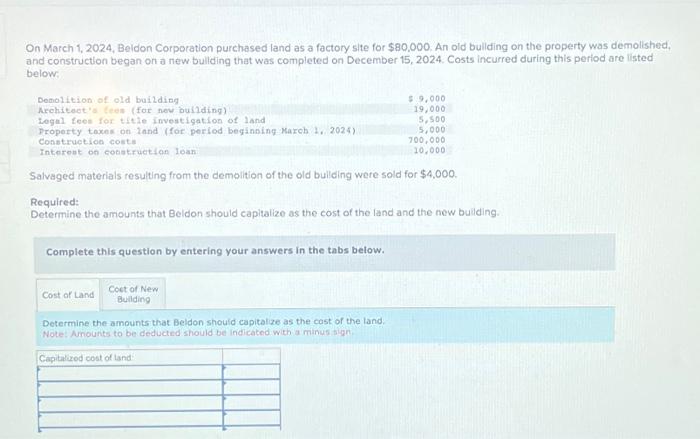

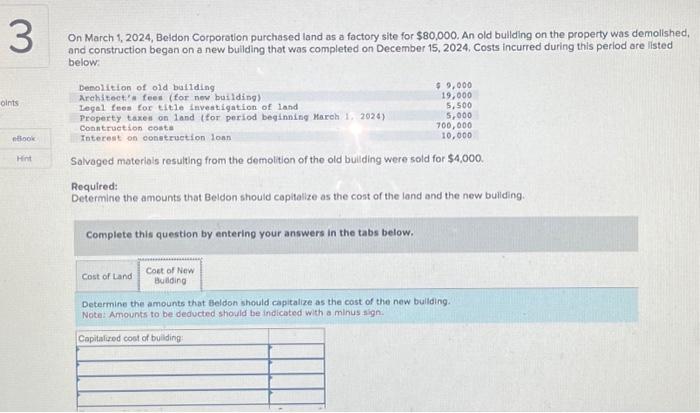

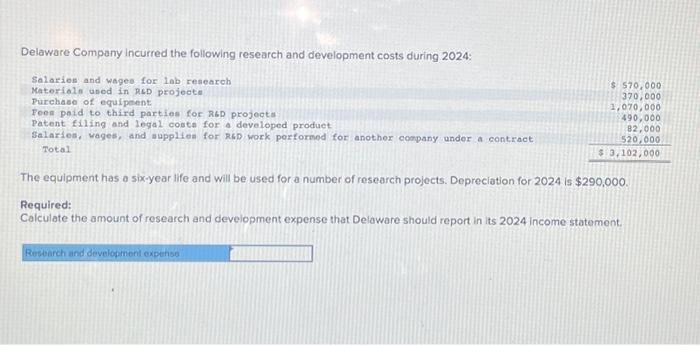

On March 1, 2024, Beldon Corporation purchased land as a factory site for $80,000. An old bullding on the property was demolished, and construction began on a new bullding that was completed on December 15, 2024. Costs incurred during this period are listed below: Salvaged materials resulting from the demolition of the old bullding were sold for $4,000. Required: Determine the amounts that Beldon should capitalize as the cost of the land and the new buliding. Complete this question by entering your answers in the tabs below. Determine the amounts that Beldon should capitalze as the cost of the tand. Note: Amounts to be deducted should be indicated with a minus sign. On March 1, 2024, Beidon Corporation purchased land as a factory site for $80,000. An old bullding on the property was demolished, and construction began on a new buliling that was completed on December 15,2024 , Costs incurred during this period are listed below: Salvaged materials resulting from the demolition of the old buliding were sold for $4,000. Required: Determine the amounts that Beldon should capitalize as the cont of the land and the new buliding. Complete this question by entering your answers in the tabs below. Determine the amounts that Beldon should capitalize as the cost of the new bullding. Note: Amounts to be deducted should be indicated with a minus sign. Delaware Company incurred the following research and development costs during 2024: Salaries and wages for lab research Matorialin unod in piD projeote Purchase of eguipent: Feon poid to third parties for R6D project: Patent filing and legal costa for a developed produet Salaries, wages, and aupplien for R6D work porformed for anothor company undor a contract Total $5,0,000370,0001,070,000490,00082,000520,000$3,102,000 The equipment has a six-year life and will be used for a number of research projects. Depreciation for 2024 is $290,000. Required: Caiculate the amount of research and development expense that Delaware should report in its 2024 income statement. On March 1, 2024, Beldon Corporation purchased land as a factory site for $80,000. An old bullding on the property was demolished, and construction began on a new bullding that was completed on December 15, 2024. Costs incurred during this period are listed below: Salvaged materials resulting from the demolition of the old bullding were sold for $4,000. Required: Determine the amounts that Beldon should capitalize as the cost of the land and the new buliding. Complete this question by entering your answers in the tabs below. Determine the amounts that Beldon should capitalze as the cost of the tand. Note: Amounts to be deducted should be indicated with a minus sign. On March 1, 2024, Beidon Corporation purchased land as a factory site for $80,000. An old bullding on the property was demolished, and construction began on a new buliling that was completed on December 15,2024 , Costs incurred during this period are listed below: Salvaged materials resulting from the demolition of the old buliding were sold for $4,000. Required: Determine the amounts that Beldon should capitalize as the cont of the land and the new buliding. Complete this question by entering your answers in the tabs below. Determine the amounts that Beldon should capitalize as the cost of the new bullding. Note: Amounts to be deducted should be indicated with a minus sign. Delaware Company incurred the following research and development costs during 2024: Salaries and wages for lab research Matorialin unod in piD projeote Purchase of eguipent: Feon poid to third parties for R6D project: Patent filing and legal costa for a developed produet Salaries, wages, and aupplien for R6D work porformed for anothor company undor a contract Total $5,0,000370,0001,070,000490,00082,000520,000$3,102,000 The equipment has a six-year life and will be used for a number of research projects. Depreciation for 2024 is $290,000. Required: Caiculate the amount of research and development expense that Delaware should report in its 2024 income statement