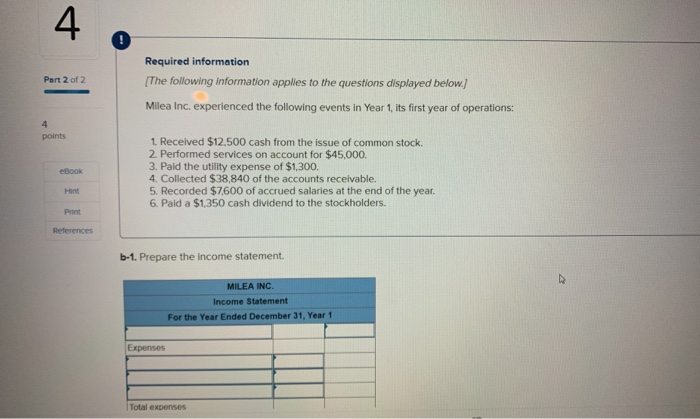

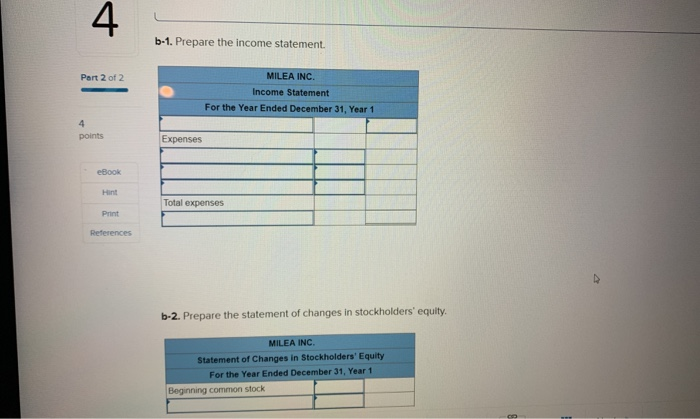

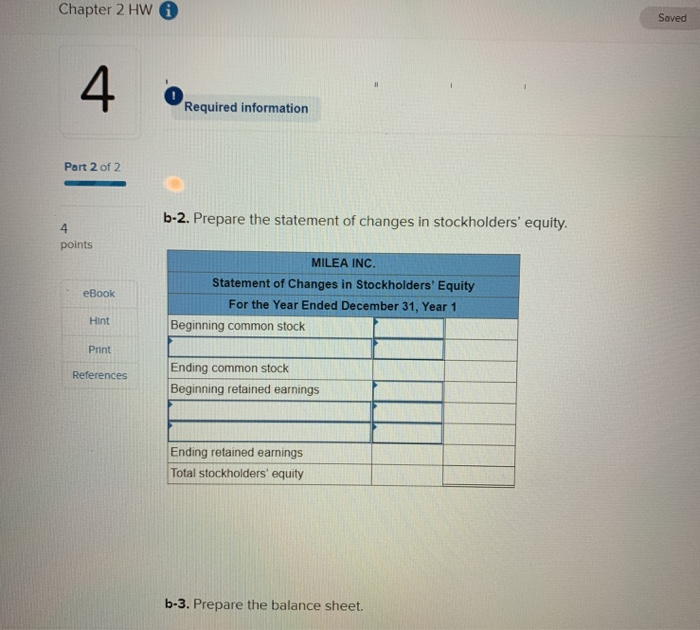

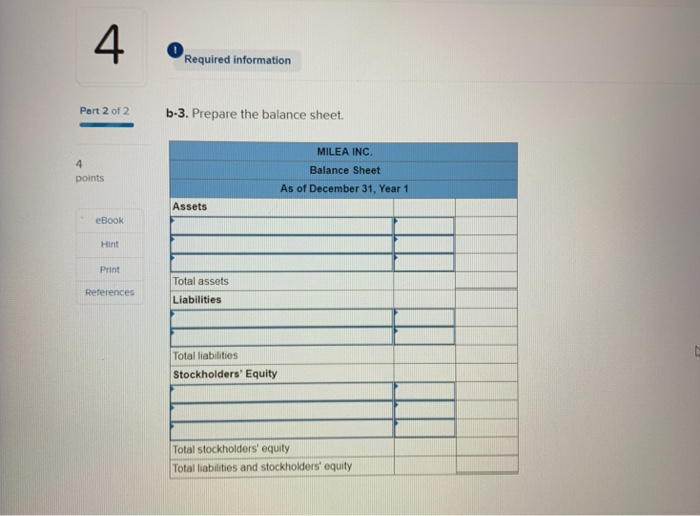

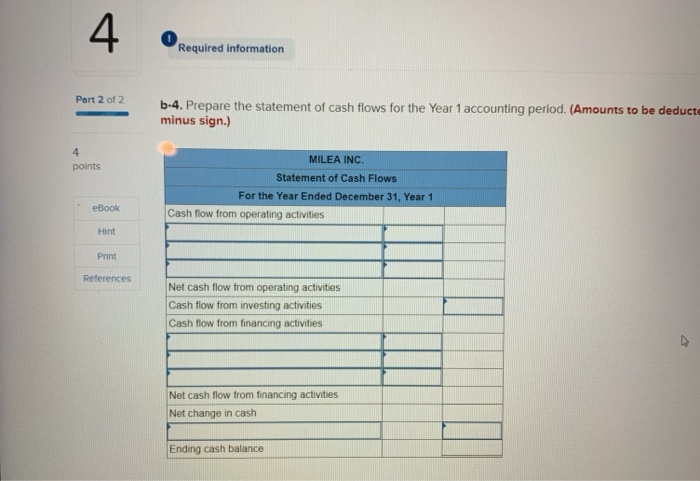

4 0 Required information [The following information applies to the questions displayed below.) Milea Inc. experienced the following events in Year 1, its first year of operations: Part 2 of 2 points eBook Hint Print References 1 Received $12,500 cash from the issue of common stock. 2. Performed services on account for $45,000. 3. Paid the utility expense of $1,300. 4. Collected $38,840 of the accounts receivable. 5. Recorded $7,600 of accrued salaries at the end of the year. 6. Paid a $1,350 cash dividend to the stockholders. b-1. Prepare the income statement MILEA INC. Income Statement For the Year Ended December 31, Year 1 Expenses Total expenses 4 b-1. Prepare the income statement. MILEA INC. Income Statement For the Year Ended December 31, Year 1 Part 2 of 2 points Expenses eBook Hint Print References Total expenses b-2. Prepare the statement of changes in stockholders' equity MILEA INC Statement of Changes in Stockholders' Equity For the Year Ended December 31, Year 1 Beginning common stock Chapter 2 HW Saved Required information Part 2 of 2 b-2. Prepare the statement of changes in stockholders' equity. 4 points MILEA INC Statement of Changes in Stockholders' Equity For the Year Ended December 31, Year 1 eBook Hint Beginning common stock Print Ending common stock Beginning retained earnings References Ending retained earnings Total stockholders' equity b-3. Prepare the balance sheet. Required information Part 2 of 2 b-3. Prepare the balance sheet MILEA INC. Balance Sheet As of December 31, Year 1 points Assets eBook Hint Print Total assets References Liabilities Total liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders equity 4 Required information Part 2 of 2 b-4. Prepare the statement of cash flows for the Year 1 accounting period.(Amounts to be deducte minus sign.) 4 points MILEA INC. Statement of Cash Flows For the Year Ended December 31, Year 1 eBook Cash flow from operating activities Hint Print References Net cash flow from operating activities Cash flow from investing activities Cash flow from financing activities Net cash flow from financing activities Net change in cash Ending cash balance