Answered step by step

Verified Expert Solution

Question

1 Approved Answer

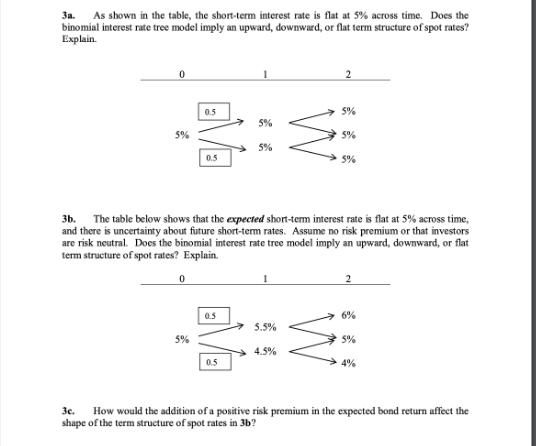

3a. As shown in the table, the short-term interest rate is flat at 5% across time. Does the binomial interest rate tree model imply

3a. As shown in the table, the short-term interest rate is flat at 5% across time. Does the binomial interest rate tree model imply an upward, downward, or flat term structure of spot rates? Explain. 2 0.5 5% 5% 5% 5% 5% 0.5 5% 3b. The table below shows that the expected short-term interest rate is flat at 5% across time, and there is uncertainty about future short-term rates. Assume no risk premium or that investors are risk neutral. Does the binomial interest rate tree model imply an upward, downward, or flat term structure of spot rates? Explain. 0 2 0.5 6% 5.5% 5% 5% 4.5% 0.5 4% 3c. How would the addition of a positive risk premium in the expected bond return affect the shape of the term structure of spot rates in 3b?

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Binomial Interest Rate Tree and Term Structure The binomial interest rate tree model in this scenari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started