Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3questions Which of the following factors should be reviewed by a wealth manager before recommending asset allocation strategies to the client ? a. business profitability,

3questions

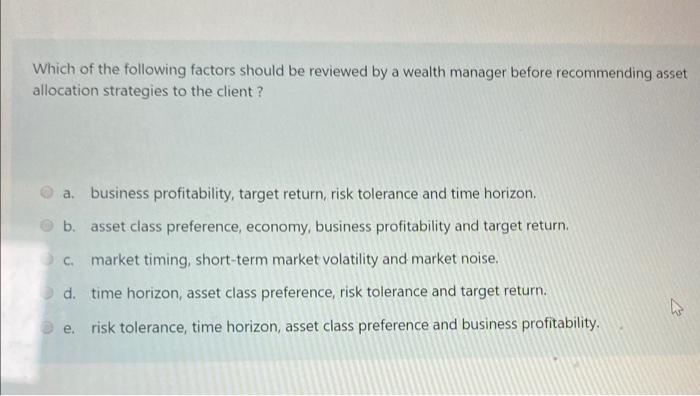

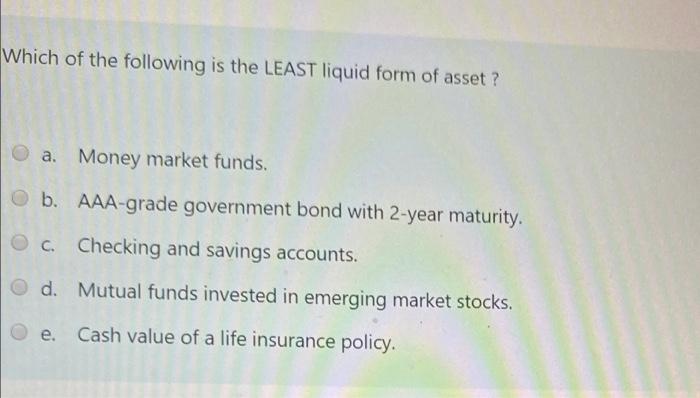

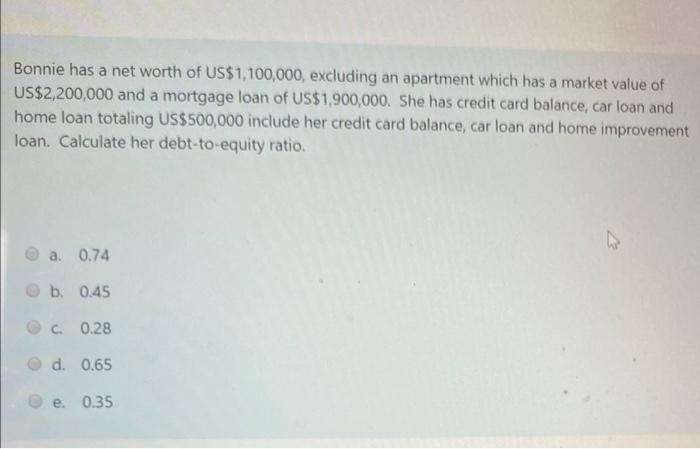

Which of the following factors should be reviewed by a wealth manager before recommending asset allocation strategies to the client ? a. business profitability, target return, risk tolerance and time horizon. b.asset class preference, economy, business profitability and target return. C market timing, short-term market volatility and market noise. d. time horizon, asset class preference, risk tolerance and target return. We e. risk tolerance, time horizon, asset class preference and business profitability. Which of the following is the LEAST liquid form of asset ? a. Money market funds. b. AAA-grade government bond with 2-year maturity. C. Checking and savings accounts. d. Mutual funds invested in emerging market stocks, e. Cash value of a life insurance policy. Bonnie has a net worth of US$1,100,000, excluding an apartment which has a market value of US$2,200,000 and a mortgage loan of US$1,900,000. She has credit card balance, car loan and home loan totaling US$500,000 include her credit card balance, car loan and home improvement loan. Calculate her debt-to-equity ratio. IN a. 0.74 b. 0.45 C 0.28 d. 0.65 e. 0.35 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started