Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3c. Lewis Enterprises is considering relaxing its credit standards to increase its currently sagging sales. As a result of the proposed relaxation, sales are expected

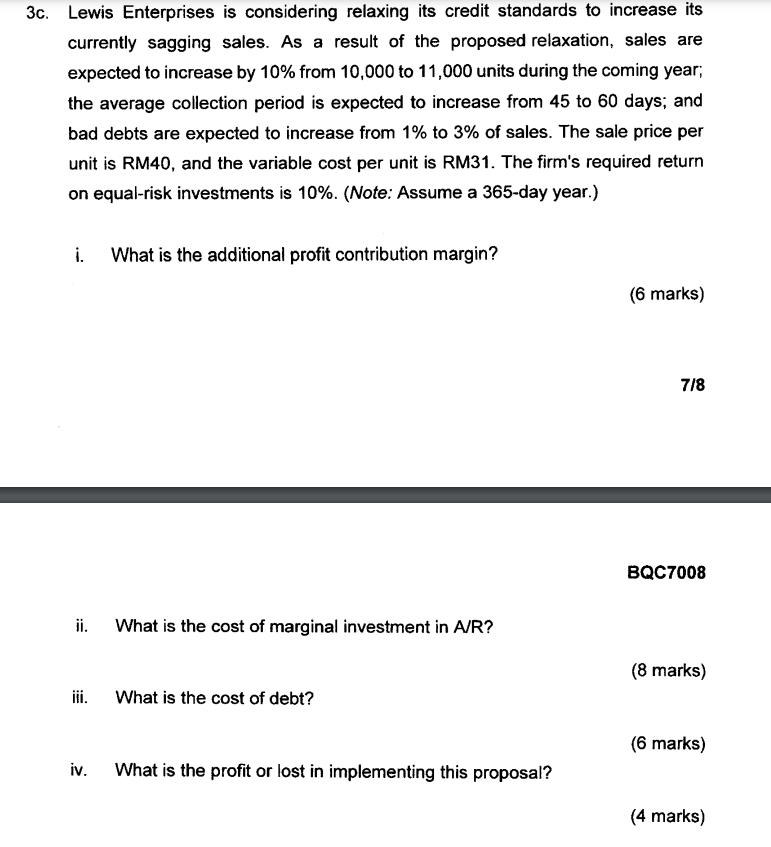

3c. Lewis Enterprises is considering relaxing its credit standards to increase its currently sagging sales. As a result of the proposed relaxation, sales are expected to increase by 10% from 10,000 to 11,000 units during the coming year; the average collection period is expected to increase from 45 to 60 days; and bad debts are expected to increase from 1% to 3% of sales. The sale price per unit is RM40, and the variable cost per unit is RM31. The firm's required return on equal-risk investments is 10%. (Note: Assume a 365 -day year.) i. What is the additional profit contribution margin? (6 marks) 7/8 BQC7008 ii. What is the cost of marginal investment in A/R? ( 8 marks) iii. What is the cost of debt? (6 marks) iv. What is the profit or lost in implementing this proposal

3c. Lewis Enterprises is considering relaxing its credit standards to increase its currently sagging sales. As a result of the proposed relaxation, sales are expected to increase by 10% from 10,000 to 11,000 units during the coming year; the average collection period is expected to increase from 45 to 60 days; and bad debts are expected to increase from 1% to 3% of sales. The sale price per unit is RM40, and the variable cost per unit is RM31. The firm's required return on equal-risk investments is 10%. (Note: Assume a 365 -day year.) i. What is the additional profit contribution margin? (6 marks) 7/8 BQC7008 ii. What is the cost of marginal investment in A/R? ( 8 marks) iii. What is the cost of debt? (6 marks) iv. What is the profit or lost in implementing this proposal Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started