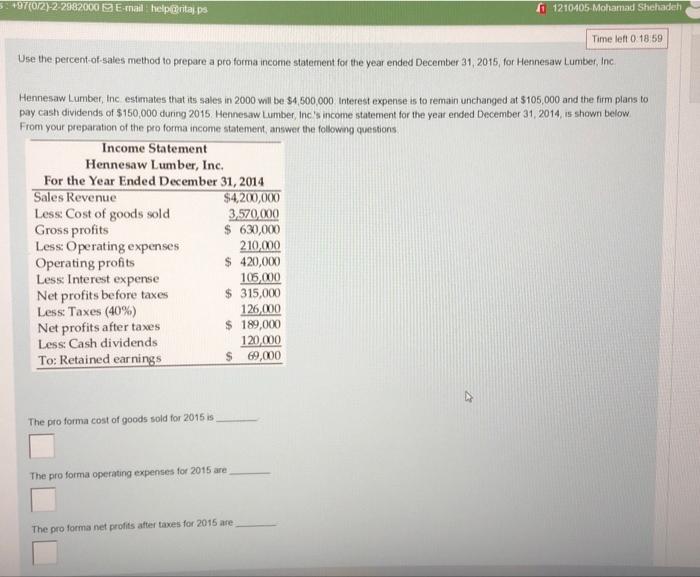

3:+97(0/2)-2-2982000 E-mail: help@@@ritaj ps 1210405 Mohamad Shehadeh Time left 0 18:59 Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2015, for Hennesaw Lumber, Inc. Hennesaw Lumber, Inc. estimates that its sales in 2000 will be $4,500,000. Interest expense is to remain unchanged at $105,000 and the firm plans to pay cash dividends of $150,000 during 2015. Hennesaw Lumber, Inc.'s income statement for the year ended December 31, 2014, is shown below From your preparation of the pro forma income statement, answer the following questions. Income Statement Hennesaw Lumber, Inc. For the Year Ended December 31, 2014 Sales Revenue $4,200,000 Less: Cost of goods sold 3,570,000 Gross profits $ 630,000 210,000 $ 420,000 105,000 $ 315,000 Less: Operating expenses Operating profits Less: Interest expense Net profits before taxes Less: Taxes (40%) Net profits after taxes Less: Cash dividends. To: Retained earnings 126,000 $ 189,000 120,000 $ 69,000 The pro forma cost of goods sold for 2015 is The pro forma operating expenses for 2015 are The pro forma net profits after taxes for 2015 are 3:+97(0/2)-2-2982000 E-mail: help@@@ritaj ps 1210405 Mohamad Shehadeh Time left 0 18:59 Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2015, for Hennesaw Lumber, Inc. Hennesaw Lumber, Inc. estimates that its sales in 2000 will be $4,500,000. Interest expense is to remain unchanged at $105,000 and the firm plans to pay cash dividends of $150,000 during 2015. Hennesaw Lumber, Inc.'s income statement for the year ended December 31, 2014, is shown below From your preparation of the pro forma income statement, answer the following questions. Income Statement Hennesaw Lumber, Inc. For the Year Ended December 31, 2014 Sales Revenue $4,200,000 Less: Cost of goods sold 3,570,000 Gross profits $ 630,000 210,000 $ 420,000 105,000 $ 315,000 Less: Operating expenses Operating profits Less: Interest expense Net profits before taxes Less: Taxes (40%) Net profits after taxes Less: Cash dividends. To: Retained earnings 126,000 $ 189,000 120,000 $ 69,000 The pro forma cost of goods sold for 2015 is The pro forma operating expenses for 2015 are The pro forma net profits after taxes for 2015 are