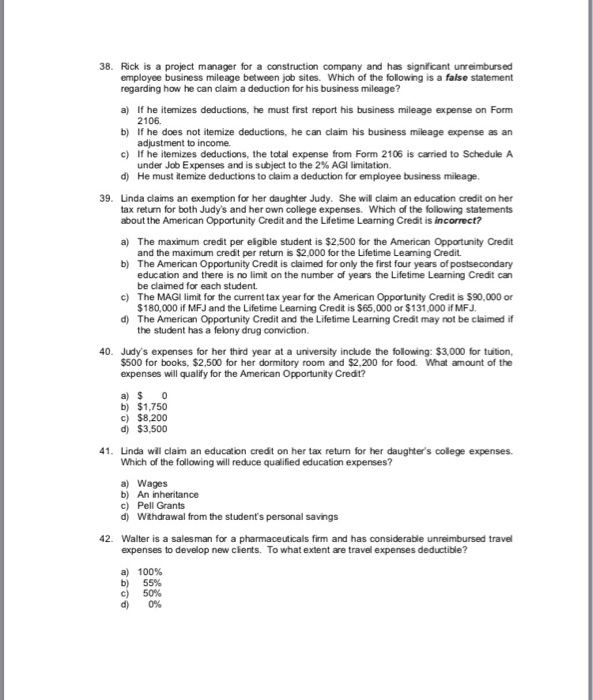

38. Rick is a project manager for a construction company and has signficant unreimbursed employee business mileage between job sites. Which of the following is a false statement regarding how he can claim a deduction for his business mileage? a) If he itemizes deductions, he must first report his business mileage expense on Form 2106. b) If he does not itemize deductions, he can claim his business mileage expense as an adjustment to income. c) If he itemizes deductions, the total expense from Form 2106 is carried to Schedule A under Job Expenses and is subject to the 2% AGI limitation. d) He must temize deductions to claim a deduction for employee business mileage 39. Linda claims an exemption for her daughter Judy. She will claim an education credit on her tax return for both Judy's and her own college expenses. Which of the following statements about the American Opportunity Credit and the Lifetime Learning Credit is incorrect? a) The maximum credit per eligible student is $2,500 for the American Opportunity Credit and the maximum credt per return is $2,000 for the Lifetime Learning Credit. b) The American Opportunity Credit is claimed for only the first four years of postsecondary education and there is no limit on the number of years the Lifetime Leaning Credit can be claimed for each student c) The MAGI limit for the current tax year for the American Opportunity Credit is $90,000 or $180,000 if MFJ and the Lifetime Leaning Credit is $65,000 or $131,000 if MFJ d) The American Opportunity Credit and the Lifetime Leaning Credit may not be claimed if the student has a felony drug conviction. 40. Judy's expenses for her third year at a university include the folowing: $3,000 for tuition, $500 for books, $2,500 for her dormitory room and $2,200 for food. What amount of the expenses will qualify for the American Opportunity Credt? a) $0 b) $1,750 c) $8,200 d) $3,500 1. Linda wll claim an education credit on her tax return for her daughter's colege expenses. Which of the following will reduce qualifed education expenses? a) Wages b) An inheritance c) Pell Grants d) Wthdrawal from the student's personal savings 42. Walter is a sales man for a pharmaceuticals firm and has considerable unreimbursed travel expenses to develop new cients. To what extent are travel expenses deductible? a) b) c) d) 100% 55% 50% 0%