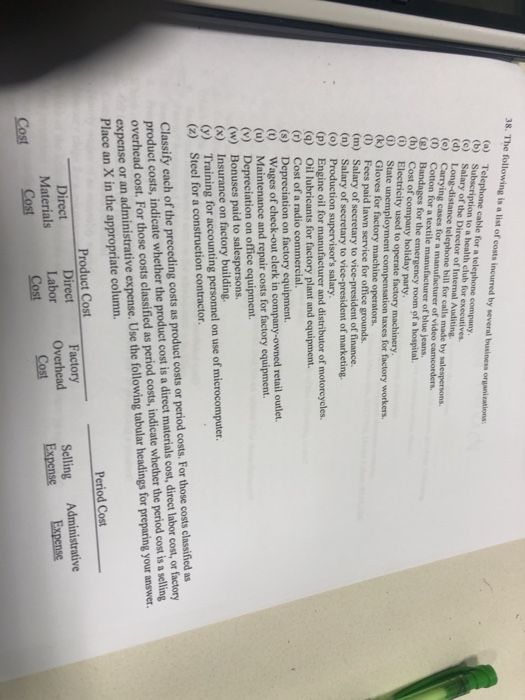

38. The following is a list of costs incurred by several business organizationa (a) Telephone cable for a telephone company (b) Subscription to a health club for executives. (c) Salary of the Director of Internal Auditing. (d) Long-distance telephone bill for calls made by salespersons. (e) Carrying cases for a manufacturer of video camcorders (D Cotton for a textile manufacturer of blue jeans. (g) Bandages for the emergency room of a hospital. (h) Cost of company holiday party. (i) Electricity used to operate factory machinery. State unemployment compensation taxes for factory workers (k) Gloves for factory machine operators. (I) Fees paid lawn service for office grounds. (m) Salary of secretary to vice-president of finance. (n) Salary of secretary to vice-president of marketing. (o) Production supervisor's salary. (p) Engine oil for manufacturer and distributor of motoreycles (q) Oil lubricants for factory plant and equipment. (r) Cost of a radio commercial. Depreciation on factory equipment. (t) (s) Wages of check-out clerk in company-owned retail outlet. Maintenance and repair costs for factory equipment. (u) Depreciation on office equipment. (v) (w) Bonuses paid to salespersons. (x) Insurance on factory building (y) Training for accounting personnel on use (z) Steel for a construction contractor. of microcomputer. Classify each of the preceding costs as product costs or period costs. For those costs classified as product costs, indicate whether the product cost is a direct materials cost, direct labor cost, or factory overhead cost. For those costs classified as period costs, indicate whether the period cost is a selling expense or an administrative expense. Use the following tabular headings for preparing your answer. Place an X in the appropriate column Period Cost Product Cost Direct Labor Cost Factory Overhead Cost Direct Materials Cost Selling Expense Administrative Expense Cost 38. The following is a list of costs incurred by several business organizationa (a) Telephone cable for a telephone company (b) Subscription to a health club for executives. (c) Salary of the Director of Internal Auditing. (d) Long-distance telephone bill for calls made by salespersons. (e) Carrying cases for a manufacturer of video camcorders (D Cotton for a textile manufacturer of blue jeans. (g) Bandages for the emergency room of a hospital. (h) Cost of company holiday party. (i) Electricity used to operate factory machinery. State unemployment compensation taxes for factory workers (k) Gloves for factory machine operators. (I) Fees paid lawn service for office grounds. (m) Salary of secretary to vice-president of finance. (n) Salary of secretary to vice-president of marketing. (o) Production supervisor's salary. (p) Engine oil for manufacturer and distributor of motoreycles (q) Oil lubricants for factory plant and equipment. (r) Cost of a radio commercial. Depreciation on factory equipment. (t) (s) Wages of check-out clerk in company-owned retail outlet. Maintenance and repair costs for factory equipment. (u) Depreciation on office equipment. (v) (w) Bonuses paid to salespersons. (x) Insurance on factory building (y) Training for accounting personnel on use (z) Steel for a construction contractor. of microcomputer. Classify each of the preceding costs as product costs or period costs. For those costs classified as product costs, indicate whether the product cost is a direct materials cost, direct labor cost, or factory overhead cost. For those costs classified as period costs, indicate whether the period cost is a selling expense or an administrative expense. Use the following tabular headings for preparing your answer. Place an X in the appropriate column Period Cost Product Cost Direct Labor Cost Factory Overhead Cost Direct Materials Cost Selling Expense Administrative Expense Cost