Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3rd row Dimsdale Sports, a merchandising company, reports the following balance sheet at December 31 . a. The company's single product is purchased for $20

3rd row

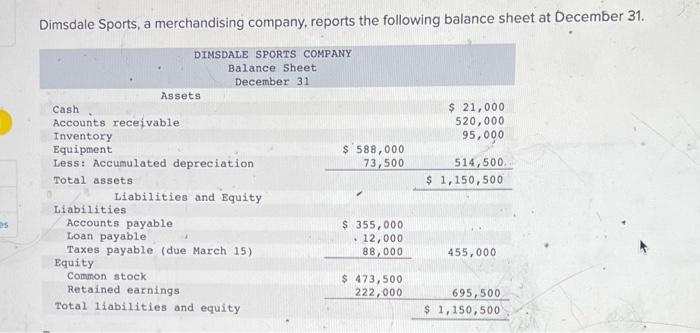

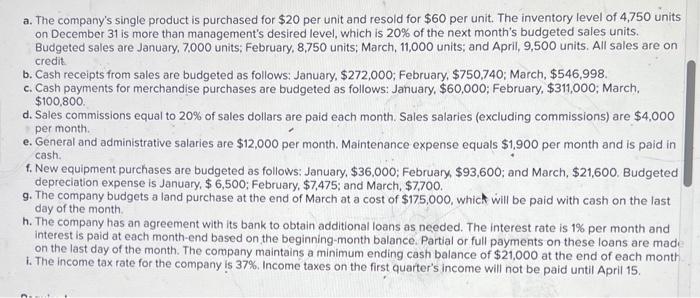

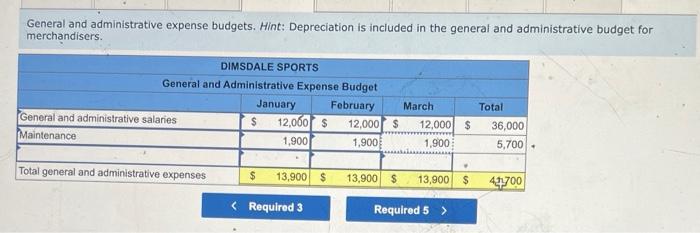

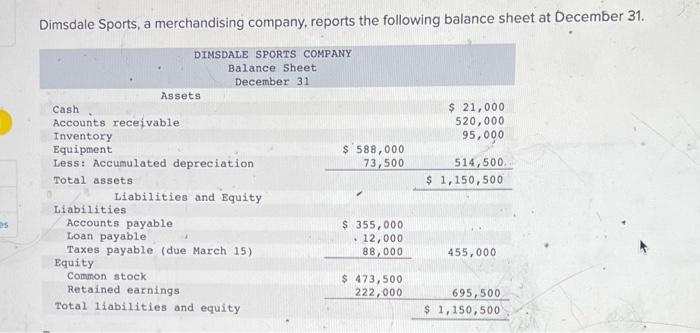

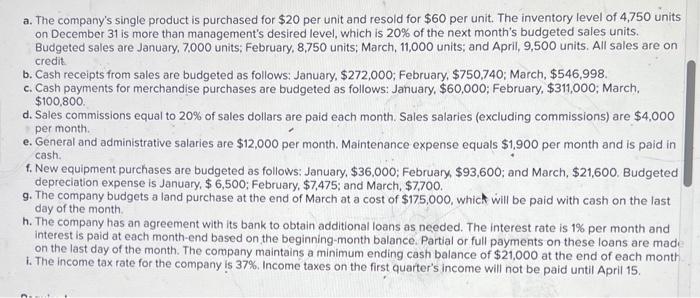

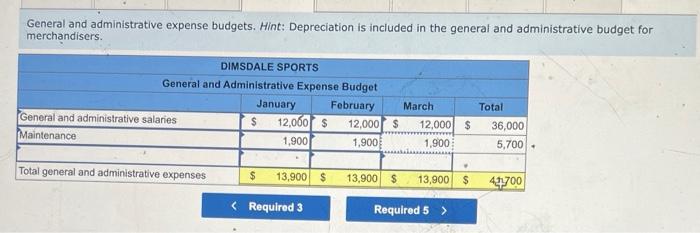

Dimsdale Sports, a merchandising company, reports the following balance sheet at December 31 . a. The company's single product is purchased for $20 per unit and resold for $60 per unit. The inventory level of 4,750 units on December 31 is more than management's desired level, which is 20% of the next month's budgeted sales units. Budgeted sales are January, 7,000 units; February, 8,750 units; March, 11,000 units; and April, 9,500 units. All sales are on credit. b. Cash receipts from sales are budgeted as follows: January, $272,000; February, $750,740; March, $546,998. c. Cash payments for merchandise purchases are budgeted as follows: January, $60,000; February, $311,000; March. $100,800. d. Sales commissions equal to 20% of sales dollars are paid each month. Sales salaries (excluding commissions) are $4,000 per month. e. General and administrative salaries are $12,000 per month. Maintenance expense equals $1,900 per month and is paid in cash. f. New equipment purchases are budgeted as follows: January, $36,000; February, $93,600; and March, $21,600, Budgeted depreciation expense is January, $6,500; February, $7,475; and March, $7,700. g. The company budgets a land purchase at the end of March at a cost of $175,000, whick will be paid with cash on the last day of the month. h. The company has an agreement with its bank to obtain additional loans as needed. The interest rate is 1% per month and interest is paid at each month-end based on the beginning-month balance. Partial or full payments on these loans are madi on the last day of the month. The company maintains a minimum ending cash balance of $21,000 at the end of each month 1. The income tax rate for the company is 37%. Income taxes on the first quarter's income will not be paid until April 15. General and administrative expense budgets. Hint: Depreciation is included in the general and administrative budget for merchandisers

Dimsdale Sports, a merchandising company, reports the following balance sheet at December 31 . a. The company's single product is purchased for $20 per unit and resold for $60 per unit. The inventory level of 4,750 units on December 31 is more than management's desired level, which is 20% of the next month's budgeted sales units. Budgeted sales are January, 7,000 units; February, 8,750 units; March, 11,000 units; and April, 9,500 units. All sales are on credit. b. Cash receipts from sales are budgeted as follows: January, $272,000; February, $750,740; March, $546,998. c. Cash payments for merchandise purchases are budgeted as follows: January, $60,000; February, $311,000; March. $100,800. d. Sales commissions equal to 20% of sales dollars are paid each month. Sales salaries (excluding commissions) are $4,000 per month. e. General and administrative salaries are $12,000 per month. Maintenance expense equals $1,900 per month and is paid in cash. f. New equipment purchases are budgeted as follows: January, $36,000; February, $93,600; and March, $21,600, Budgeted depreciation expense is January, $6,500; February, $7,475; and March, $7,700. g. The company budgets a land purchase at the end of March at a cost of $175,000, whick will be paid with cash on the last day of the month. h. The company has an agreement with its bank to obtain additional loans as needed. The interest rate is 1% per month and interest is paid at each month-end based on the beginning-month balance. Partial or full payments on these loans are madi on the last day of the month. The company maintains a minimum ending cash balance of $21,000 at the end of each month 1. The income tax rate for the company is 37%. Income taxes on the first quarter's income will not be paid until April 15. General and administrative expense budgets. Hint: Depreciation is included in the general and administrative budget for merchandisers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started