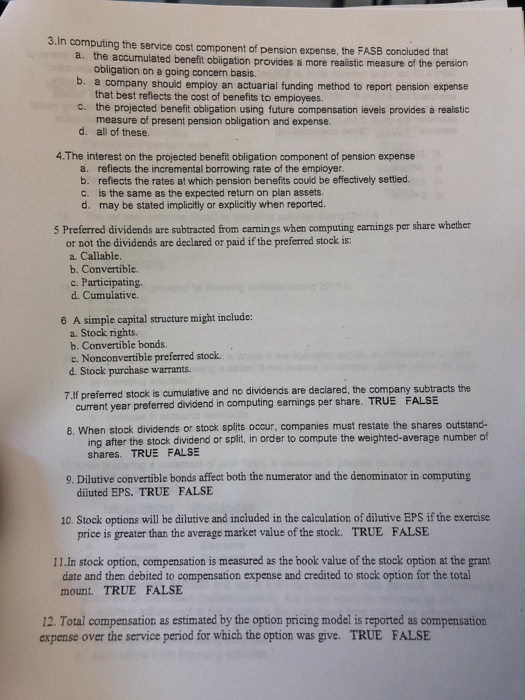

3.In computing the service cost component of pension expense, the FASB concluded that a. the accumulated benefit obligation provides a more realistic b. a company should employ an actuarial funding method to report pension expense C. the projected benefit obligation using future compensation levels provides a realstic d. all of these. measure of the pension obligation on a going concern basis. that best reflects the cost of benefits to employees. measure of present pension obligation and expense. 4.The interest on the projected benefit obligation component of pension expense reflects the incremental borrowing rate of the employer b. a. refiects the rates at which pension benefits could be effectively settled. c. is the same as the expected return on plan assets. d. may be stated implicitly or explicitly when reported. 5 Preferred dividends are subtracted from earnings when computing earnings per share whether or not the dividends are declared or paid if the preferred stock is: a. Callable. b. Convertible c. Participating. d. Cumulative. 6 A simpie capital sructure migh in a. Stock rights. b. Convertible bonds. c. Nonconvertible preferred stock. d. Stock purchase warrants. 7.lf preferred stock is cumulative and no dividends are declared, the company subtracts the TRUE FALSE current year preferred dividend in computing earnings per share. 8. When stock dividends or stock splits occur, companies must restate the shares outstand- ing after the stock dividend or split, in order to compute the weighted-average number of shares. TRUE FALSE 9. Dilutive convertible bonds affect both the numerator and the denominator in computing diluted EPS. TRUE FALSE 10. Stock options will be dilutive and included in the calculation of dilutive EPS if the exercise price is greater than the average market value of the stock. TRUE FALSE 11.In stock option, compensation is measured as the book value of the stock option at the grant date and then debited to compensation expense and credited to stock option for the total mount. TRUE FALSE 12. Total compensation as estimated by the option pricing model is reported as compensation expense over the service period for which the option was give. TRUE FALSE