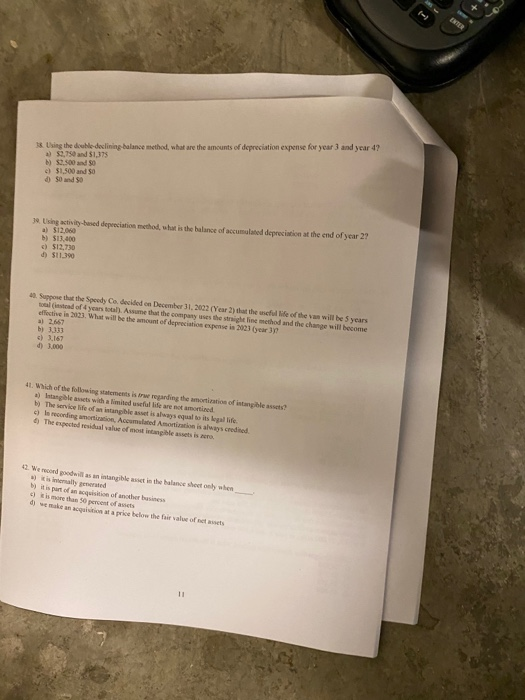

38. Using the double declining balance method, what are the amounts of depreciation expense for year 3 and year 4? a) $2,750 and $1,375 M) 50.500 and 30 e) $1,500 and $0 d) 50 and 50 m ed deprec Using activity-based depreciation method what is the balance of a) 512.060 ) $13,000 G) 512,730 d) $11.19 a t the end of year 21 Sopower that the Speedy Codecided on December 31, 2002 (Year 2) that the useful life of the vas will be 5 years ofy ) Assume that the company uses the straight line method and the change will become effective 2023. What will be the amount of depreciation expenses 2021 year d) 3.000 L ich of the following statements is in regarding the amortization of intangibles gles with a limited useful life are not amortized The w i fe of an intangible asset is always equal to its legal life. lo d ing amoniaco, Accumulated Amortization is always credited The expected residual value of most intangible assets is er Wecord goodwill as an intangible asset in the balance sheet > isimlynesied is part of an acquisition of another business 6) is more than 50 percent of assets e an acquisition at a price below the fair value of net when d 38. Using the double declining balance method, what are the amounts of depreciation expense for year 3 and year 4? a) $2,750 and $1,375 M) 50.500 and 30 e) $1,500 and $0 d) 50 and 50 m ed deprec Using activity-based depreciation method what is the balance of a) 512.060 ) $13,000 G) 512,730 d) $11.19 a t the end of year 21 Sopower that the Speedy Codecided on December 31, 2002 (Year 2) that the useful life of the vas will be 5 years ofy ) Assume that the company uses the straight line method and the change will become effective 2023. What will be the amount of depreciation expenses 2021 year d) 3.000 L ich of the following statements is in regarding the amortization of intangibles gles with a limited useful life are not amortized The w i fe of an intangible asset is always equal to its legal life. lo d ing amoniaco, Accumulated Amortization is always credited The expected residual value of most intangible assets is er Wecord goodwill as an intangible asset in the balance sheet > isimlynesied is part of an acquisition of another business 6) is more than 50 percent of assets e an acquisition at a price below the fair value of net when d