Answered step by step

Verified Expert Solution

Question

1 Approved Answer

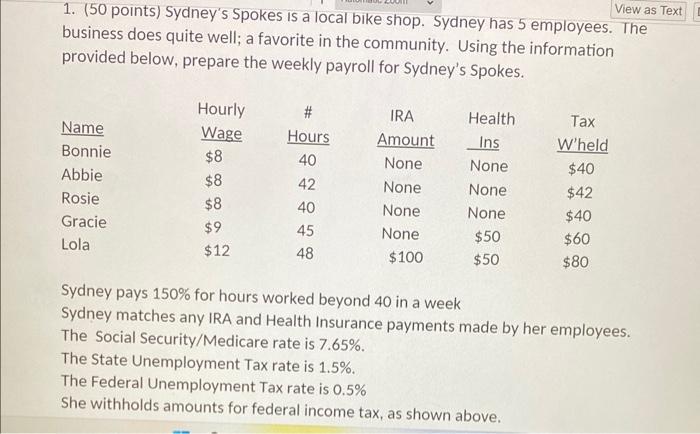

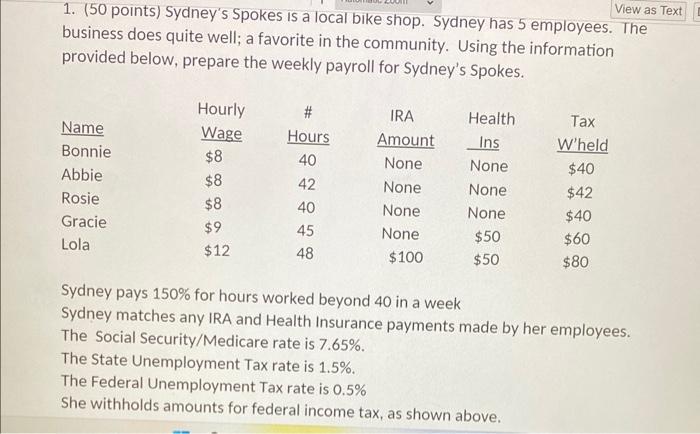

#4 1. (50 points) Sydney's Spokes is a local bike shop. Sydney has 5 employees. The business does quite well; a favorite in the community.

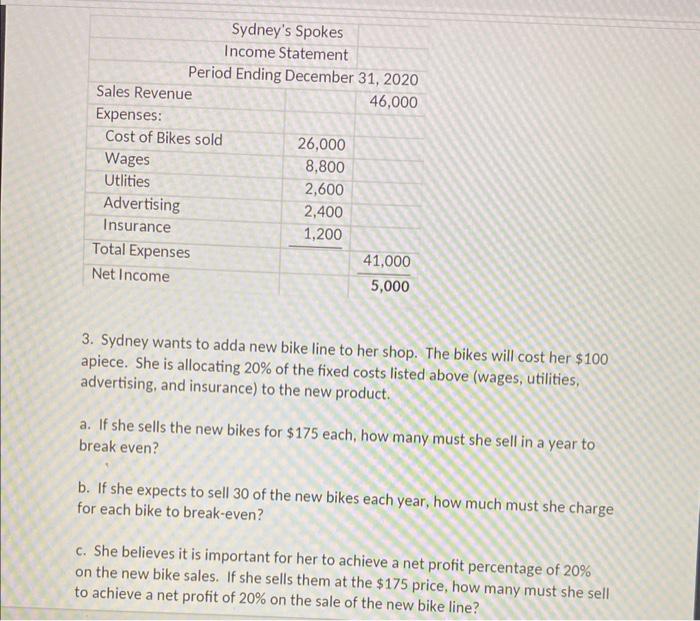

#4

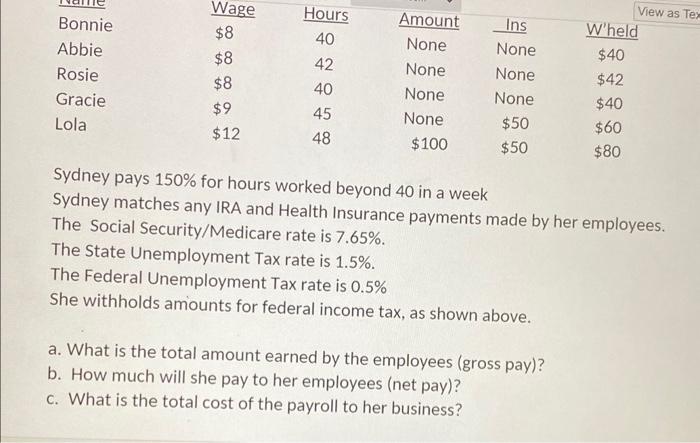

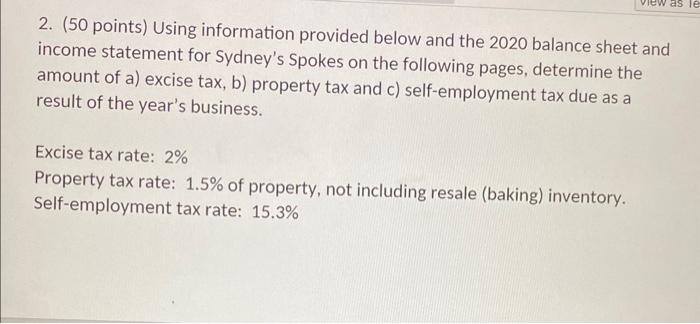

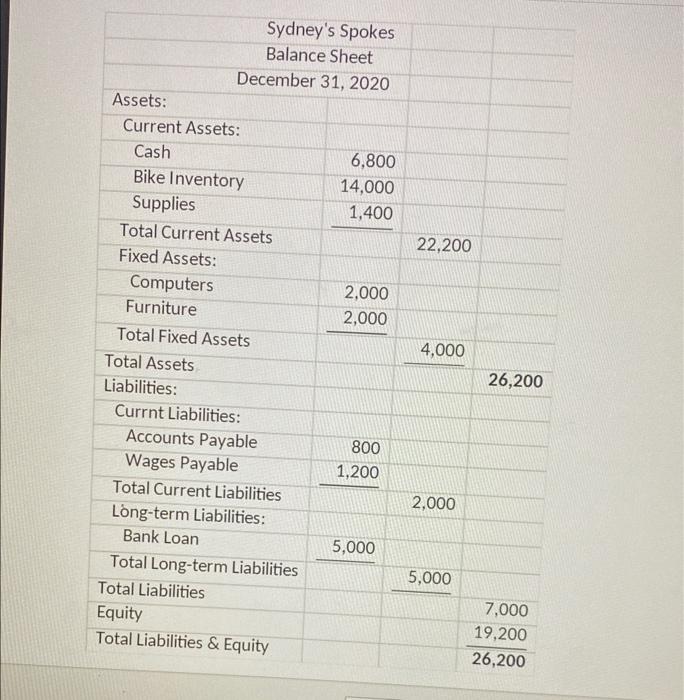

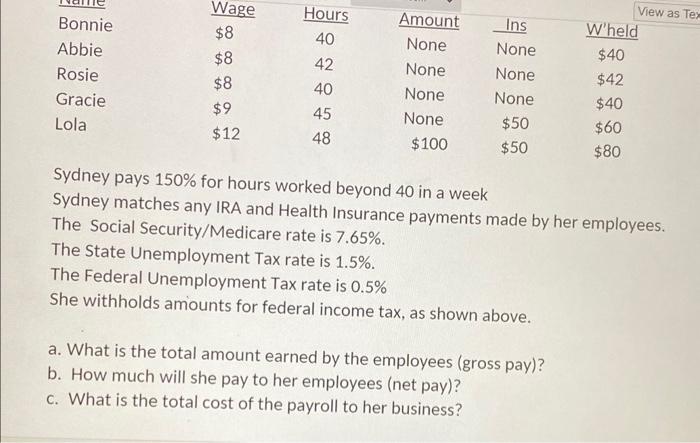

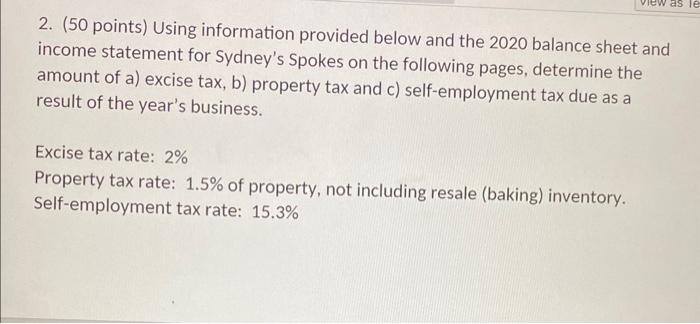

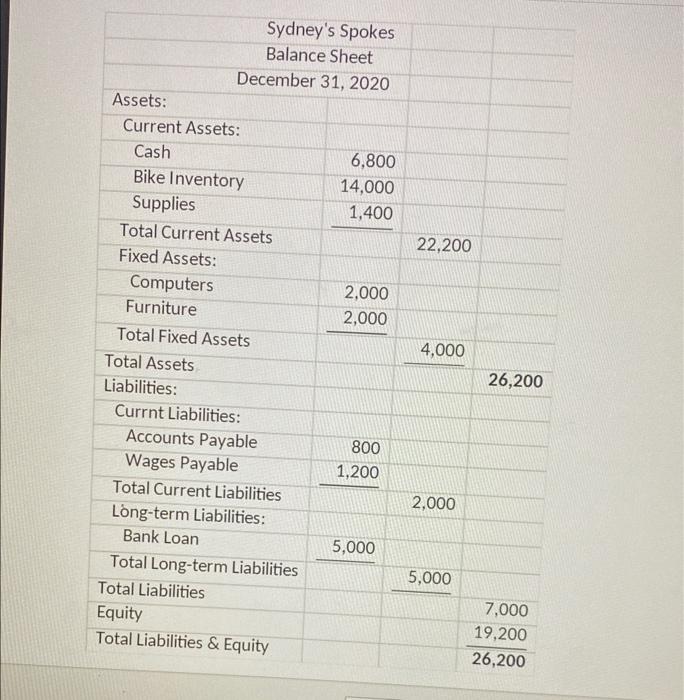

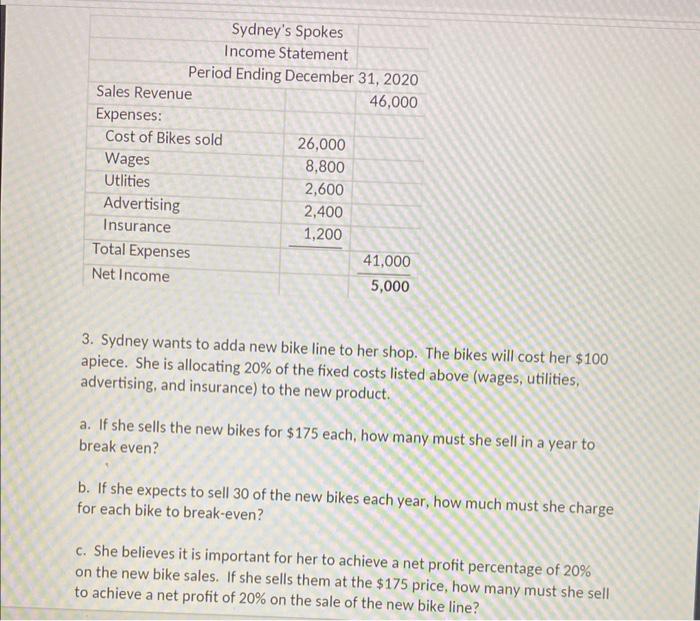

1. (50 points) Sydney's Spokes is a local bike shop. Sydney has 5 employees. The business does quite well; a favorite in the community. Using the information provided below, prepare the weekly payroll for Sydney's Spokes. Sydney pays 150% for hours worked beyond 40 in a week Sydney matches any IRA and Health Insurance payments made by her employees. The Social Security/Medicare rate is 7.65%. The State Unemployment Tax rate is 1.5%. The Federal Unemployment Tax rate is 0.5% She withholds amounts for federal income tax, as shown above. Sydney pays 150% for hours worked beyond 40 in a week Sydney matches any IRA and Health Insurance payments made by her employees. The Social Security/Medicare rate is 7.65%. The State Unemployment Tax rate is 1.5%. The Federal Unemployment Tax rate is 0.5% She withholds amounts for federal income tax, as shown above. a. What is the total amount earned by the employees (gross pay)? b. How much will she pay to her employees (net pay)? c. What is the total cost of the payroll to her business? 2. (50 points) Using information provided below and the 2020 balance sheet and income statement for Sydney's Spokes on the following pages, determine the amount of a) excise tax, b) property tax and c) self-employment tax due as a result of the year's business. Excise tax rate: 2% Property tax rate: 1.5% of property, not including resale (baking) inventory. Self-employment tax rate: 15.3% Sydney's Spokes Balance Sheet December 31, 2020 Assets: 3. Sydney wants to adda new bike line to her shop. The bikes will cost her $100 apiece. She is allocating 20% of the fixed costs listed above (wages, utilities, advertising, and insurance) to the new product. a. If she sells the new bikes for $175 each, how many must she sell in a year to break even? b. If she expects to sell 30 of the new bikes each year, how much must she charge for each bike to break-even? c. She believes it is important for her to achieve a net profit percentage of 20% on the new bike sales. If she sells them at the $175 price, how many must she sell to achieve a net profit of 20% on the sale of the new bike line

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started