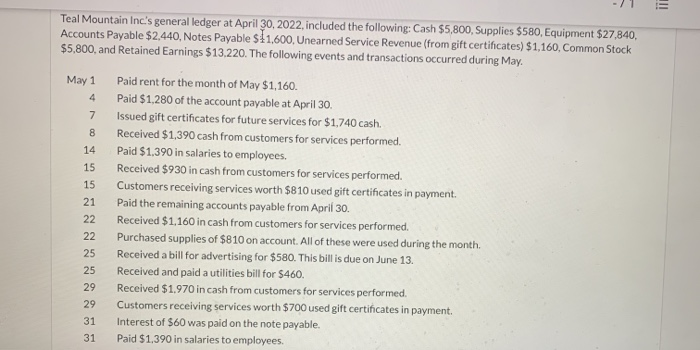

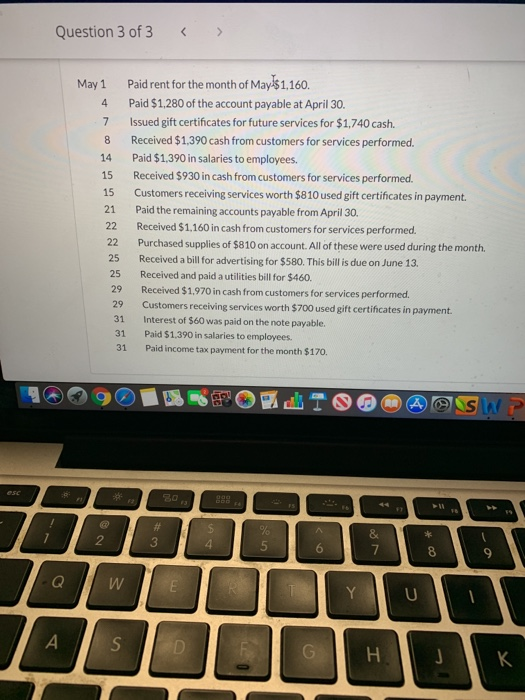

4 14 15 Teal Mountain Inc's general ledger at April 30, 2022, included the following: Cash $5,800, Supplies $580, Equipment $27,840, Accounts Payable $2,440, Notes Payable $11,600, Unearned Service Revenue (from gift certificates) $1,160, Common Stock $5,800, and Retained Earnings $13.220. The following events and transactions occurred during May. May 1 Paid rent for the month of May $1,160. Paid $1,280 of the account payable at April 30. 7 Issued gift certificates for future services for $1,740 cash. 8 Received $1,390 cash from customers for services performed. Paid $1.390 in salaries to employees. Received $930 in cash from customers for services performed. 15 Customers receiving services worth $810 used gift certificates in payment. Paid the remaining accounts payable from April 30. Received $1,160 in cash from customers for services performed Purchased supplies of $810 on account. All of these were used during the month. Received a bill for advertising for $580. This bill is due on June 13. 25 Received and paid a utilities bill for $460. Received $1.970 in cash from customers for services performed. Customers receiving services worth $700 used gift certificates in payment. Interest of $60 was paid on the note payable. 31 Paid $1,390 in salaries to employees. 21 22 22 25 29 29 31 Question 3 of 3 May 1 4 7 8 14 15 15 21 22 22 25 25 29 Paid rent for the month of May$1,160. Paid $1,280 of the account payable at April 30. Issued gift certificates for future services for $1,740 cash. Received $1,390 cash from customers for services performed. Paid $1,390 in salaries to employees. Received $930 in cash from customers for services performed. Customers receiving services worth $810 used gift certificates in payment. Paid the remaining accounts payable from April 30. Received $1,160 in cash from customers for services performed. Purchased supplies of $810 on account. All of these were used during the month. Received a bill for advertising for $580. This bill is due on June 13. Received and paid a utilities bill for $460. Received $1.970 in cash from customers for services performed. Customers receiving services worth $700 used gift certificates in payment Interest of $60 was paid on the note payable. Paid $1.390 in salaries to employees Paid income tax payment for the month $170. 29 31 31 31 999 # 3 * 2 4 % 5 & 7 6 8 9 Q W E Y U S G H. 4 14 15 Teal Mountain Inc's general ledger at April 30, 2022, included the following: Cash $5,800, Supplies $580, Equipment $27,840, Accounts Payable $2,440, Notes Payable $11,600, Unearned Service Revenue (from gift certificates) $1,160, Common Stock $5,800, and Retained Earnings $13.220. The following events and transactions occurred during May. May 1 Paid rent for the month of May $1,160. Paid $1,280 of the account payable at April 30. 7 Issued gift certificates for future services for $1,740 cash. 8 Received $1,390 cash from customers for services performed. Paid $1.390 in salaries to employees. Received $930 in cash from customers for services performed. 15 Customers receiving services worth $810 used gift certificates in payment. Paid the remaining accounts payable from April 30. Received $1,160 in cash from customers for services performed Purchased supplies of $810 on account. All of these were used during the month. Received a bill for advertising for $580. This bill is due on June 13. 25 Received and paid a utilities bill for $460. Received $1.970 in cash from customers for services performed. Customers receiving services worth $700 used gift certificates in payment. Interest of $60 was paid on the note payable. 31 Paid $1,390 in salaries to employees. 21 22 22 25 29 29 31 Question 3 of 3 May 1 4 7 8 14 15 15 21 22 22 25 25 29 Paid rent for the month of May$1,160. Paid $1,280 of the account payable at April 30. Issued gift certificates for future services for $1,740 cash. Received $1,390 cash from customers for services performed. Paid $1,390 in salaries to employees. Received $930 in cash from customers for services performed. Customers receiving services worth $810 used gift certificates in payment. Paid the remaining accounts payable from April 30. Received $1,160 in cash from customers for services performed. Purchased supplies of $810 on account. All of these were used during the month. Received a bill for advertising for $580. This bill is due on June 13. Received and paid a utilities bill for $460. Received $1.970 in cash from customers for services performed. Customers receiving services worth $700 used gift certificates in payment Interest of $60 was paid on the note payable. Paid $1.390 in salaries to employees Paid income tax payment for the month $170. 29 31 31 31 999 # 3 * 2 4 % 5 & 7 6 8 9 Q W E Y U S G H