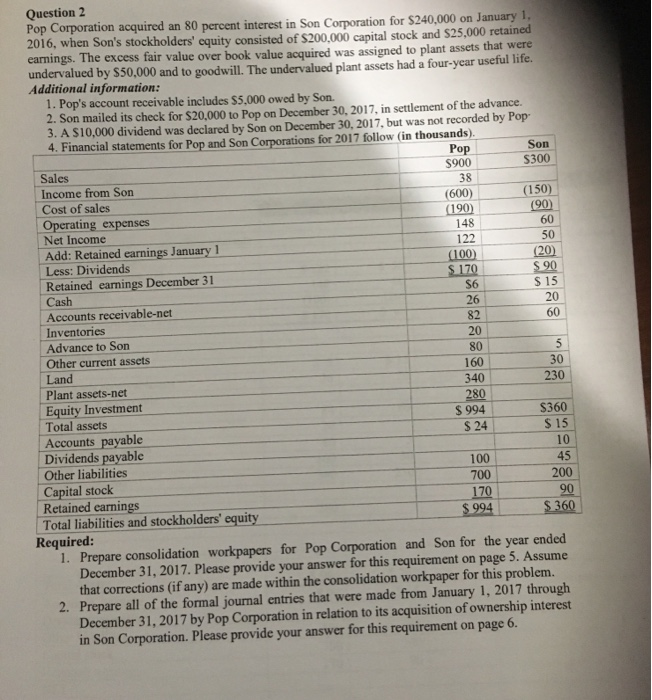

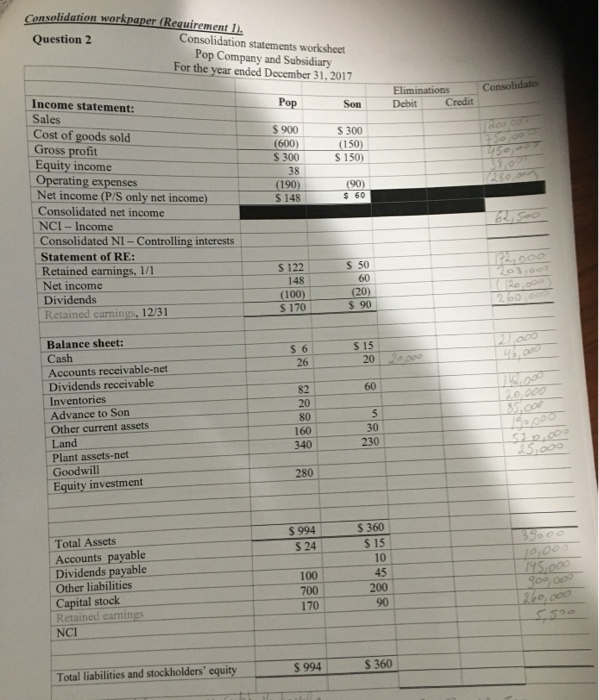

38 S6 20 Question Pop Corporation acquired an 80 percent interest in Son Corporation for S240,000 on January 2016, when Son's stockholders' equity consisted of $200,000 capital stock and $25,000 retained earnings. The excess fair value over book value acquired was assigned to plant assets that were undervalued by S50,000 and to goodwill. The undervalued plant assets had a four-year useful life Additional information: 1. Pop's account receivable includes $5,000 owed by Son. 2. Son mailed its check for $20,000 to Pop on December 30, 2017. in settlement of the advance. 3. A $10,000 dividend was declared by Son on December 30, 2017, but was not recorded by Pop 4. Financial statements for Pop and Son Corporations for 2017 follow (in thousands). Pop Son Sales $900 $300 Income from Son Cost of sales (600) (150) Operating expenses (190) (90) Net Income 148 Add: Retained earnings January 1 122 50 Less: Dividends (100) (20) Retained earnings December 31 S 170 Cash Accounts receivable-net 26 Inventories 82 Advance to Son Other current assets Land 160 30 Plant assets-net 340 230 Equity Investment 280 Total assets $ 994 $360 Accounts payable S 24 Dividends payable Other liabilities 100 45 Capital stock 700 200 Retained earnings 170 90 Total liabilities and stockholders' equity $ 994 S 360 Required: 1. Prepare consolidation workpapers for Pop Corporation and Son for the year ended December 31, 2017. Please provide your answer for this requirement on page 5. Assume that corrections (if any) are made within the consolidation workpaper for this problem. 2. Prepare all of the formal journal entries that were made from January 1, 2017 through December 31, 2017 by Pop Corporation in relation to its acquisition of ownership interest in Son Corporation. Please provide your answer for this requirement on page 6. 20 80 $ 15 10 Consolidation workpaper Requirement 1. Consolidation statements worksheet Pop Company and Subsidiary For the year ended December 31, 2017 Question 2 Income statement: Consolidate Pop Son Eliminations Debit Credit S 900 (600) S 300 38 (190) $ 148 S 300 (150) S 150) (90) $ 60 Sales Cost of goods sold Gross profit Equity income Operating expenses Net income (P/S only net income) Consolidated net income NCI -Income Consolidated NI - Controlling interests Statement of RE: Retained earnings, 1/1 Net income Dividends Retained earnings, 12/31 Sao S 122 (100) S 170 S 50 60 (20) S 90 S6 26 S 15 20 82 60 Balance sheet: Cash Accounts receivable-net Dividends receivable Inventories Advance to Son Other current assets Land Plant assets-net Goodwill Equity investment 20 80 160 340 30 230 280 $ 994 S 24 Total Assets Accounts payable Dividends payable Other liabilities Capital stock Retained earnings NCI S 360 S 15 10 45 200 90 100 700 170 Total liabilities and stockholders' equity S994 S 360 38 S6 20 Question Pop Corporation acquired an 80 percent interest in Son Corporation for S240,000 on January 2016, when Son's stockholders' equity consisted of $200,000 capital stock and $25,000 retained earnings. The excess fair value over book value acquired was assigned to plant assets that were undervalued by S50,000 and to goodwill. The undervalued plant assets had a four-year useful life Additional information: 1. Pop's account receivable includes $5,000 owed by Son. 2. Son mailed its check for $20,000 to Pop on December 30, 2017. in settlement of the advance. 3. A $10,000 dividend was declared by Son on December 30, 2017, but was not recorded by Pop 4. Financial statements for Pop and Son Corporations for 2017 follow (in thousands). Pop Son Sales $900 $300 Income from Son Cost of sales (600) (150) Operating expenses (190) (90) Net Income 148 Add: Retained earnings January 1 122 50 Less: Dividends (100) (20) Retained earnings December 31 S 170 Cash Accounts receivable-net 26 Inventories 82 Advance to Son Other current assets Land 160 30 Plant assets-net 340 230 Equity Investment 280 Total assets $ 994 $360 Accounts payable S 24 Dividends payable Other liabilities 100 45 Capital stock 700 200 Retained earnings 170 90 Total liabilities and stockholders' equity $ 994 S 360 Required: 1. Prepare consolidation workpapers for Pop Corporation and Son for the year ended December 31, 2017. Please provide your answer for this requirement on page 5. Assume that corrections (if any) are made within the consolidation workpaper for this problem. 2. Prepare all of the formal journal entries that were made from January 1, 2017 through December 31, 2017 by Pop Corporation in relation to its acquisition of ownership interest in Son Corporation. Please provide your answer for this requirement on page 6. 20 80 $ 15 10 Consolidation workpaper Requirement 1. Consolidation statements worksheet Pop Company and Subsidiary For the year ended December 31, 2017 Question 2 Income statement: Consolidate Pop Son Eliminations Debit Credit S 900 (600) S 300 38 (190) $ 148 S 300 (150) S 150) (90) $ 60 Sales Cost of goods sold Gross profit Equity income Operating expenses Net income (P/S only net income) Consolidated net income NCI -Income Consolidated NI - Controlling interests Statement of RE: Retained earnings, 1/1 Net income Dividends Retained earnings, 12/31 Sao S 122 (100) S 170 S 50 60 (20) S 90 S6 26 S 15 20 82 60 Balance sheet: Cash Accounts receivable-net Dividends receivable Inventories Advance to Son Other current assets Land Plant assets-net Goodwill Equity investment 20 80 160 340 30 230 280 $ 994 S 24 Total Assets Accounts payable Dividends payable Other liabilities Capital stock Retained earnings NCI S 360 S 15 10 45 200 90 100 700 170 Total liabilities and stockholders' equity S994 S 360