Answered step by step

Verified Expert Solution

Question

1 Approved Answer

39. Kate owns 1,000 shares of Pills Drug Firm and has heard rumors that the firm is about to be investigated by the Food

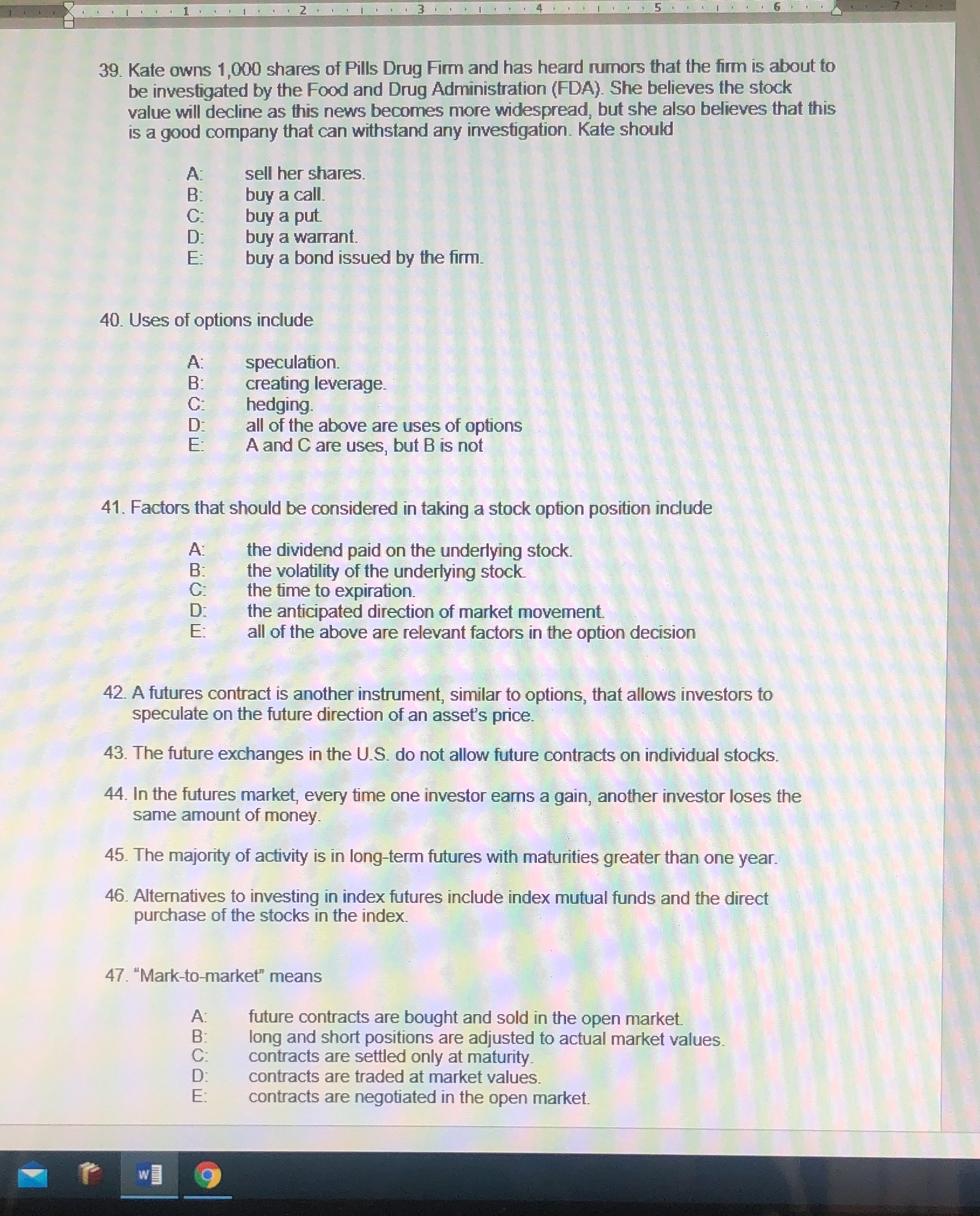

39. Kate owns 1,000 shares of Pills Drug Firm and has heard rumors that the firm is about to be investigated by the Food and Drug Administration (FDA). She believes the stock value will decline as this news becomes more widespread, but she also believes that this is a good company that can withstand any investigation. Kate should A: B: C: D: E: 40. Uses of options include A: B: C: D: E: 41. Factors that w] ABUDE sell her shares. buy a call. buy a put. should be considered in taking a stock option position include A: the dividend paid on the underlying stock. B: the volatility of the underlying stock. the time to expiration. D: the anticipated direction of market movement. E: all of the above are relevant factors in the option decision C: buy a warrant. buy a bond issued by the firm. speculation. creating leverage. hedging. all of the above are uses of options A and C are uses, but B is not 42. A futures contract is another instrument, similar to options, that allows investors to speculate on the future direction of an asset's price. 43. The future exchanges in the U.S. do not allow future contracts on individual stocks. 44. In the futures market, every time one investor earns a gain, another investor loses the same amount of money. 45. The majority of activity is in long-term futures with maturities greater than one year. 46. Alternatives to investing in index futures include index mutual funds and the direct purchase of the stocks in the index. 47. "Mark-to-market" means ABCDE A: future contracts are bought and sold in the open market. B: long and short positions are adjusted to actual market values. C: contracts are settled only at maturity. D: contracts are traded at market values. E: contracts are negotiated in the open market.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 39 Answer C Buy a put Buying a put opti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started