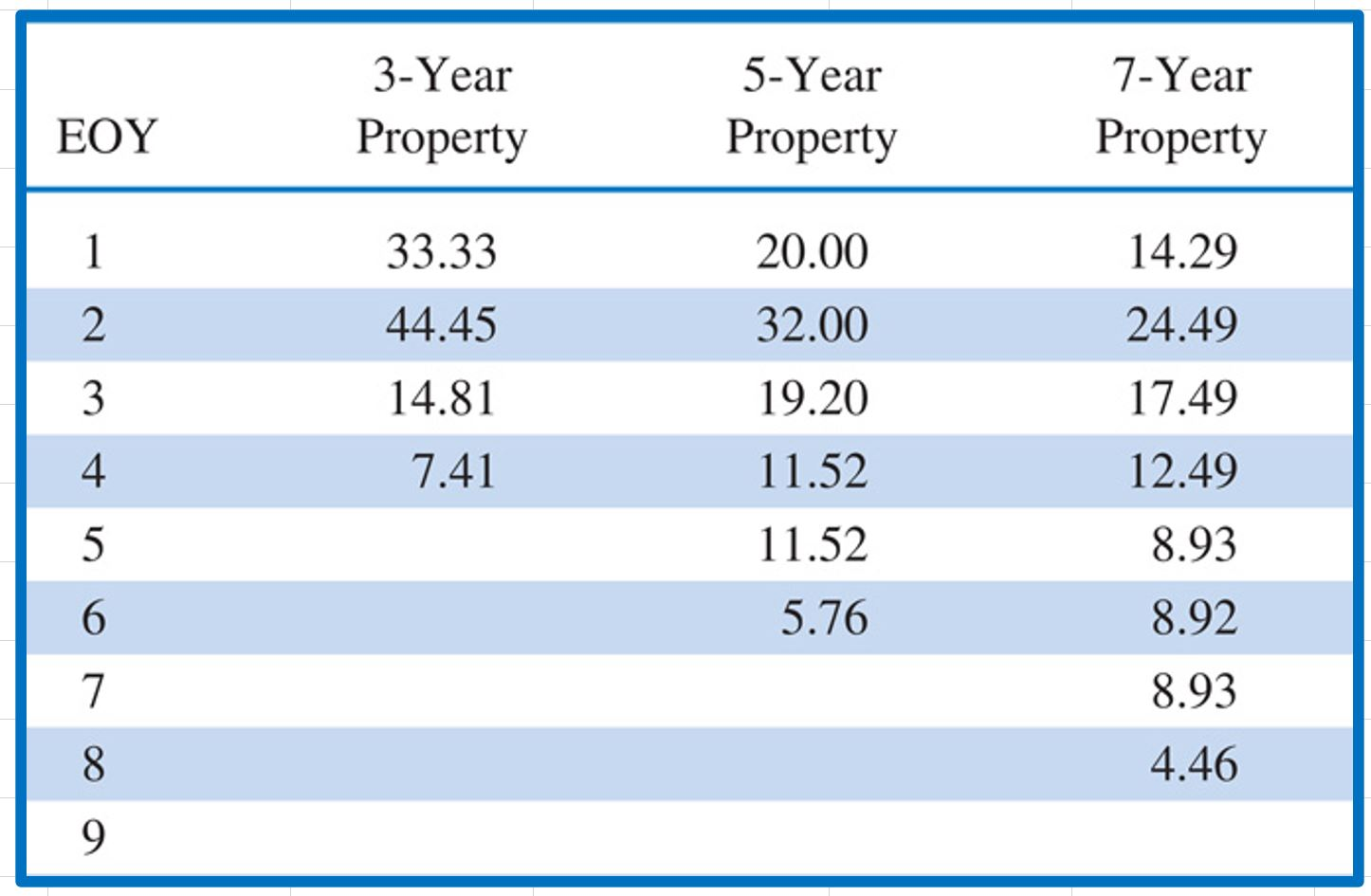

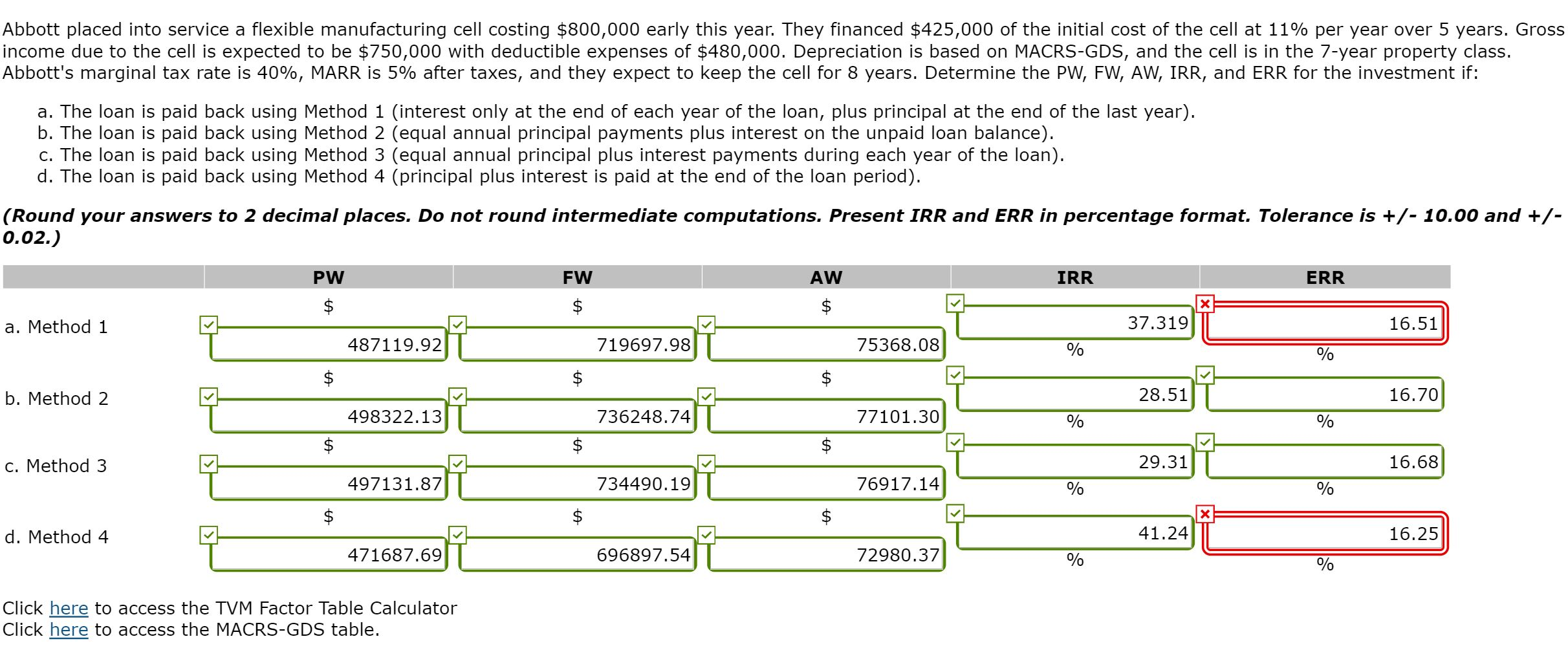

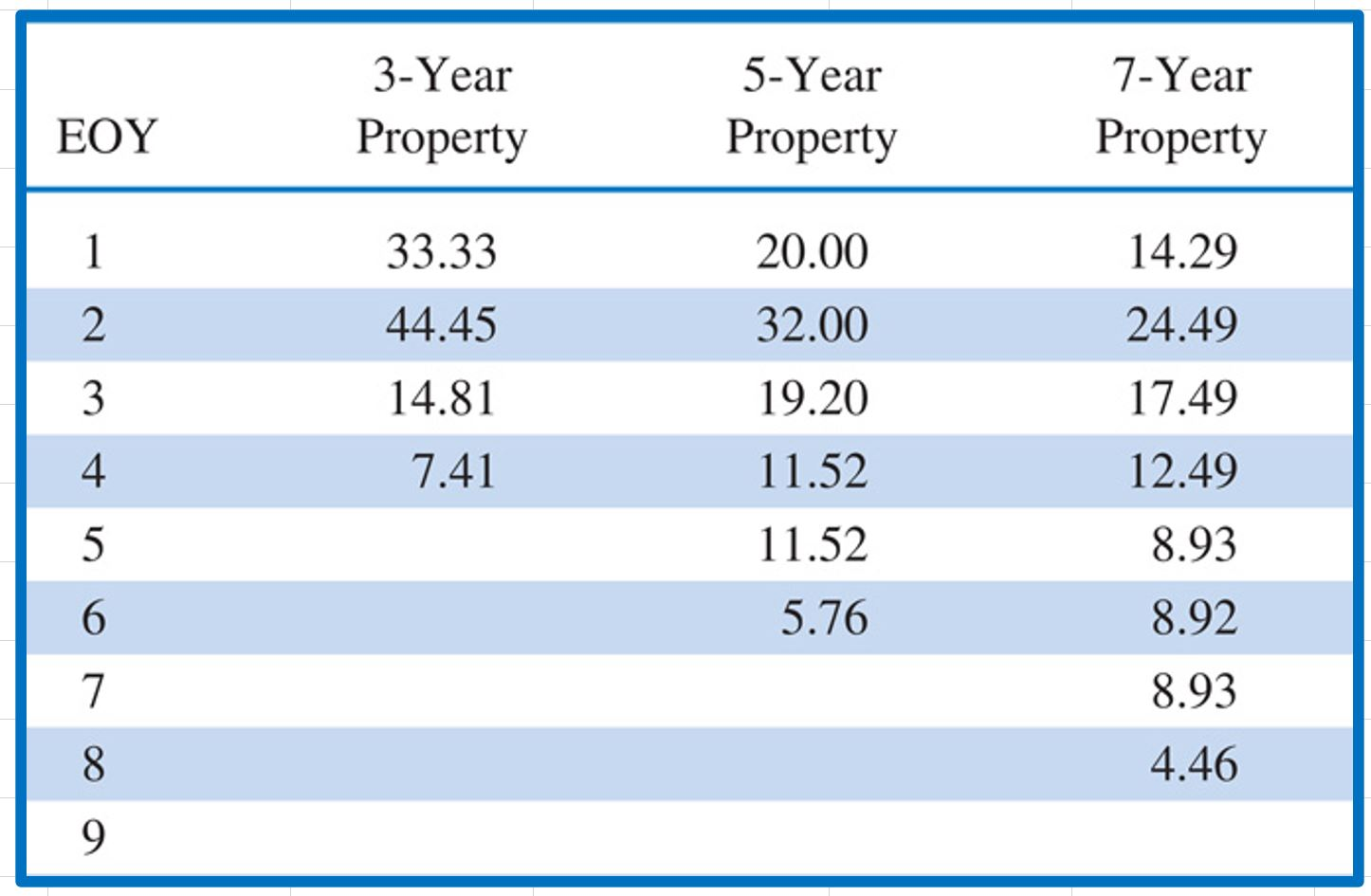

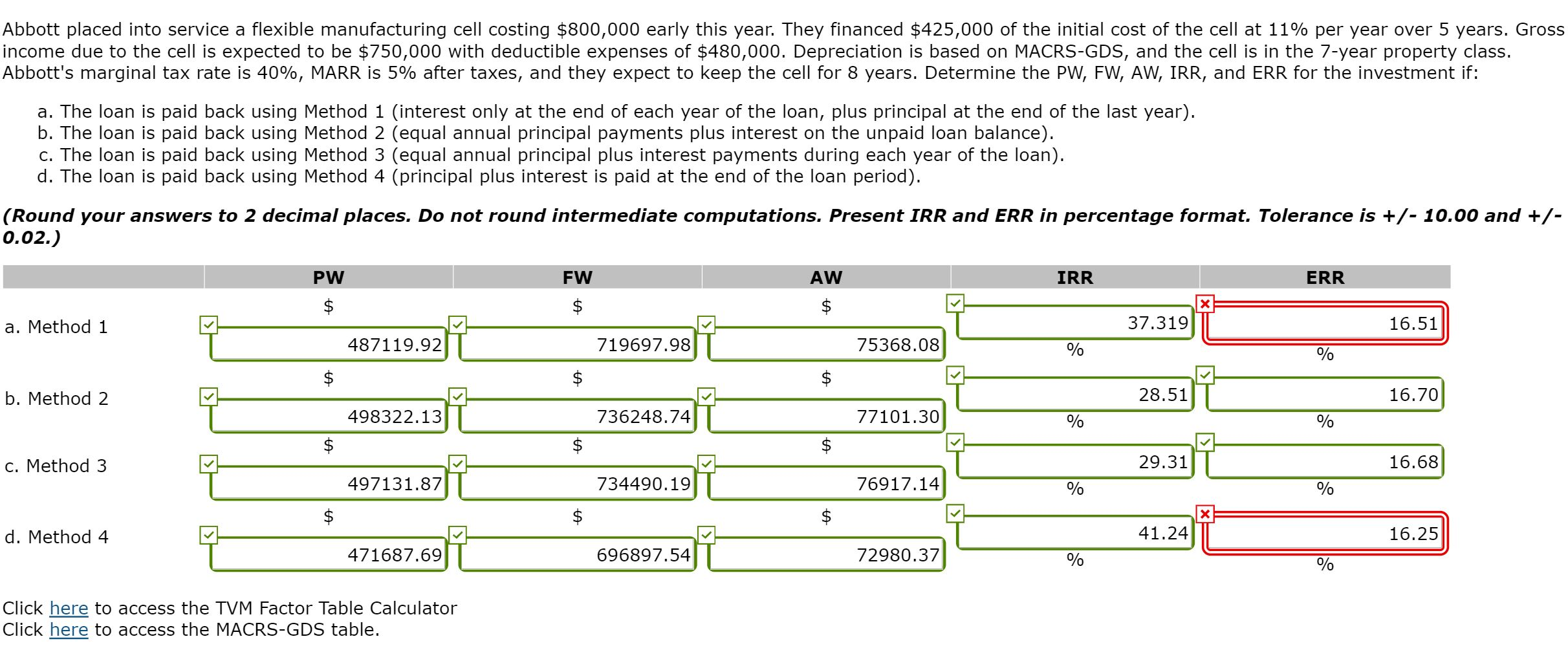

3-Year Property 5-Year Property 7-Year Property 1 2 33.33 44.45 14.81 7.41 20.00 32.00 19.20 11.52 11.52 5.76 4 14.29 24.49 17.49 12.49 8.93 8.92 8.93 6 8 4.46 Abbott placed into service a flexible manufacturing cell costing $800,000 early this year. They financed $425,000 of the initial cost of the cell at 11% per year over 5 years. Gross income due to the cell is expected to be $750,000 with deductible expenses of $480,000. Depreciation is based on MACRS-GDS, and the cell is in the 7-year property class. Abbott's marginal tax rate is 40%, MARR is 5% after taxes, and they expect to keep the cell for 8 years. Determine the PW, FW, AW, IRR, and ERR for the investment if: a. The loan is paid back using Method 1 (interest only at the end of each year of the loan, plus principal at the end of the last year). b. The loan is paid back using Method 2 (equal annual principal payments plus interest on the unpaid loan balance). c. The loan is paid back using Method 3 (equal annual principal plus interest payments during each year of the loan). d. The loan is paid back using Method 4 (principal plus interest is paid at the end of the loan period). (Round your answers to 2 decimal places. Do not round intermediate computations. Present IRR and ERR in percentage format. Tolerance is +/- 10.00 and +/- 0.02.) PW FW AW IRR ERR a. Method 1 7 3 7.319 487119.92 16.51 % b. Method 2 28.51 16.70 1 7 2 % 487119.927 4 98322.1317 4 97131.87 471687.692 % 719697. 98 7 36248.741 734490.19 6 96897. 54 5368.08 U 77101.30) 76917.14 2980.37) $ c. Method 3 16.68 29.31 T 497131.87 734490.19 20 %OL 76917.14 % $ d. Method 4 7 4 1.24 L 696897.54 16.25 % % Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table. 3-Year Property 5-Year Property 7-Year Property 1 2 33.33 44.45 14.81 7.41 20.00 32.00 19.20 11.52 11.52 5.76 4 14.29 24.49 17.49 12.49 8.93 8.92 8.93 6 8 4.46 Abbott placed into service a flexible manufacturing cell costing $800,000 early this year. They financed $425,000 of the initial cost of the cell at 11% per year over 5 years. Gross income due to the cell is expected to be $750,000 with deductible expenses of $480,000. Depreciation is based on MACRS-GDS, and the cell is in the 7-year property class. Abbott's marginal tax rate is 40%, MARR is 5% after taxes, and they expect to keep the cell for 8 years. Determine the PW, FW, AW, IRR, and ERR for the investment if: a. The loan is paid back using Method 1 (interest only at the end of each year of the loan, plus principal at the end of the last year). b. The loan is paid back using Method 2 (equal annual principal payments plus interest on the unpaid loan balance). c. The loan is paid back using Method 3 (equal annual principal plus interest payments during each year of the loan). d. The loan is paid back using Method 4 (principal plus interest is paid at the end of the loan period). (Round your answers to 2 decimal places. Do not round intermediate computations. Present IRR and ERR in percentage format. Tolerance is +/- 10.00 and +/- 0.02.) PW FW AW IRR ERR a. Method 1 7 3 7.319 487119.92 16.51 % b. Method 2 28.51 16.70 1 7 2 % 487119.927 4 98322.1317 4 97131.87 471687.692 % 719697. 98 7 36248.741 734490.19 6 96897. 54 5368.08 U 77101.30) 76917.14 2980.37) $ c. Method 3 16.68 29.31 T 497131.87 734490.19 20 %OL 76917.14 % $ d. Method 4 7 4 1.24 L 696897.54 16.25 % % Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table