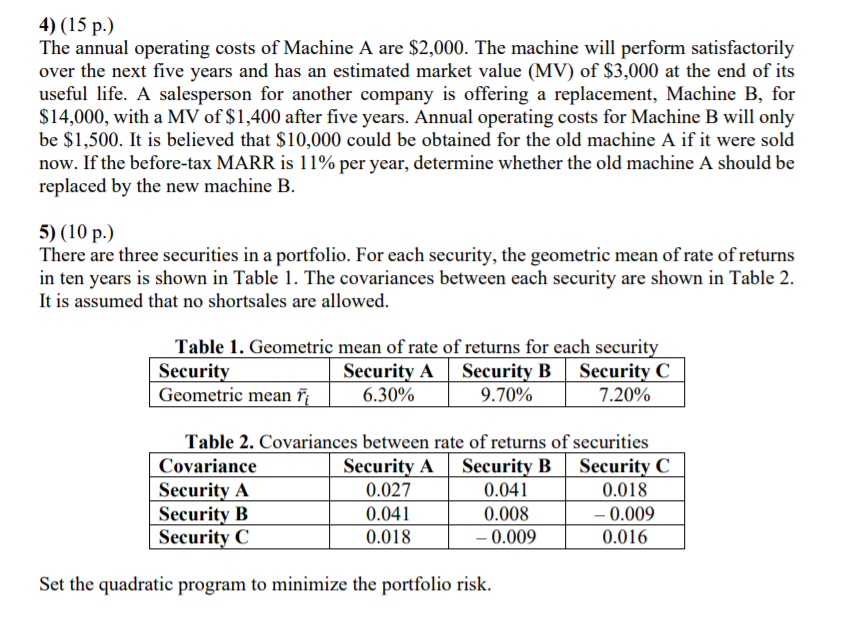

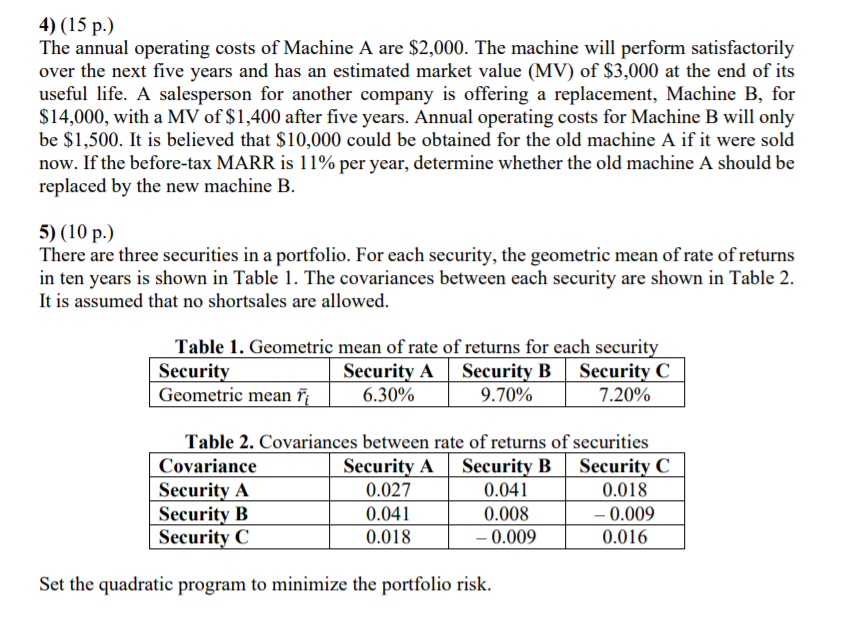

4) (15 p.) The annual operating costs of Machine A are $2,000. The machine will perform satisfactorily over the next five years and has an estimated market value (MV) of $3,000 at the end of its useful life. A salesperson for another company is offering a replacement, Machine B, for $14,000, with a MV of $1,400 after five years. Annual operating costs for Machine B will only be $1,500. It is believed that $10,000 could be obtained for the old machine A if it were sold now. If the before-tax MARR is 11% per year, determine whether the old machine A should be replaced by the new machine B. 5) (10 p.) There are three securities in a portfolio. For each security, the geometric mean of rate of returns in ten years is shown in Table 1. The covariances between each security are shown in Table 2. It is assumed that no shortsales are allowed. Table 1. Geometric mean of rate of returns for each security Security Security A Security B Security C Geometric mean i 6.30% 9.70% 7.20% Table 2. Covariances between rate of returns of securities Covariance Security A Security B Security C Security A 0.027 0.041 0.018 Security B 0.041 0.008 -0.009 Security C 0.018 -0.009 0.016 Set the quadratic program to minimize the portfolio risk. 4) (15 p.) The annual operating costs of Machine A are $2,000. The machine will perform satisfactorily over the next five years and has an estimated market value (MV) of $3,000 at the end of its useful life. A salesperson for another company is offering a replacement, Machine B, for $14,000, with a MV of $1,400 after five years. Annual operating costs for Machine B will only be $1,500. It is believed that $10,000 could be obtained for the old machine A if it were sold now. If the before-tax MARR is 11% per year, determine whether the old machine A should be replaced by the new machine B. 5) (10 p.) There are three securities in a portfolio. For each security, the geometric mean of rate of returns in ten years is shown in Table 1. The covariances between each security are shown in Table 2. It is assumed that no shortsales are allowed. Table 1. Geometric mean of rate of returns for each security Security Security A Security B Security C Geometric mean i 6.30% 9.70% 7.20% Table 2. Covariances between rate of returns of securities Covariance Security A Security B Security C Security A 0.027 0.041 0.018 Security B 0.041 0.008 -0.009 Security C 0.018 -0.009 0.016 Set the quadratic program to minimize the portfolio risk