Answered step by step

Verified Expert Solution

Question

1 Approved Answer

38. What is the future value at the end of year 40 of depositing $15,000 today, $3,500 at the end of years 1, 2 and

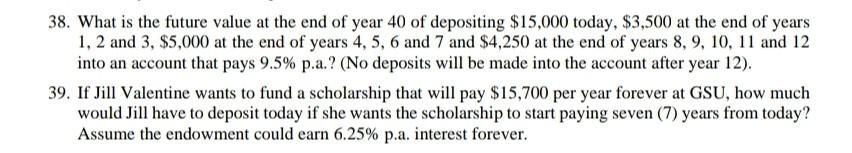

38. What is the future value at the end of year 40 of depositing $15,000 today, $3,500 at the end of years 1, 2 and 3, $5,000 at the end of years 4, 5, 6 and 7 and $4,250 at the end of years 8, 9, 10, 11 and 12 into an account that pays 9.5% p.a.? (No deposits will be made into the account after year 12). 39. If Jill Valentine wants to fund a scholarship that will pay $15,700 per year forever at GSU, how much would Jill have to deposit today if she wants the scholarship to start paying seven (7) years from today? Assume the endowment could earn 6.25% p.a. interest forever

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started