Answered step by step

Verified Expert Solution

Question

1 Approved Answer

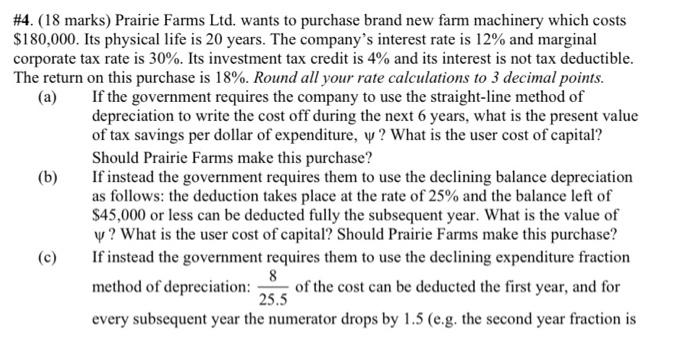

#4. (18 marks) Prairie Farms Ltd. wants to purchase brand new farm machinery which costs $180,000. Its physical life is 20 years. The company's

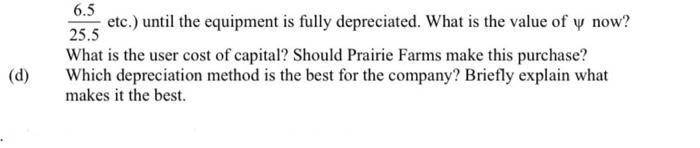

#4. (18 marks) Prairie Farms Ltd. wants to purchase brand new farm machinery which costs $180,000. Its physical life is 20 years. The company's interest rate is 12% and marginal corporate tax rate is 30%. Its investment tax credit is 4% and its interest is not tax deductible. The return on this purchase is 18%. Round all your rate calculations to 3 decimal points. If the government requires the company to use the straight-line method of depreciation to write the cost off during the next 6 years, what is the present value of tax savings per dollar of expenditure, y? What is the user cost of capital? Should Prairie Farms make this purchase? (a) If instead the government requires them to use the declining balance depreciation as follows: the deduction takes place at the rate of 25% and the balance left of $45,000 or less can be deducted fully the subsequent year. What is the value of y? What is the user cost of capital? Should Prairie Farms make this purchase? If instead the government requires them to use the declining expenditure fraction 8 method of depreciation: of the cost can be deducted the first year, and for 25.5 every subsequent year the numerator drops by 1.5 (e.g. the second year fraction is (b) (c) (d) 6.5 etc.) until the equipment is fully depreciated. What is the value of y now? 25.5 What is the user cost of capital? Should Prairie Farms make this purchase? Which depreciation method is the best for the company? Briefly explain what makes it the best.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Using straightline depreciation Cost of machinery 180000 Physical life 20 years Depreciation each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started