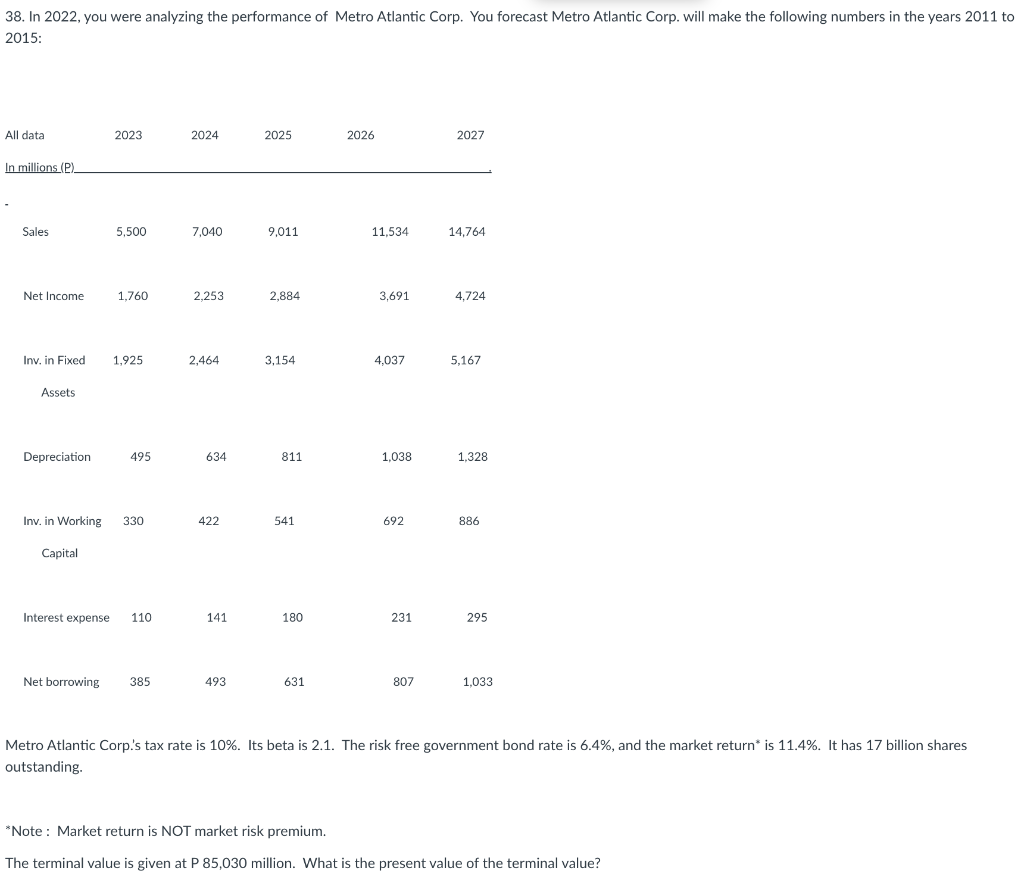

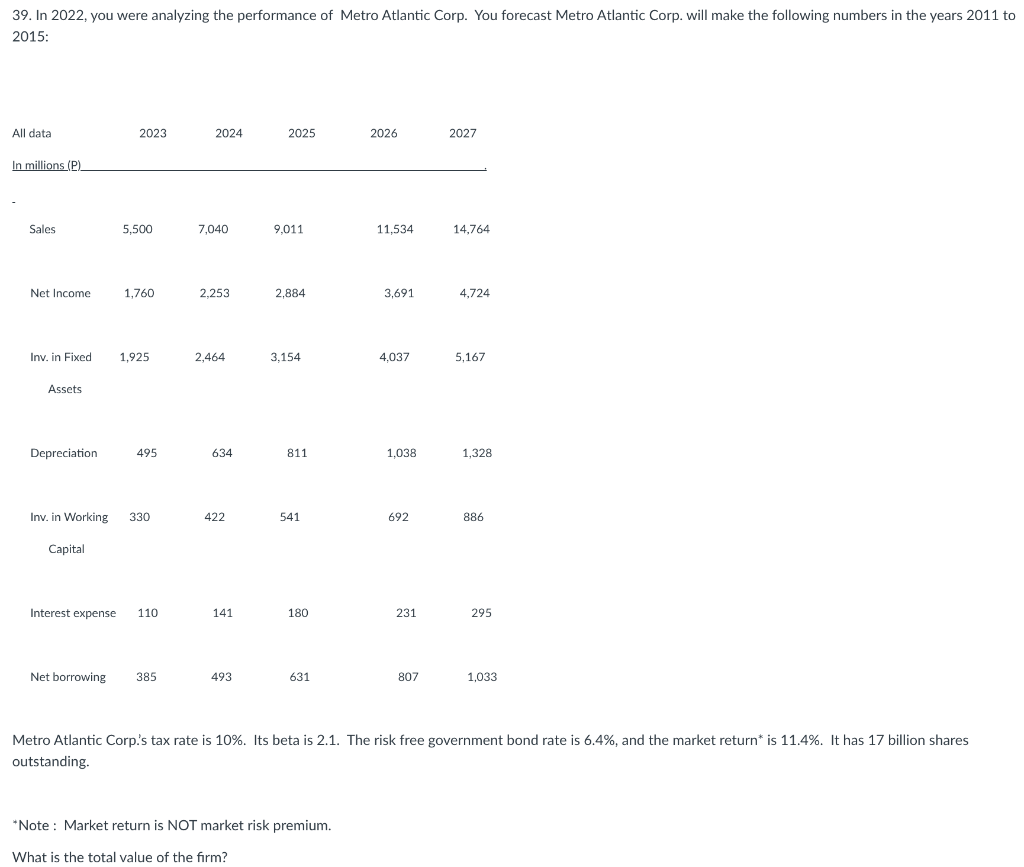

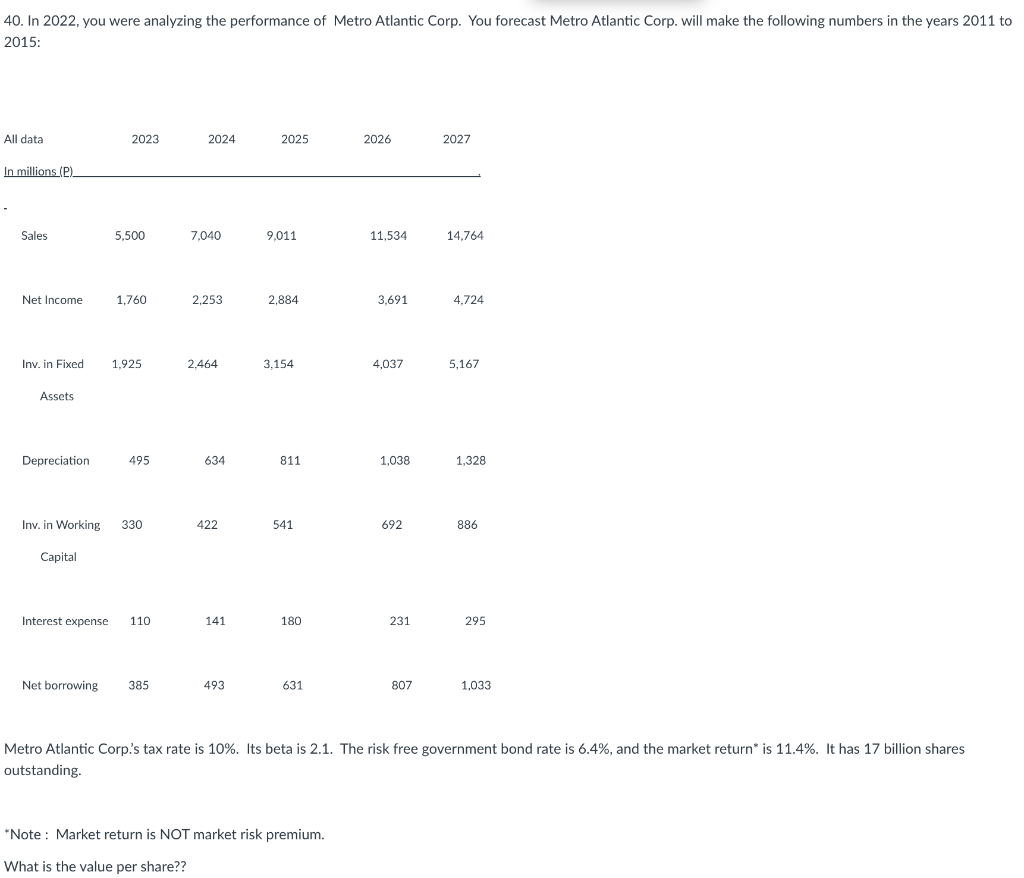

38. In 2022, you were analyzing the performance of Metro Atlantic Corp. You forecast Metro Atlantic Corp. will make the following numbers in the years 2011 to 2015: All data In millions (P). Sales Net Income Inv. in Fixed Assets Depreciation Inv. in Working Capital Interest expense 2023 5,500 1,760 1,925 495 330 110 Net borrowing 385 2024 7,040 2,253 2,464 634 422 141 493 2025 9,011 2,884 3,154 811 541 180 631 2026 11,534 3,691 4,037 1,038 692 231 18808 2027 14,764 4,724 5,167 1,328 886 295 1,033 Metro Atlantic Corp's tax rate is 10%. Its beta is 2.1. The risk free government bond rate is 6.4%, and the market return* is 11.4%. It has 17 billion shares outstanding. *Note: Market return is NOT market risk premium. The terminal value is given at P 85,030 million. What is the present value of the terminal value? 39. In 2022, you were analyzing the performance of Metro Atlantic Corp. You forecast Metro Atlantic Corp. will make the following numbers in the years 2011 to 2015: All data In millions (P) Sales Net Income Inv. in Fixed Assets Depreciation 2023 Interest expense 5,500 1,760 1,925 495 Inv. in Working 330 Capital 110 Net borrowing 385 2024 7,040 2,253 2,464 634 422 141 493 2025 9,011 2,884 3,154 811 541 180 631 2026 *Note: Market return is NOT market risk premium. What is the total value of the firm? 11,534 3,691 4.037 1,038 692 231 807 2027 14,764 4,724 5,167 1,328 886 295 1,033 Metro Atlantic Corp's tax rate is 10%. Its beta is 2.1. The risk free government bond rate is 6.4%, and the market return* is 11.4%. It has 17 billion shares outstanding. 40. In 2022, you were analyzing the performance of Metro Atlantic Corp. You forecast Metro Atlantic Corp. will make the following numbers in the years 2011 to 2015: All data In millions (P) - Sales Net Income Inv. in Fixed Assets Depreciation 2023 Interest expense 5,500 1,760 1,925 495 Inv. in Working 330 Capital 110 Net borrowing 385 2024 7,040 2,253 2,464 634 422 141 493 2025 9,011 2,884 3,154 811 541 180 631 2026 *Note: Market return is NOT market risk premium. What is the value per share?? 11,534 3,691 4,037 1,038 692 231 807 2027 14,764 4,724 5,167 1,328 886 295 1,033 Metro Atlantic Corp.'s tax rate is 10%. Its beta is 2.1. The risk free government bond rate is 6.4%, and the market return is 11.4%. It has 17 billion shares outstanding