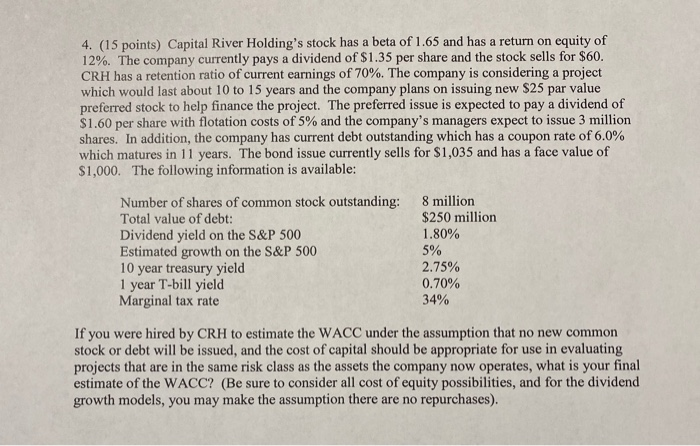

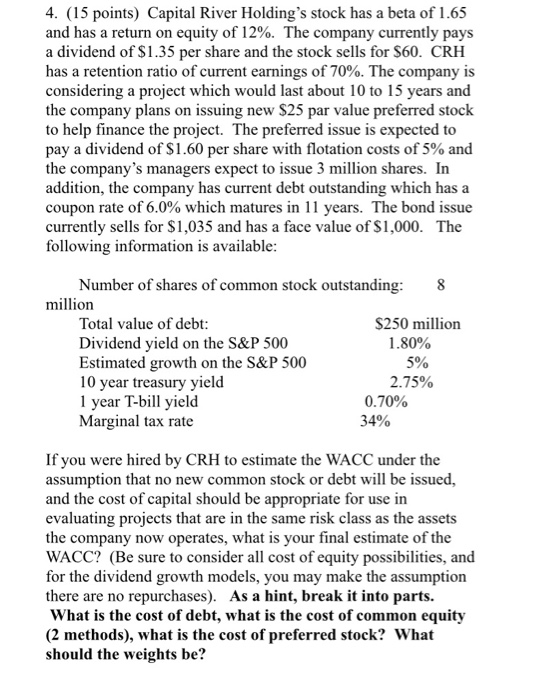

4. (15 points) Capital River Holding's stock has a beta of 1.65 and has a return on equity of 12%. The company currently pays a dividend of $1.35 per share and the stock sells for $60. CRH has a retention ratio of current earnings of 70%. The company is considering a project which would last about 10 to 15 years and the company plans on issuing new $25 par value preferred stock to help finance the project. The preferred issue is expected to pay a dividend of $1.60 per share with flotation costs of 5% and the company's managers expect to issue 3 million shares. In addition, the company has current debt outstanding which has a coupon rate of 6.0% which matures in 11 years. The bond issue currently sells for $1,035 and has a face value of $1,000. The following information is available: Number of shares of common stock outstanding: Total value of debt: Dividend yield on the S&P 500 Estimated growth on the S&P 500 10 year treasury yield 1 year T-bill yield Marginal tax rate 8 million $250 million 1.80% 5% 2.75% 0.70% 34% If you were hired by CRH to estimate the WACC under the assumption that no new common stock or debt will be issued, and the cost of capital should be appropriate for use in evaluating projects that are in the same risk class as the assets the company now operates, what is your final estimate of the WACC? (Be sure to consider all cost of equity possibilities, and for the dividend growth models, you may make the assumption there are no repurchases). 4. (15 points) Capital River Holding's stock has a beta of 1.65 and has a return on equity of 12%. The company currently pays a dividend of $1.35 per share and the stock sells for $60. CRH has a retention ratio of current earnings of 70%. The company is considering a project which would last about 10 to 15 years and the company plans on issuing new $25 par value preferred stock to help finance the project. The preferred issue is expected to pay a dividend of $1.60 per share with flotation costs of 5% and the company's managers expect to issue 3 million shares. In addition, the company has current debt outstanding which has a coupon rate of 6.0% which matures in 11 years. The bond issue currently sells for $1,035 and has a face value of $1,000. The following information is available: Number of shares of common stock outstanding: 8 million Total value of debt: $250 million Dividend yield on the S&P 500 1.80% Estimated growth on the S&P 500 5% 10 year treasury yield 2.75% 1 year T-bill yield 0.70% Marginal tax rate 34% If you were hired by CRH to estimate the WACC under the assumption that no new common stock or debt will be issued, and the cost of capital should be appropriate for use in evaluating projects that are in the same risk class as the assets the company now operates, what is your final estimate of the WACC? (Be sure to consider all cost of equity possibilities, and for the dividend growth models, you may make the assumption there are no repurchases). As a hint, break it into parts. What is the cost of debt, what is the cost of common equity (2 methods), what is the cost of preferred stock? What should the weights be