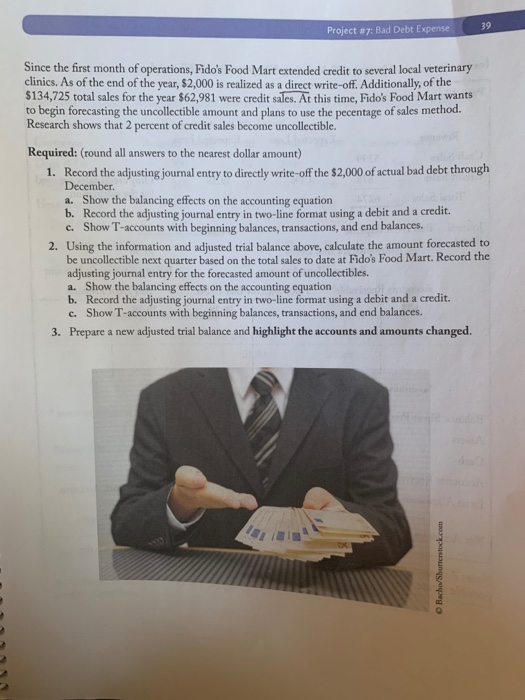

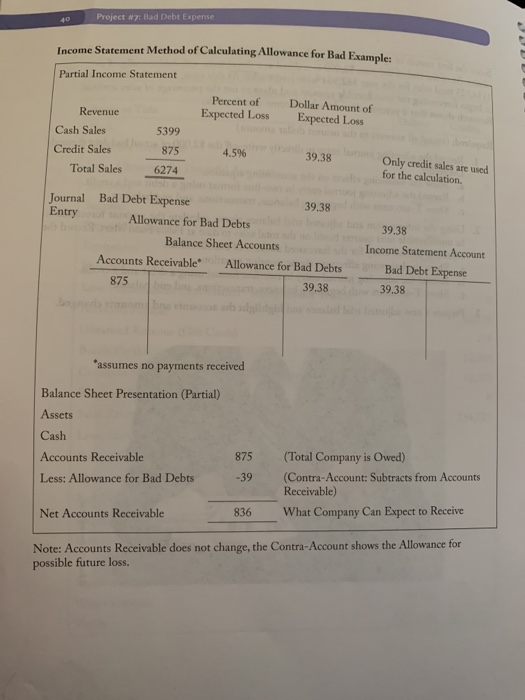

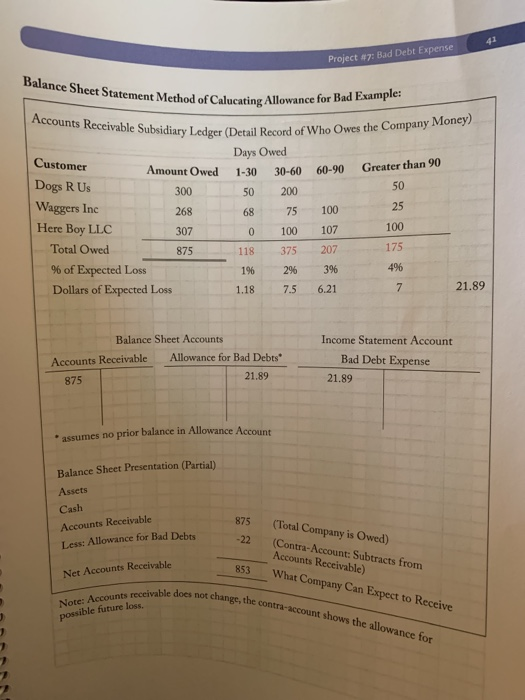

39 Project sy: Bad Debt Expense Since the first month of operations, Fido's Food Mart extended credit to several local veterinary clinics. As of the end of the year, $2,000 is realized as a direct write-off. Additionally, of the $134,725 total sales for the year $62,981 were credit sales. At this time, Fido's Food Mart wants to begin forecasting the uncollectible amount and plans to use the pecentage of sales method. Research shows that 2 percent of credit sales become uncollectible. Required: (round all answers to the nearest dollar amount) 1. Record the adjusting journal entry to directly write-off the $2,000 of actual bad debt through December a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-accounts with beginning balances, transactions, and end balances. 2. Using the information and adjusted trial balance above, calculate the amount forecasted to be uncollectible next quarter based on the total sales to date at Fido's Food Mart. Record the adjusting journal entry for the forecasted amount of uncollectibles. a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-accounts with beginning balances, transactions, and end balances. 3. Prepare a new adjusted trial balance and highlight the accounts and amounts changed. Bacho/Shutterstock.com 38 Project #7: Bad Debt Expense Credits Fido's Food Mart Adjusted Trial Balance December 31, 20XX Account Title Cash Accounts Receivable Less: Allowance for Doubtful Accounts Inventory Debits 52,898 12,250 20,390 650 320 30,550 12,250 62,128 275 12,000 42,000 Prepaid Insurance Equipment Vehicle Less: Accumulated Depreciation - Equipment & Vehicle Accounts Payable Unearned Revenue (Gift Cards) Bonds Payable (mature 12/31/XX) Common Stock (200 shares @ $210/share, par $210) Retained Earnings Sales Revenue Less: Sales Discount Cost of Goods Sold Operating Expenses Bad Debt Expense Depreciation Expense Insurance Expense Rent Expense Supplies Expense Wages Expense Totals 134,725 40 64,330 34,840 160 5,750 1,200 15,500 $251,128 $251,128 40 Project wi: Bad Debt Expense Income Statement Method of Calculating Allowance for Bad Example Partial Income Statement Percent of Expected Loss Dollar Amount of Expected Loss 5399 Revenue Cash Sales Credit Sales Total Sales 875 4.5% 39.38 6274 Only credit sales are used for the calculation. Journal Bad Debt Expense Entry A llowance for Bad Debts 39.38 39.38 Balance Sheet Accounts Accounts Receivable' Allowance for Bad Debts 875 Income Statement Account Bad Debt Expense 39.38 39.38 39 "assumes no payments received Balance Sheet Presentation (Partial) Assets Cash Accounts Receivable Less: Allowance for Bad Debts 875 -39 (Total Company is Owed) (Contra-Account: Subtracts from Accounts Receivable) What Company Can Expect to Receive Net Accounts Receivable 836 Note: Accounts Receivable does not change, the Contra-Account shows the Allowance for possible future loss. 41 Project #7: Bad Debt Expense lance Sheet Statement Method of Calucating Allowance for lucating Allowance for Bad Example: Accounts Receivable Subsidiary Ledger (Det Subsidiary Ledger (Detail Record of Who Owes the Company Money) Days Owed Customer Amount Owed 1-30 30-60 60-90 Greater than 90 Dogs R Us 300 50 200 Waggers Inc 268 68 75 100 Here Boy LLC 307 0 100 107 100 Total Owed 118 375 207 % of Expected Loss 1% 2% 3% Dollars of Expected Loss 1.18 7.5 6.21 21.89 875 Balance Sheet Accounts Accounts Receivable Allowance for Bad Debts 875 21.89 Income Statement Account Bad Debt Expense 21.89 assumes no prior balance in Allowance Account Balance Sheet Presentation (Partial) Assets Cash Accounts Receivable Less: Allowance for Bad Debts 875 22 (Total Company is Owed) (Contra-Account: Subtracts from Accounts Receivable) What Company Can Expect to Receive Net Accounts Receivable 853 oes not change, the contra-account shows the allowance for Note: Accounts receivable does possible future loss