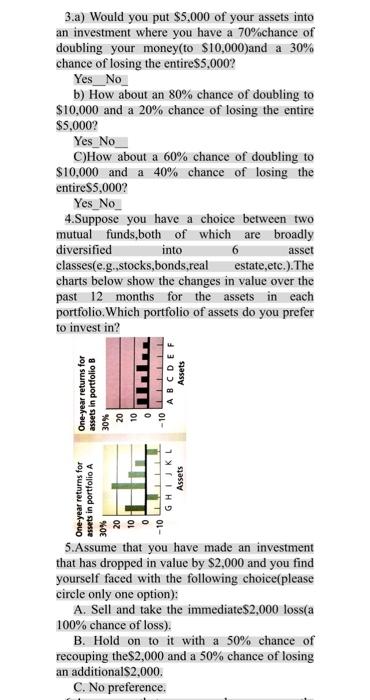

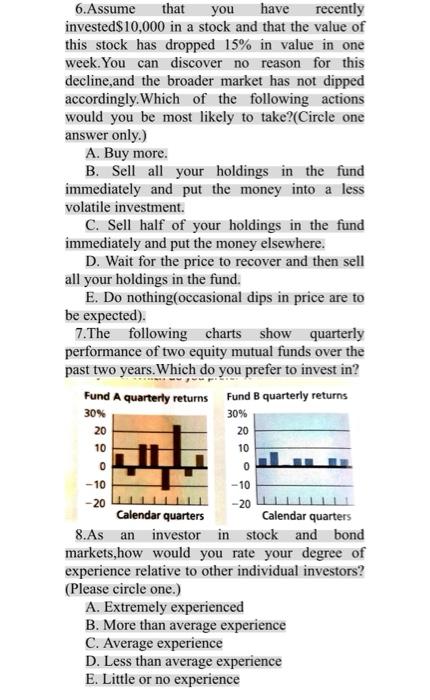

3.a) Would you put $5,000 of your assets into an investment where you have a 70%chance of doubling your money(to $10,000) and a 30% chance of losing the entire$5,000? Yes_No_ b) How about an 80% chance of doubling to $10,000 and a 20% chance of losing the entire $5,000? Yes No C)How about a 60% chance of doubling to $10,000 and a 40% chance of losing the entire$5,000? Yes No 4.Suppose you have a choice between two mutual funds both of which are broadly diversified into asset classes(e.g.,stocks,bonds real estate, etc.). The charts below show the changes in value over the past 12 months for the assets in each portfolio. Which portfolio of assets do you prefer to invest in? One-year returns for assets in portfolio B -10 ULULLL ABCDEF Assets so One-year returns for assets in portfolio A GHIJKL Assets 5.Assume that you have made an investment that has dropped in value by $2,000 and you find yourself faced with the following choice(please circle only one option): A. Sell and take the immediate$2,000 lossa 100% chance of loss). B. Hold on to it with a 50% chance of recouping the $2,000 and a 50% chance of losing an additionals2,000. C. No preference. 6.Assume that you have recently invested $10,000 in a stock and that the value of this stock has dropped 15% in value in one week. You can discover no reason for this decline, and the broader market has not dipped accordingly. Which of the following actions would you be most likely to take?(Circle one answer only.) A. Buy more. B. Sell all your holdings in the fund immediately and put the money into a less volatile investment. C. Sell half of your holdings in the fund immediately and put the money elsewhere. D. Wait for the price to recover and then sell all your holdings in the fund. E. Do nothing (occasional dips in price are to be expected). 7. The following charts show quarterly performance of two equity mutual funds over the past two years. Which do you prefer to invest in? Fund A quarterly returns Fund B quarterly returns 30% 20 30% 20 10 0 10 0 -10 -10 -20 -20 Calendar quarters Calendar quarters 8.As an investor in stock and bond markets, how would you rate your degree of experience relative to other individual investors? (Please circle one.) A. Extremely experienced B. More than average experience C. Average experience D. Less than average experience E. Little or no experience Scoring 1-A.15;B.0:0.7 FOR EACH QUESTION: 2a)-A.0;B.1;C.2 2b)through 2e) A.2:B.1;C.0 FOR EACH QUESTION: 2fthrough 2h) A.O;B.1:C.2 FOR EACH QUESTION: 3a)through 3c) Yes.5;No.0 4-A.10;B.0 5-A.0;B.10;0.10 6-A.15;B.O.C.5;D.0;E.10) 7-A.10;B.0 8-A.20;B.15;C.10;D.5;E.C Score in Points Suitable Investments* 0-11 Avoid risk!Open a money-market account or buy a bigger mattress. 12-33 Gentlemen and ladies)prefer bonds, and are most at home with high-grade corporate and government bonds of an intermediate duration. 34-55 You're still a bond buyer.But you're willing to live a bit closer to the edge with interest-only U.S.Treasury STRIPS. 56-77 Mix it up. Convertible bonds and stocks are to your liking.But safer utilities and large blue chips are as risky as you go.Real-estate investment trusts fit too. 78-99 Stock up on stocks.At the low end you're comfortable with larger value stocks;at the high end.riskier midcap and growth stocks work. 100+ Viva Las Vegas,baby!Place your bets on 'Net stocks and new-tech issues.Risks are high,but so are the payoffs. 3.a) Would you put $5,000 of your assets into an investment where you have a 70%chance of doubling your money(to $10,000) and a 30% chance of losing the entire$5,000? Yes_No_ b) How about an 80% chance of doubling to $10,000 and a 20% chance of losing the entire $5,000? Yes No C)How about a 60% chance of doubling to $10,000 and a 40% chance of losing the entire$5,000? Yes No 4.Suppose you have a choice between two mutual funds both of which are broadly diversified into asset classes(e.g.,stocks,bonds real estate, etc.). The charts below show the changes in value over the past 12 months for the assets in each portfolio. Which portfolio of assets do you prefer to invest in? One-year returns for assets in portfolio B -10 ULULLL ABCDEF Assets so One-year returns for assets in portfolio A GHIJKL Assets 5.Assume that you have made an investment that has dropped in value by $2,000 and you find yourself faced with the following choice(please circle only one option): A. Sell and take the immediate$2,000 lossa 100% chance of loss). B. Hold on to it with a 50% chance of recouping the $2,000 and a 50% chance of losing an additionals2,000. C. No preference. 6.Assume that you have recently invested $10,000 in a stock and that the value of this stock has dropped 15% in value in one week. You can discover no reason for this decline, and the broader market has not dipped accordingly. Which of the following actions would you be most likely to take?(Circle one answer only.) A. Buy more. B. Sell all your holdings in the fund immediately and put the money into a less volatile investment. C. Sell half of your holdings in the fund immediately and put the money elsewhere. D. Wait for the price to recover and then sell all your holdings in the fund. E. Do nothing (occasional dips in price are to be expected). 7. The following charts show quarterly performance of two equity mutual funds over the past two years. Which do you prefer to invest in? Fund A quarterly returns Fund B quarterly returns 30% 20 30% 20 10 0 10 0 -10 -10 -20 -20 Calendar quarters Calendar quarters 8.As an investor in stock and bond markets, how would you rate your degree of experience relative to other individual investors? (Please circle one.) A. Extremely experienced B. More than average experience C. Average experience D. Less than average experience E. Little or no experience Scoring 1-A.15;B.0:0.7 FOR EACH QUESTION: 2a)-A.0;B.1;C.2 2b)through 2e) A.2:B.1;C.0 FOR EACH QUESTION: 2fthrough 2h) A.O;B.1:C.2 FOR EACH QUESTION: 3a)through 3c) Yes.5;No.0 4-A.10;B.0 5-A.0;B.10;0.10 6-A.15;B.O.C.5;D.0;E.10) 7-A.10;B.0 8-A.20;B.15;C.10;D.5;E.C Score in Points Suitable Investments* 0-11 Avoid risk!Open a money-market account or buy a bigger mattress. 12-33 Gentlemen and ladies)prefer bonds, and are most at home with high-grade corporate and government bonds of an intermediate duration. 34-55 You're still a bond buyer.But you're willing to live a bit closer to the edge with interest-only U.S.Treasury STRIPS. 56-77 Mix it up. Convertible bonds and stocks are to your liking.But safer utilities and large blue chips are as risky as you go.Real-estate investment trusts fit too. 78-99 Stock up on stocks.At the low end you're comfortable with larger value stocks;at the high end.riskier midcap and growth stocks work. 100+ Viva Las Vegas,baby!Place your bets on 'Net stocks and new-tech issues.Risks are high,but so are the payoffs