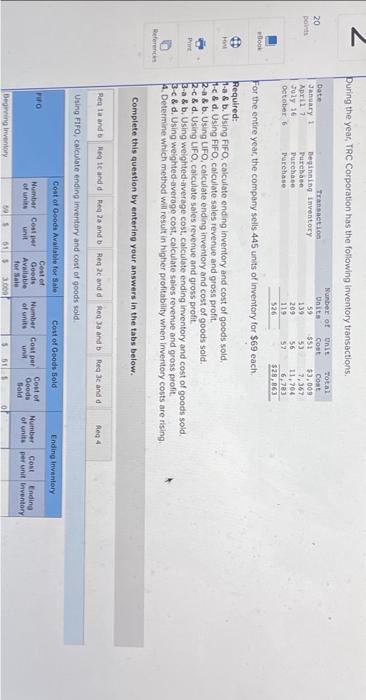

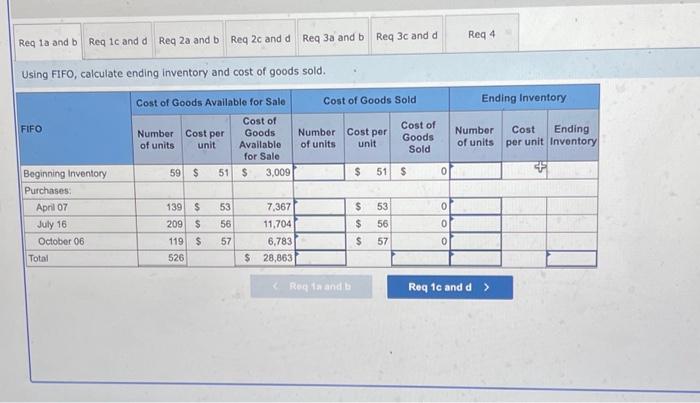

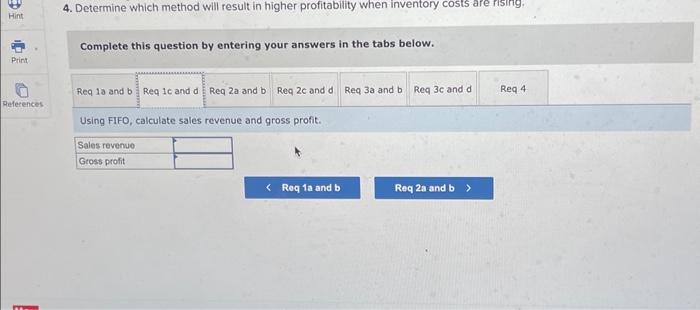

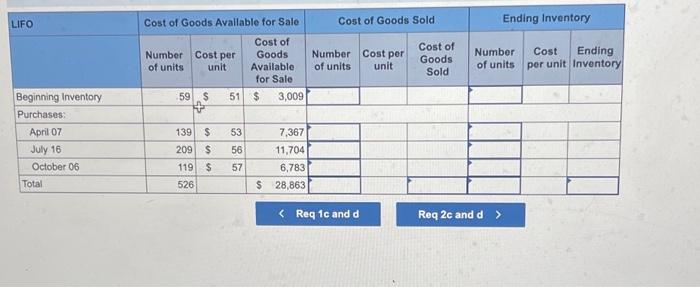

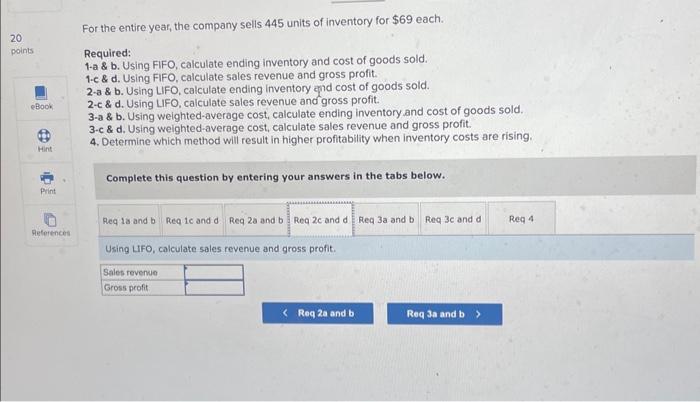

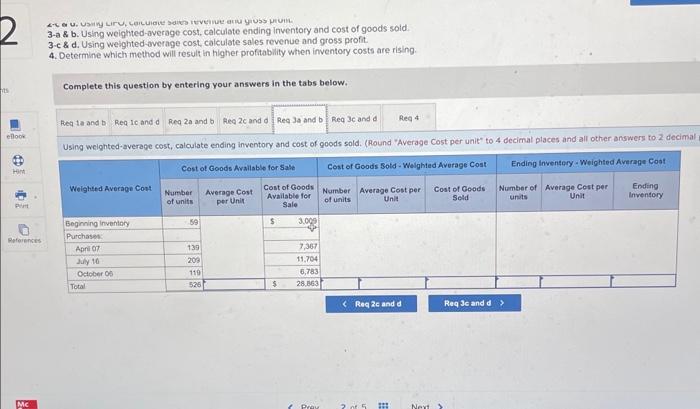

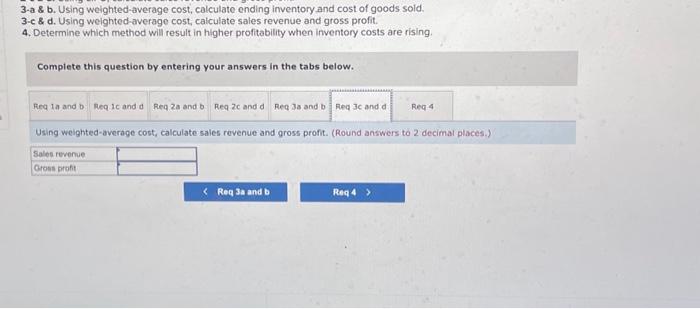

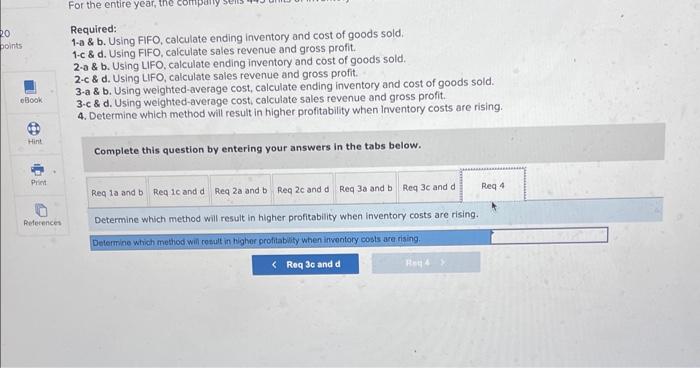

3-a \& b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c \& d. Using weighted-average cost; calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are rising. Complete this question by entering your answers in the tabs below. Using weighted-average cost, calculate sales revenue and gross profit. (Round answers to 2 decimal places.) 3-a \& b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c \& d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are rising. Complete this question by entering your answers in the tabs below. Required: 1-a \& b. Using FIFO, calculate ending inventory and cost of goods sold. 1.c \& d. Using FIFO, calculate sales revenue and gross profit. 2a&b. Using LIFO, calculate ending inventory and cost of goods sold. 2c \& d. Using LIFO, calculate sales revenue and gross profit: 3-a \& b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3.c\& d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when Inventory costs are rising. Complete this question by entering your answers in the tabs below. Determine which method will result in higher profitability when inventory costs are rising. Complete this question by entering your answers in the tabs below. Using FIFO, calculate sales revenue and gross profit. Duning the year, TRC Corporation has the following inventory transactions. For the entire year, the company sells 445 units of inventory for $69 each. Required: 1-a \& b. Using FIFO, calculate ending inventory and cost of goods sold. 1-e 8 d. Using FIFO, calculete sales revenue and gross profit. 2-a \& b. Using LIFO, calculate ending inventory and cost of goods sold. 2c& d. Using UFO, calculate sales revenue and gross profit. 3-a \& b. Using weighted-average cost, calculate ending inventory and cost of goods sold, 3-c \& d. Using weighted-average cost, calculate salos revenue and gross profit. 4. Determine which method will result in higher profitability when invertory costs are rising Complete this question by entering your answers in the tabs below. Using FIFO, calculate ending itwentory and cost of goods sold For the entire year, the company sells 445 units of inventory for $69 each. Required: 1-a \& b. Using FIFO, calculate ending inventory and cost of goods sold, 1 - & d. Using FIFO, calculate sales revenue and gross profit. 2-a \& b. Using LFO, calculate ending inventory and cost of goods sold. 2-c \& d. Using LIFO, calculate sales revenue and gross profit. 3-a \& b. Using weighted-average cost, calculate ending inventory and cost of goods sold, 3-c \& d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are rising. Complete this question by entering your answers in the tabs below. Using LiFO, calculate sales revenue and gross profit. Using FIFO, calculate ending inventory and cost of goods sold