Answered step by step

Verified Expert Solution

Question

1 Approved Answer

39. You bought a painting 10 years ago as an investment. You originally paid $85,000 for it. If you sold it for $484,050, what

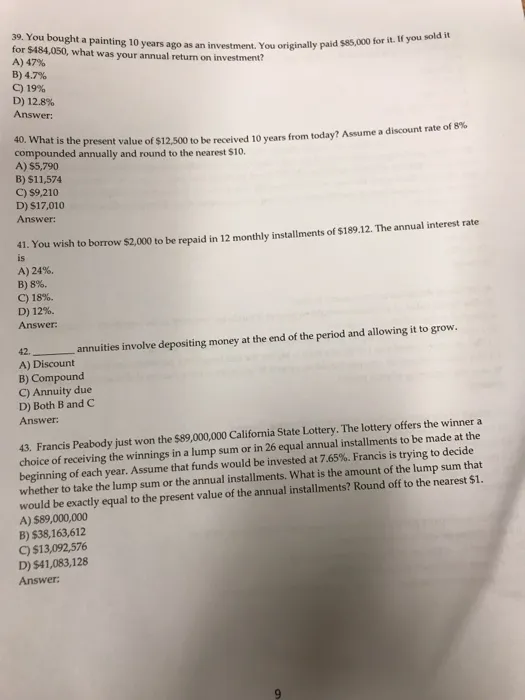

39. You bought a painting 10 years ago as an investment. You originally paid $85,000 for it. If you sold it for $484,050, what was your annual return on investment? A) 47% B) 4.7% C) 19% D) 12.8% Answer: 40. What is the present value of $12,500 to be received 10 years from today? Assume a discount rate of 8% compounded annually and round to the nearest $10. A) $5,790 B) $11,574 C) $9,210 D) $17,010 Answer: 41. You wish to borrow $2,000 to be repaid in 12 monthly installments of $189.12. The annual interest rate is A) 24%. B) 8%. C) 18%. D) 12%. Answer: annuities involve depositing money at the end of the period and allowing it to grow. 42. A) Discount B) Compound C) Annuity due D) Both B and C Answer: 43. Francis Peabody just won the $89,000,000 California State Lottery. The lottery offers the winner a choice of receiving the winnings in a lump sum or in 26 equal annual installments to be made at the beginning of each year. Assume that funds would be invested at 7.65%. Francis is trying to decide whether to take the lump sum or the annual installments. What is the amount of the lump sum that would be exactly equal to the present value of the annual installments? Round off to the nearest $1. A) $89,000,000 B) $38,163,612 C) $13,092,576 D) $41,083,128 Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Painting Investment Question 40 Solution Calculate the total profit 484050 selling price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started