Question

3-IRR CO C1 C2 C3 C4 -2450 1700 0900 940 3.a: what is the IRR of the project above? (1 Point) 3.b: Do you

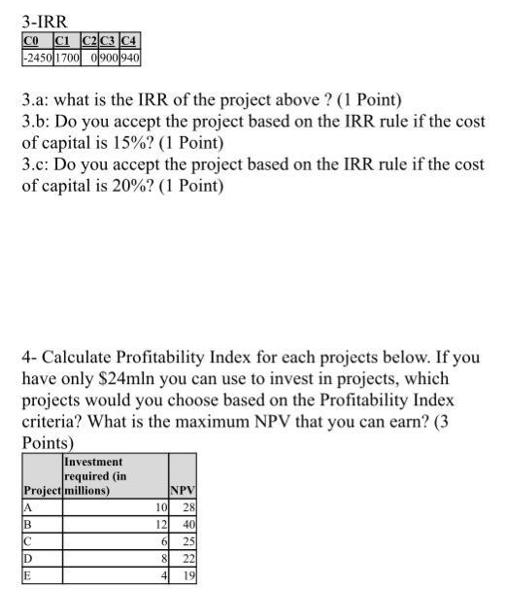

3-IRR CO C1 C2 C3 C4 -2450 1700 0900 940 3.a: what is the IRR of the project above? (1 Point) 3.b: Do you accept the project based on the IRR rule if the cost of capital is 15%? (1 Point) 3.c: Do you accept the project based on the IRR rule if the cost of capital is 20%? (1 Point) 4- Calculate Profitability Index for each projects below. If you have only $24mln you can use to invest in projects, which projects would you choose based on the Profitability Index criteria? What is the maximum NPV that you can earn? (3 Points) Project millions) A B Investment required (in D E NPV 10 28 12 40 6 25 8 22 4 19

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

3 To calculate the IRR of the project we need to solve for the discount rate that equates the present value of cash inflows with the present value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App