Answered step by step

Verified Expert Solution

Question

1 Approved Answer

39. Identify which of the following statements is false. A) In a Type C reorganization, the acquired corporation must distribute stock, securities, and other property

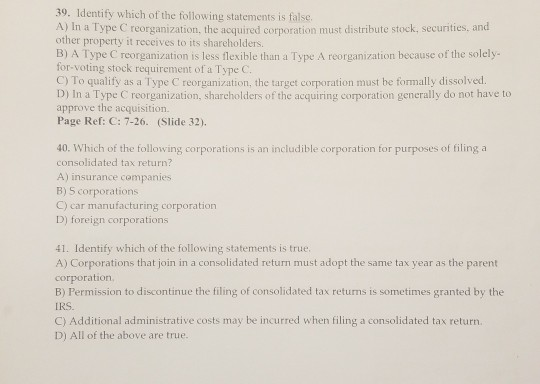

39. Identify which of the following statements is false. A) In a Type C reorganization, the acquired corporation must distribute stock, securities, and other property it receives to its shareholders. B) A Type C reorganization is less flexible than a Type A reorganization because of the solely for-voting stock requirement of a Type C. C) To qualify as a Type C reorganization, the target corporation must be formally dissolved. D) In a Type C reorganization, shareholders of the acquiring corporation generally do not have to approve the acquisition Page Ref: C: 7-26. (Slide 32). 40. Which of the following corporations is an includible corporation for purposes of filing a consolidated tax return? A) insurance companies B) 5 corporations C) car manufacturing corporation D) foreign corporations 41. Identify which of the following statements is true. A) Corporations that join in a consolidated return must adopt the same tax year as the parent corporation B) Permission to discontinue the filing of consolidated tax returns is sometimes granted by the IRS. C) Additional administrative costs may be incurred when filing a consolidated tax return D) All of the above are true

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started