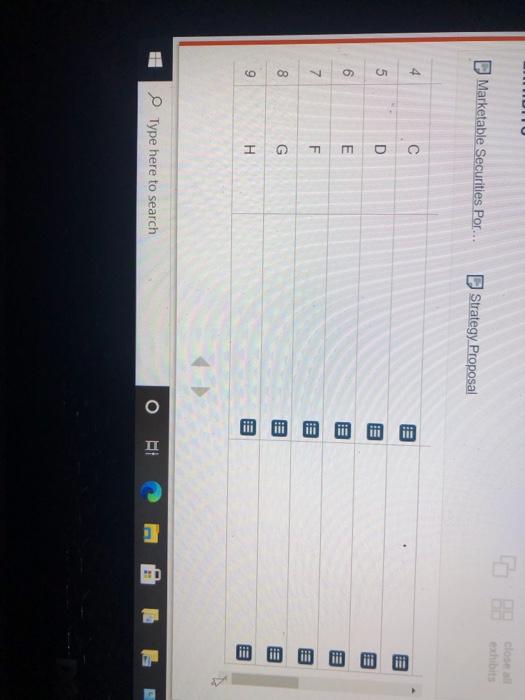

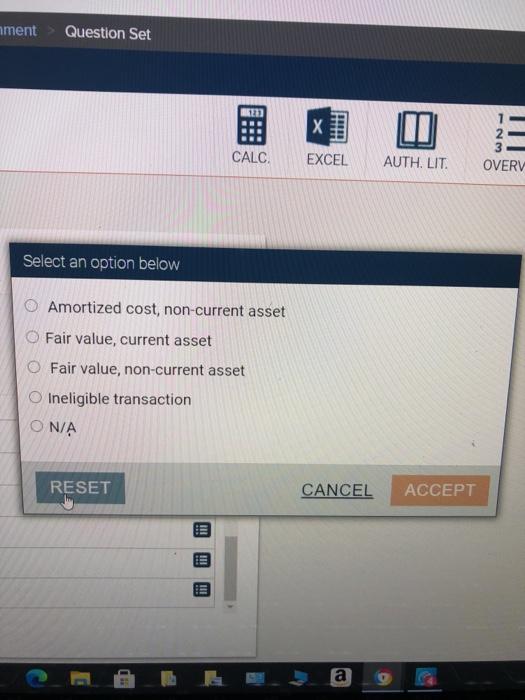

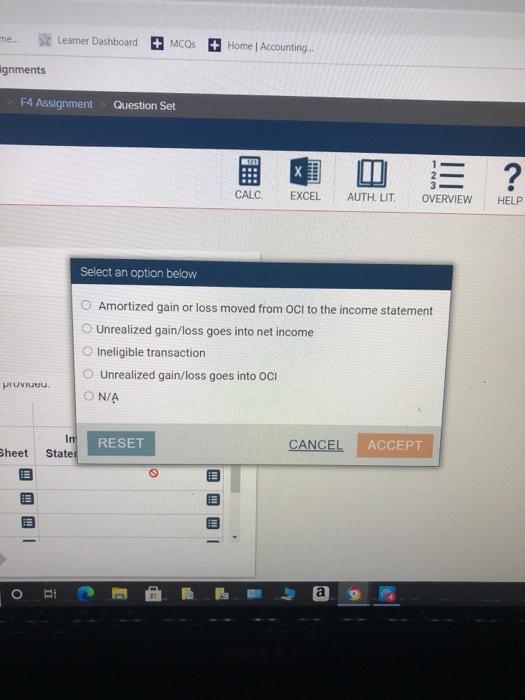

3rd picture is for all of column B(reported on the balance sheet) 4th picture is for column C (impact on the financial statement from gain/losses)

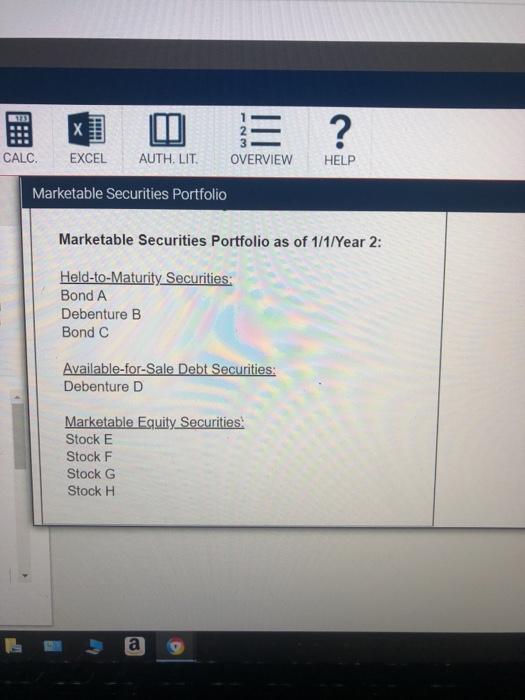

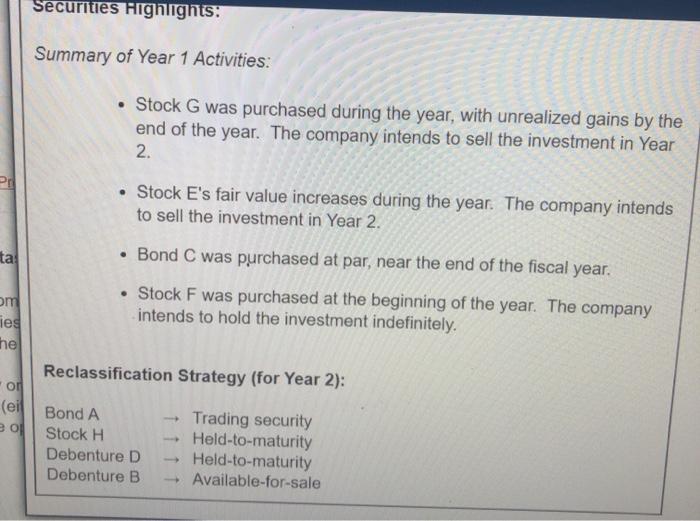

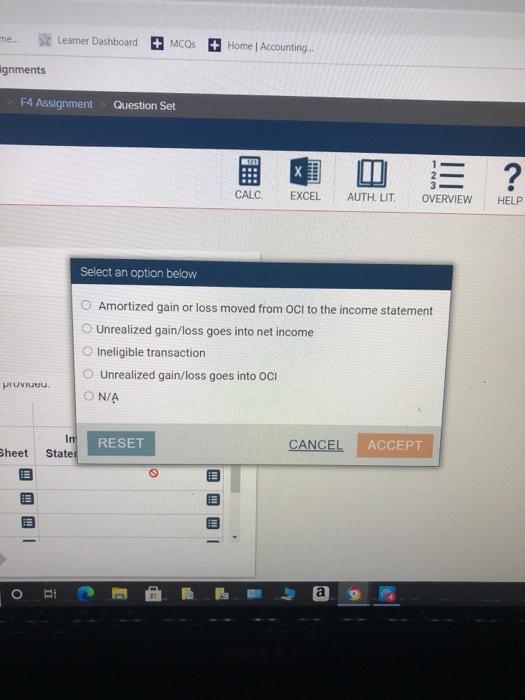

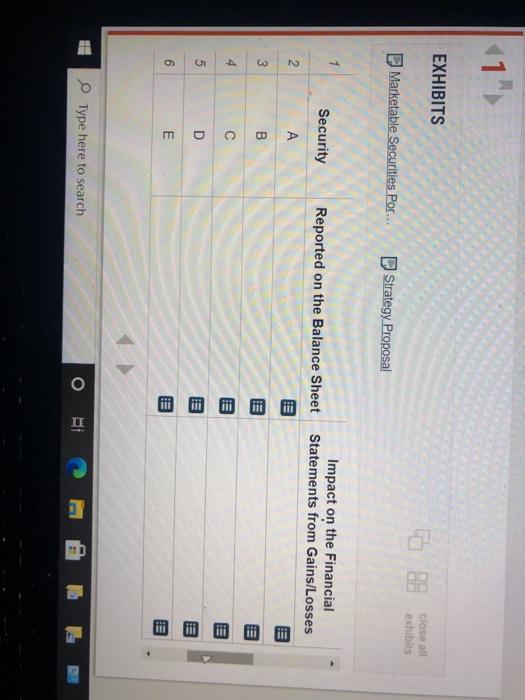

EXHIBITS close all exhibits Marketable Securities Por... Strategy Proposal Logan Inc. is a technology company. The company is evaluating its current marketable securities portfolio, including a review of Year 1 activities and a review of a proposed Year 2 strategy. Use the information in the exhibits to complete the table below. For each security, indicate how the security or transaction will be reported on the balance sheet and the impact on the financial statements (either in Year 1 or Year 2) based on activity or proposed strategy. Select answers from the option list provided. B Imnart on the Financial Type here to search 1" EXHIBITS close all exhibits Marketable Securities Por... Strategy Proposal Security Reported on the Balance Sheet Impact on the Financial Statements from Gains/Losses 2 A 52 4 C !!! 5 D 6 E Type here to search IT IU Marketable Securities Por... Strategy Proposal 4 C ili 5 D 6 E 7 !!!!!!!! CO G 9 H Type here to search o Et nment Question Set -NM CALC. EXCEL AUTH. LIT. OVERV Select an option below Amortized cost, non-current asset Fair value, current asset O Fair value, non-current asset Ineligible transaction N/A RESET CANCEL ACCEPT a e Learner Dashboard MCOS Home | Accounting ignments F4 Assignment Question Set = ? w CALC. EXCEL AUTH. LIT OVERVIEW HELP Select an option below Amortized gain or loss moved from OCI to the income statement Unrealized gain/loss goes into net income Ineligible transaction Unrealized gain/loss goes into OCI ONA Pluviu RESET CANCEL ACCEPT Sheet State HE o TE | O FI EXCEL Hill un = ? CALC. AUTH. LIT. OVERVIEW HELP Marketable Securities Portfolio Marketable Securities Portfolio as of 1/1/Year 2: Held-to-Maturity Securities: Bond A Debenture B Bond C Available-for-Sale Debt Securities: Debenture D Marketable Equity Securities! Stock E Stock F Stock G Stock H a Securities Highlights: Summary of Year 1 Activities: Stock G was purchased during the year, with unrealized gains by the end of the year. The company intends to sell the investment in Year 2. ta Stock E's fair value increases during the year. The company intends to sell the investment in Year 2. Bond C was purchased at par, near the end of the fiscal year. Stock F was purchased at the beginning of the year. The company intends to hold the investment indefinitely. om ies he Reclassification Strategy (for Year 2): op (eil Bond A el Stock H Debenture D Debenture B Trading security Held-to-maturity Held-to-maturity Available-for-sale EXHIBITS close all exhibits Marketable Securities Por... Strategy Proposal Logan Inc. is a technology company. The company is evaluating its current marketable securities portfolio, including a review of Year 1 activities and a review of a proposed Year 2 strategy. Use the information in the exhibits to complete the table below. For each security, indicate how the security or transaction will be reported on the balance sheet and the impact on the financial statements (either in Year 1 or Year 2) based on activity or proposed strategy. Select answers from the option list provided. B Imnart on the Financial Type here to search 1" EXHIBITS close all exhibits Marketable Securities Por... Strategy Proposal Security Reported on the Balance Sheet Impact on the Financial Statements from Gains/Losses 2 A 52 4 C !!! 5 D 6 E Type here to search IT IU Marketable Securities Por... Strategy Proposal 4 C ili 5 D 6 E 7 !!!!!!!! CO G 9 H Type here to search o Et nment Question Set -NM CALC. EXCEL AUTH. LIT. OVERV Select an option below Amortized cost, non-current asset Fair value, current asset O Fair value, non-current asset Ineligible transaction N/A RESET CANCEL ACCEPT a e Learner Dashboard MCOS Home | Accounting ignments F4 Assignment Question Set = ? w CALC. EXCEL AUTH. LIT OVERVIEW HELP Select an option below Amortized gain or loss moved from OCI to the income statement Unrealized gain/loss goes into net income Ineligible transaction Unrealized gain/loss goes into OCI ONA Pluviu RESET CANCEL ACCEPT Sheet State HE o TE | O FI EXCEL Hill un = ? CALC. AUTH. LIT. OVERVIEW HELP Marketable Securities Portfolio Marketable Securities Portfolio as of 1/1/Year 2: Held-to-Maturity Securities: Bond A Debenture B Bond C Available-for-Sale Debt Securities: Debenture D Marketable Equity Securities! Stock E Stock F Stock G Stock H a Securities Highlights: Summary of Year 1 Activities: Stock G was purchased during the year, with unrealized gains by the end of the year. The company intends to sell the investment in Year 2. ta Stock E's fair value increases during the year. The company intends to sell the investment in Year 2. Bond C was purchased at par, near the end of the fiscal year. Stock F was purchased at the beginning of the year. The company intends to hold the investment indefinitely. om ies he Reclassification Strategy (for Year 2): op (eil Bond A el Stock H Debenture D Debenture B Trading security Held-to-maturity Held-to-maturity Available-for-sale

3rd picture is for all of column B(reported on the balance sheet) 4th picture is for column C (impact on the financial statement from gain/losses)

3rd picture is for all of column B(reported on the balance sheet) 4th picture is for column C (impact on the financial statement from gain/losses)