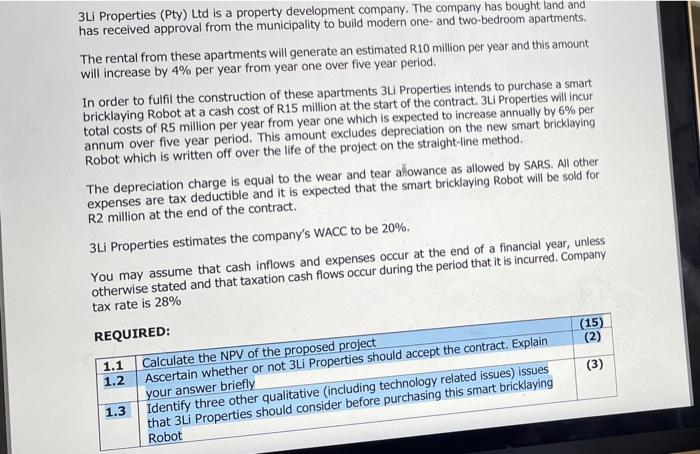

3Li Properties (Pty) Ltd is a property development company. The company has bought land and has received approval from the municipality to build modern one- and two-bedroom apartments. The rental from these apartments will generate an estimated R10 million per year and this amount will increase by 4% per year from year one over five year period. In order to fulfil the construction of these apartments 3L Properties intends to purchase a smart bricklaying Robot at a cash cost of R15 million at the start of the contract. 3Li Properties will incur total costs of R5 million per year from year one which is expected to increase annually by 6% per annum over five year period. This amount excludes depreciation on the new smart bricklaying Robot which is written off over the life of the project on the straight-line method. The depreciation charge is equal to the wear and tear akowance as allowed by SARS. All other expenses are tax deductible and it is expected that the smart bricklaying Robot will be sold for R2 million at the end of the contract. 3Li Properties estimates the company's WACC to be 20%. You may assume that cash inflows and expenses occur at the end of a financial year, unless otherwise stated and that taxation cash flows occur during the period that it is incurred. Company tax rate is 28% REQUIRED: (15) 1.1 Calculate the NPV of the proposed project (2) 1.2 Ascertain whether or not 3Li Properties should accept the contract. Explain your answer briefly (3) 1.3 Identify three other qualitative (including technology related issues) issues that 3Li Properties should consider before purchasing this smart bricklaying Robot 3Li Properties (Pty) Ltd is a property development company. The company has bought land and has received approval from the municipality to build modern one- and two-bedroom apartments. The rental from these apartments will generate an estimated R10 million per year and this amount will increase by 4% per year from year one over five year period. In order to fulfil the construction of these apartments 3L Properties intends to purchase a smart bricklaying Robot at a cash cost of R15 million at the start of the contract. 3Li Properties will incur total costs of R5 million per year from year one which is expected to increase annually by 6% per annum over five year period. This amount excludes depreciation on the new smart bricklaying Robot which is written off over the life of the project on the straight-line method. The depreciation charge is equal to the wear and tear akowance as allowed by SARS. All other expenses are tax deductible and it is expected that the smart bricklaying Robot will be sold for R2 million at the end of the contract. 3Li Properties estimates the company's WACC to be 20%. You may assume that cash inflows and expenses occur at the end of a financial year, unless otherwise stated and that taxation cash flows occur during the period that it is incurred. Company tax rate is 28% REQUIRED: (15) 1.1 Calculate the NPV of the proposed project (2) 1.2 Ascertain whether or not 3Li Properties should accept the contract. Explain your answer briefly (3) 1.3 Identify three other qualitative (including technology related issues) issues that 3Li Properties should consider before purchasing this smart bricklaying Robot