Answered step by step

Verified Expert Solution

Question

1 Approved Answer

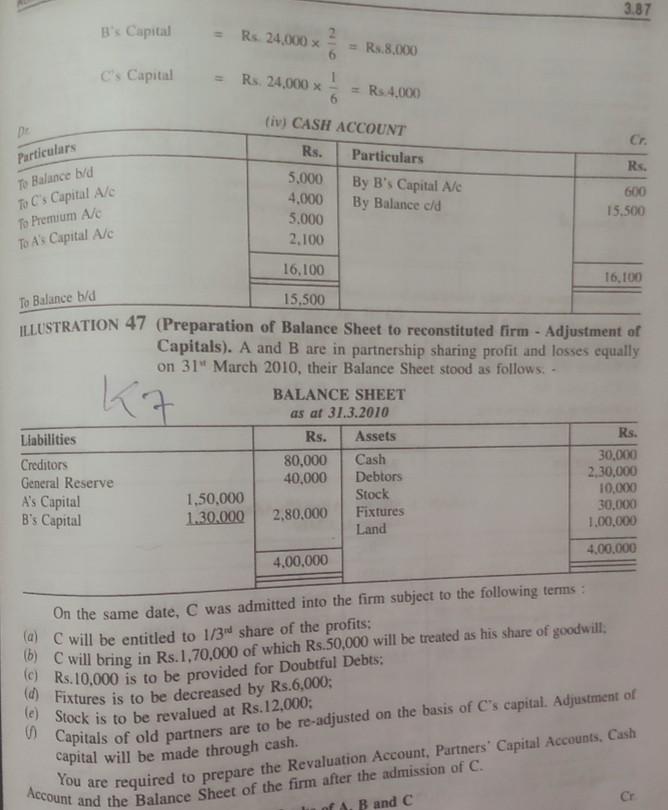

3.87 B's Capital Rs. 24.000 x C's Capital = Rs.8,000 6 = Rs. 24.000 x 1 = Rs 4,000 6 (iv) CASH ACCOUNT Rs. Particulars

3.87 B's Capital Rs. 24.000 x C's Capital = Rs.8,000 6 = Rs. 24.000 x 1 = Rs 4,000 6 (iv) CASH ACCOUNT Rs. Particulars 5.000 By B's Capital Alc 4.000 By Balance eld 5.000 2.100 Cr. Rs. Particulars To Balance b/d To C's Capital Alc To Premium Alc To A Capital Alc 600 15.500 To Balance b/d 16.100 16.100 15,500 ILLUSTRATION 47 (Preparation of Balance Sheet to reconstituted firm - Adjustment of Capitals). A and B are in partnership sharing profit and losses equally on 31 March 2010, their Balance Sheet stood as follows. - BALANCE SHEET as af 31.3.2010 Liabilities Rs. Assets Rs. Creditors 80,000 Cash 30,000 General Reserve 40,000 Debtors 2,30,000 10,000 A's Capital Stock 1,50.000 B's Capital 30.000 1.30,000 2,80,000 Fixtures Land 1.00,000 4,00.000 4,00.000 K7 On the same date, C was admitted into the firm subject to the following terms: (a) C will be entitled to 1/3 share of the profits: (6) Cwill bring in Rs.1,70,000 of which Rs.50,000 will be treated as his share of goodwill: (c) Rs.10,000 is to be provided for Doubtful Debts: (d) Fixtures is to be decreased by Rs.6,000; (e) Stock is to be revalued at Rs.12,000: capital will be made through cash. You are required to prepare the Revaluation Account, Partners' Capital Accounts, Cash Account and the Balance Sheet of the firm after the admission of C. A B and C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started