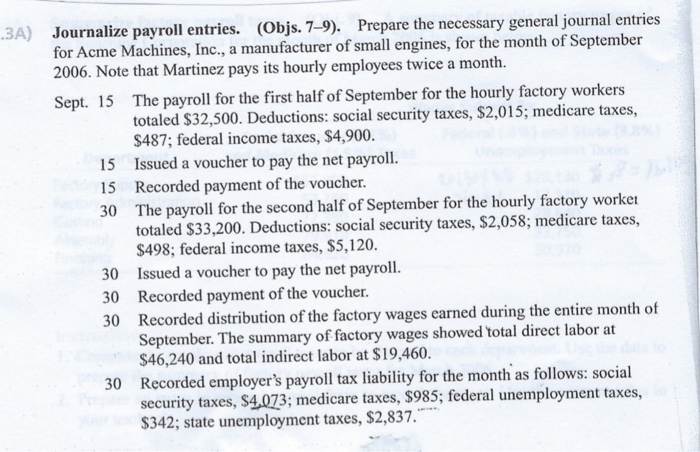

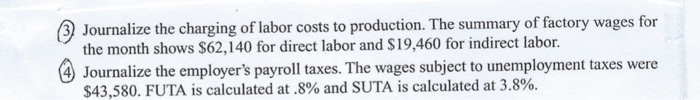

.3A) Journalize payroll entries. (Objs. 79). Prepare the necessary general journal entries for Acme Machines, Inc., a manufacturer of small engines, for the month of September 2006. Note that Martinez pays its hourly employees twice a month. Sept. 15 The payroll for the first half of September for the hourly factory workers totaled $32,500. Deductions: social security taxes, $2,015; medicare taxes, $487; federal income taxes, $4,900. 15 Issued a voucher to pay the net payroll. 15 Recorded payment of the voucher. 30 The payroll for the second half of September for the hourly factory worker totaled $33,200. Deductions: social security taxes, $2,058; medicare taxes, $498; federal income taxes, $5,120. 30 Issued a voucher to pay the net payroll. 30 Recorded payment of the voucher. 30 Recorded distribution of the factory wages earned during the entire month of September. The summary of factory wages showed total direct labor at $46,240 and total indirect labor at $19,460. 30 Recorded employer's payroll tax liability for the month as follows: social security taxes, $4,073; medicare taxes, $985; federal unemployment taxes, $342; state unemployment taxes, $2,837." Journalize the charging of labor costs to production. The summary of factory wages for the month shows $62,140 for direct labor and $19,460 for indirect labor. Journalize the employer's payroll taxes. The wages subject to unemployment taxes were $43,580. FUTA is calculated at.8% and SUTA is calculated at 3.8%. .3A) Journalize payroll entries. (Objs. 79). Prepare the necessary general journal entries for Acme Machines, Inc., a manufacturer of small engines, for the month of September 2006. Note that Martinez pays its hourly employees twice a month. Sept. 15 The payroll for the first half of September for the hourly factory workers totaled $32,500. Deductions: social security taxes, $2,015; medicare taxes, $487; federal income taxes, $4,900. 15 Issued a voucher to pay the net payroll. 15 Recorded payment of the voucher. 30 The payroll for the second half of September for the hourly factory worker totaled $33,200. Deductions: social security taxes, $2,058; medicare taxes, $498; federal income taxes, $5,120. 30 Issued a voucher to pay the net payroll. 30 Recorded payment of the voucher. 30 Recorded distribution of the factory wages earned during the entire month of September. The summary of factory wages showed total direct labor at $46,240 and total indirect labor at $19,460. 30 Recorded employer's payroll tax liability for the month as follows: social security taxes, $4,073; medicare taxes, $985; federal unemployment taxes, $342; state unemployment taxes, $2,837." Journalize the charging of labor costs to production. The summary of factory wages for the month shows $62,140 for direct labor and $19,460 for indirect labor. Journalize the employer's payroll taxes. The wages subject to unemployment taxes were $43,580. FUTA is calculated at.8% and SUTA is calculated at 3.8%