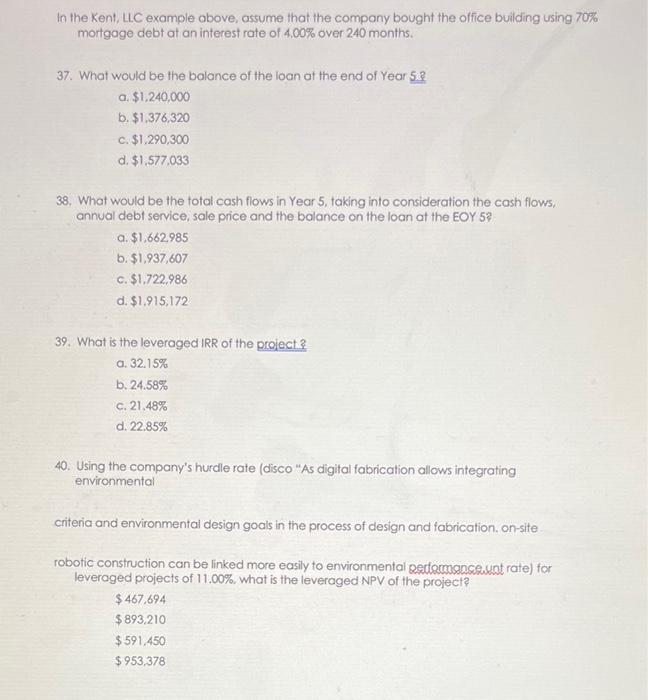

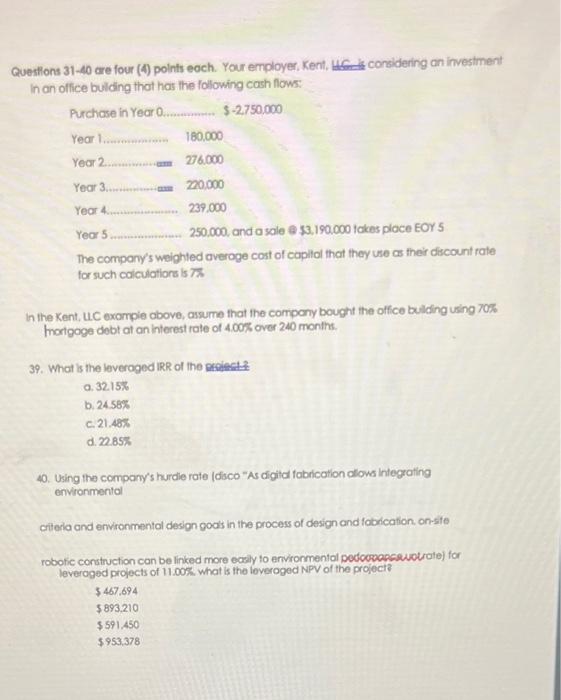

39. What is the leveraged IRR of the project? a. 32.15% b. 24.58% c. 21.48% d. 22.85% 40. Using the company's hurdle rate (disco "As digital fabrication allows integrating environmental criteria and environmental design goals in the process of design and fabrication. on-site robotic construction can be linked more easily to environmental performanceunt rate) for leveraged projects of 11.00%, what is the leveraged NPV of the project? $467,694$893,210$591,450$953,378 In the Kent, LLC example above, assume that the company bought the office building using 70% mortgage debt at an interest rate of 4.00% over 240 months. 35. What would be the monthly debt service on the office building? a. $11,665 b. $9,544 c. $6.890 d. $1,877 In the Kent, L.C example obove, assume that the company bought the office building using 70% mortgage debt at an interest rate of 4.00% over 240 months. 37. What would be the balance of the loan at the end of Year 5 ? a. $1,240,000 b. $1,376,320 c. $1,290,300 d. $1.577.033 38. What would be the total cash flows in Year 5 , taking into consideration the cash flows, annual debt service, sale price and the balance on the loan at the EOY 5 ? a. $1,662,985 b. $1,937,607 c. $1,722,986 d. $1,915,172 39. What is the leveraged IRR of the project? a. 32.15% b. 24.58% c. 21.48% d. 22.85% 40. Using the company's hurdle rate (disco "As digital fabrication allows integrating environmental criteria and environmental design goals in the process of design and fabrication. on-site robotic construction can be linked more easily to environmental pediocmanaseaunt rate) for leveraged projects of 11.00%, what is the leveraged NPV of the project? $467.694$893.210$591.450$953.378 Questlons 31-40 are four (4) points each. Your employer, Kent, 4 , his considering an investment In an office bulding that has the following cash flow: Purchose in Year 0. \$-2.750,000 Year 1 180.000 Year 2. 276000 Year 3....n.m.m. Yeor 4._.......... 239,000 Year 5 250.000, and a sale a 13.190.000 tokes place EOY 5 The company's weighted averoge cost of capilal that they use as fheir discount rate for such calculations is 76 In the Kent, UC example above, assume that the company bought the office bulding using 70% thorigoge debt at an interest rate of 4.008 over 240 monthe. 39. What is the leveroged IRR of the a. 32.15\% b. 24.58% c. 21.48% d. 22.85% 40. Using the company's hurdie rate Idisco "As digitd fabrication dlows integrating environmental citela and environmental design goas in the process of design and fabication on-ste robolic construction can be linked more ecaly to environmental pedcopapsevotvate) for leveroged projects of 11.00%. what is the loveroged NPV of the project? $467.694$893.210$591.450$953,378