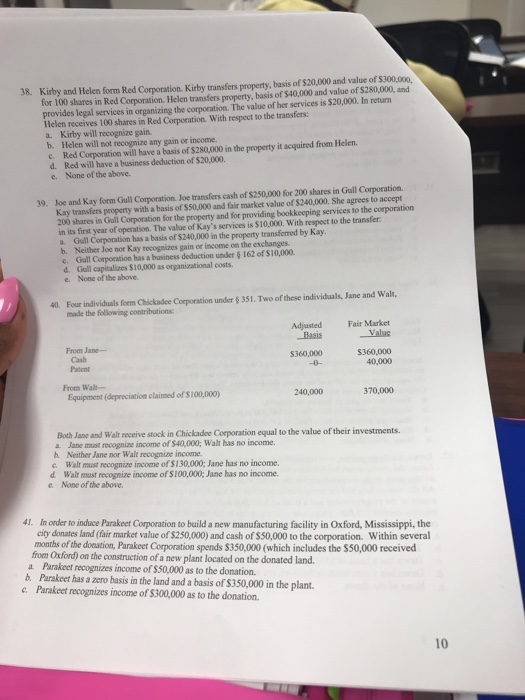

38. Kirby and Helen form Red Corporation. Kirby transfers property, basis of $20,000 and value of $300,000, for 100 shares in Red Corporation. Helen transfers property, basis of $40,000 and value of $280,000, and provides legal services in organizing the corporation. The value of her services is $20,000. In return Helen receives 100 shares in Red Corporation. With respect to the transfers: a. Kirby will recognize gain. b. Helen will not recognize any gain or income. c. Red Corporation will have a basis of$280,000 in the property it acquired from Helen. d. Red will have a business deduction of $20,000 e. None of the above. 39. Joe and Kay form Gull Corporation. Joe transfers cash of $250,000 for 200 shares in Gull Corporation Kay transfers property with a basis of $50,000 and fair market value of $240,000. She agrees to accept 200 shares in Gull Corporation for the property and for providing bookkeeping services to the corporation in its first year of operation. The value of Kay's services is $10,000. With respect to the transfer a Guall Corporation has a basis of $240,000 in the property transferred by Kay b. Neither Joe nor Kay recognizes gain or income on the exchanges e. Gull Corporation has a business deduction under $ 162 of $10,000 d. Gull capitalizes $10,000 as organizational costs e. None of the above Four individuals fraickadee Corporation undr351. Two ofthese individuals, Jane and walt, made the folowing contributions 40, Adjusted Basis Fair Market Valuc From Jane Cash Patent 5360,000 40,000 $360,000 From Wal- Equipment (depreciation claimed of $100,000) 370,000 Both Jane and Walr receive stock in Chickadee Corporation equal to the value of their investments a Jane must recognize income of S40,000; Walt has no income. b. Neither Jane nor Walt recognize income. e Walt must recognize income of $130,000; Jane has no income. d. Walt must recognize income of $100,000; Jane has no income. e. None of the above. 4 In onder to induce Parakeet Corporation to build a new manufacturing facility in Oxford, Mississippi, the city donates land (fair market value of $250,000) and cash of $50,000 to the corporation. Within several months of the donation, Parakeet Corporation spends $350,000 (which includes the $50,000 received from Oxford) on the construction of a new plant located on the donated land. Parakeet recognizes income of $50,000 as to the donation. b. Parakeet has a zero basis in the land and a basis of $350,000 in the plant. c. Parakeet recognizes income of $300,000 as to the donation. a 10 38. Kirby and Helen form Red Corporation. Kirby transfers property, basis of $20,000 and value of $300,000, for 100 shares in Red Corporation. Helen transfers property, basis of $40,000 and value of $280,000, and provides legal services in organizing the corporation. The value of her services is $20,000. In return Helen receives 100 shares in Red Corporation. With respect to the transfers: a. Kirby will recognize gain. b. Helen will not recognize any gain or income. c. Red Corporation will have a basis of$280,000 in the property it acquired from Helen. d. Red will have a business deduction of $20,000 e. None of the above. 39. Joe and Kay form Gull Corporation. Joe transfers cash of $250,000 for 200 shares in Gull Corporation Kay transfers property with a basis of $50,000 and fair market value of $240,000. She agrees to accept 200 shares in Gull Corporation for the property and for providing bookkeeping services to the corporation in its first year of operation. The value of Kay's services is $10,000. With respect to the transfer a Guall Corporation has a basis of $240,000 in the property transferred by Kay b. Neither Joe nor Kay recognizes gain or income on the exchanges e. Gull Corporation has a business deduction under $ 162 of $10,000 d. Gull capitalizes $10,000 as organizational costs e. None of the above Four individuals fraickadee Corporation undr351. Two ofthese individuals, Jane and walt, made the folowing contributions 40, Adjusted Basis Fair Market Valuc From Jane Cash Patent 5360,000 40,000 $360,000 From Wal- Equipment (depreciation claimed of $100,000) 370,000 Both Jane and Walr receive stock in Chickadee Corporation equal to the value of their investments a Jane must recognize income of S40,000; Walt has no income. b. Neither Jane nor Walt recognize income. e Walt must recognize income of $130,000; Jane has no income. d. Walt must recognize income of $100,000; Jane has no income. e. None of the above. 4 In onder to induce Parakeet Corporation to build a new manufacturing facility in Oxford, Mississippi, the city donates land (fair market value of $250,000) and cash of $50,000 to the corporation. Within several months of the donation, Parakeet Corporation spends $350,000 (which includes the $50,000 received from Oxford) on the construction of a new plant located on the donated land. Parakeet recognizes income of $50,000 as to the donation. b. Parakeet has a zero basis in the land and a basis of $350,000 in the plant. c. Parakeet recognizes income of $300,000 as to the donation. a 10