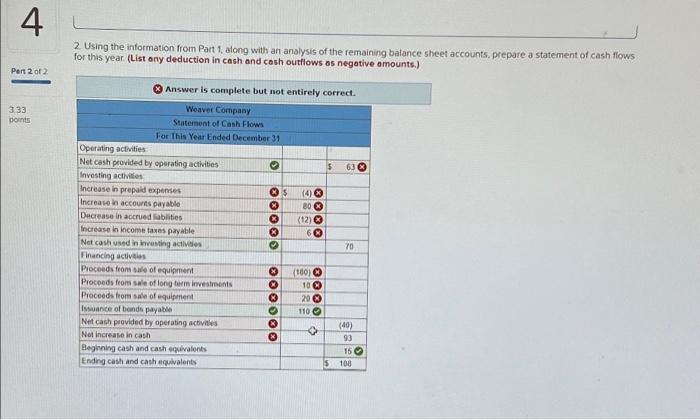

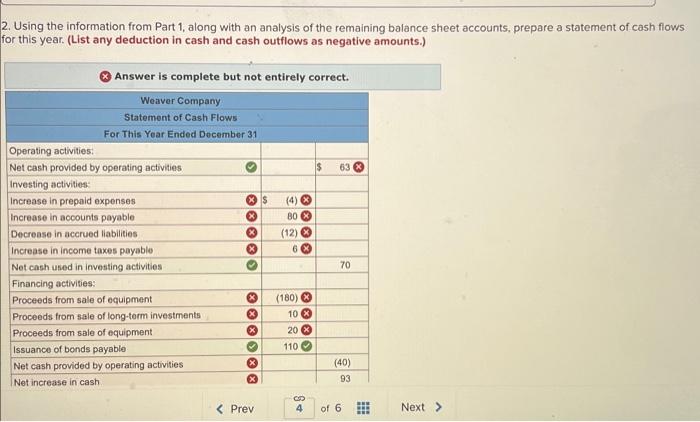

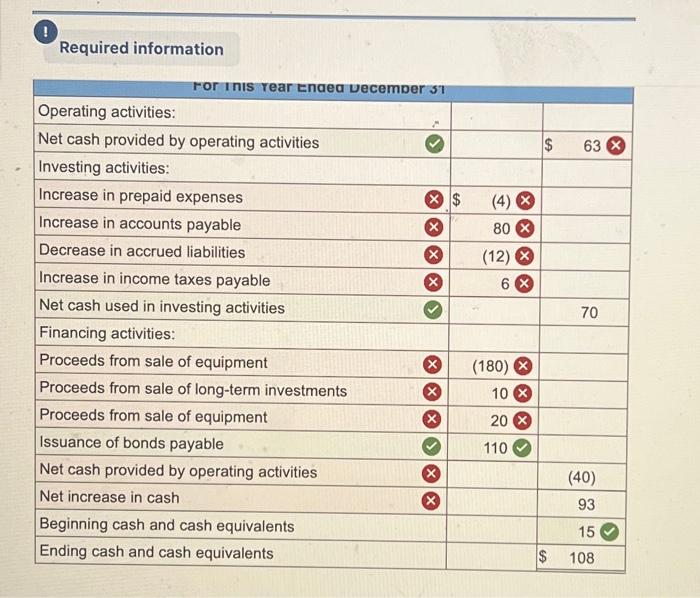

4 2. Using the information from Part 1, along with an analysis of the remaining balance sheet accounts, prepare a statement of cash flows for this year. (List any deduction in cash and cash outflows as negative amounts.) Part 2 of 2 3.33 points X Answer is complete but not entirely correct. Weaver Company Statement of Cash Flows For This Year Ended December 31 Operating activities: Net cash provided by operating activities Investing activities. Increase in prepaid expenses Increase in accounts payable Decrease in accrued liabilities Increase in income taxes payable Net cash used in investing activities Financing activities Proceeds from sale of equipment Proceeds from sale of long-term investments Proceeds from sale of equipment Issuance of bonds payable Net cash provided by operating activities Net increase in cash Beginning cash and cash equivalents Ending cash and cash equivalents ****> X S X XX3 (4) X 80 x (12) X 6 x (180) X 10 x 20 x 110 V $ $ 63 70 (40) 93 15 108

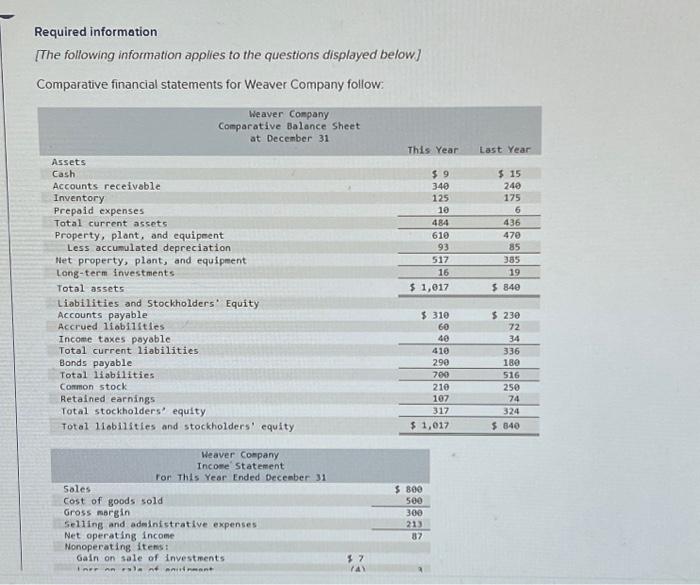

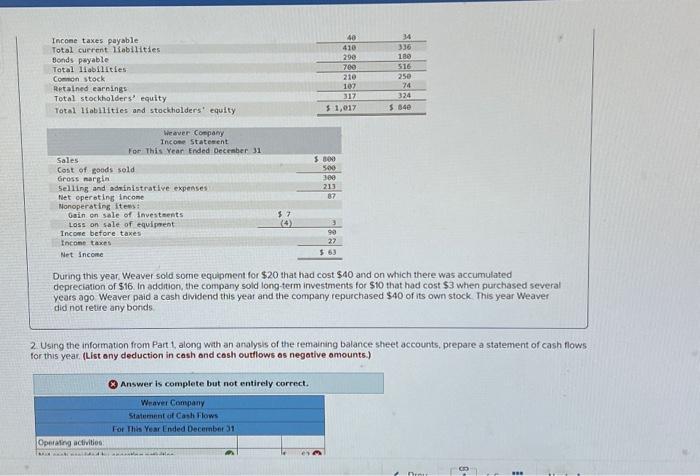

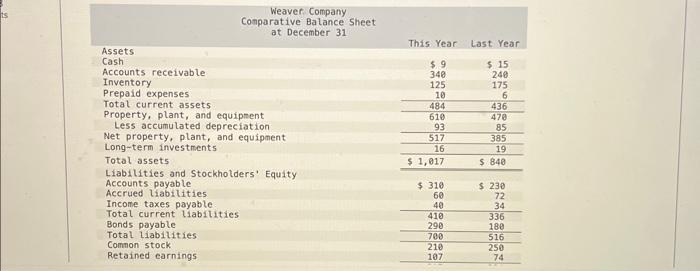

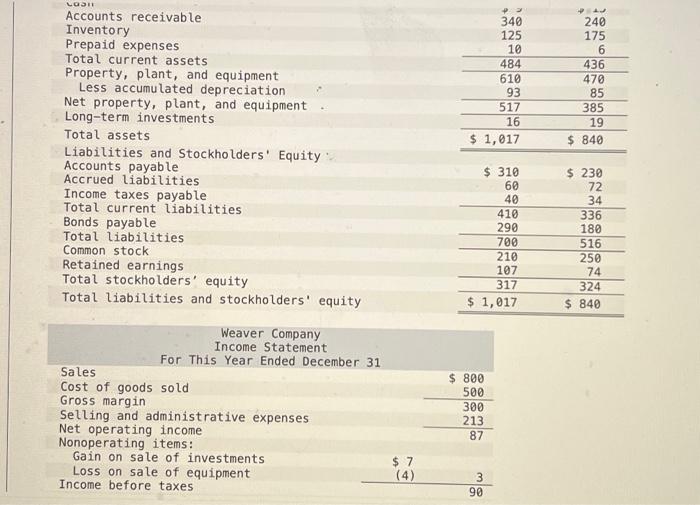

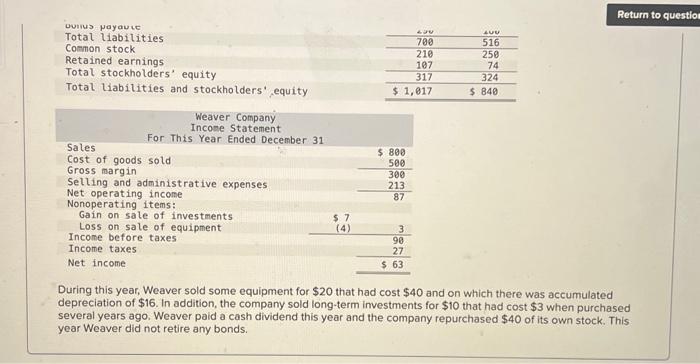

2. Using the information from Part 1, along with an analysis of the remaining balance sheet accounts, prepare a statement of cash flows for this year. (List any deduction in cash and cash outflows as negative amounts.) Return to questio vorius payaure Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Weaver Company Income Statement For This Year Ended December 31 During this year, Weaver sold some equipment for $20 that had cost $40 and on which there was accumulated depreciation of $16. In addition, the company sold long-term investments for $10 that had cost $3 when purchased several years ago. Weaver paid a cash dividend this year and the company repurchased $40 of its own stock. This year Weaver did not retire any bonds. Required information [The following information applies to the questions displayed below] Comparative financial statements for Weaver Company follow: Incone taxes payable Total current liabilities fonds payable Toral liabilities Coenon stock Retalned earnings Total stockholders' equity Tatal IfablHities and stacktiolders' equity Wewer cotpary Incone statesent for This Yean Ended Decisaber M1 Sales Cost of poods sold Gross nargin selling and adxinistrative expenses let eperoting incone Monoperating ltews: osin on sale of investeents Loss on sale of equiment Income before taxes Incone taxes Net Incore During this year. Weaver sold some equipment for $20 that had cost $40 and on which there was accumulated depreciation of $16. In addition, the company sold long-term investments for $10 that had cost $3 when purchased several years ago Weaver paid a cash dividend this year and the company repuechased $40 of its own stock. This year Weaver did not retire any bonds 2. Using the information from Part 1 along wth an analysis of the remaining balance sheet accounts, prepare a statement of cash flows for this year. (List ony deduction in cash ond cosh outlows as negative omounts) Answer is complete but not entirely correct. Weaver Company Statement of Cash Flows For Thas Year Lnded December 31 Operarro activities: Weaver Company Comparative Balance Sheet at December 31 This Year Last Year Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Long-term investments Total assets Liabilities and Stockhoiders' Equity Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total Liabilities Comnon stock Retained earnings \begin{tabular}{rr} $9 & $15 \\ 340 & 240 \\ 125 & 175 \\ 10 & 6 \\ \hline 484 & 436 \\ \hline 610 & 470 \\ 93 & 85 \\ \hline 517 & 385 \\ \hline 16 & 19 \\ \hline$1,017 & $840 \\ \hline & \\ $310 & $230 \\ 60 & 72 \\ 40 & 34 \\ \hline 410 & 336 \\ 290 & 180 \\ \hline 700 & 516 \\ \hline 210 & 250 \\ 107 & 74 \\ \hline \end{tabular} Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Long-term investments Total assets Liabilities and Stockholders' Equity Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Weaver Company Income Statement For This Year Ended December 31 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Gain on sale of investments Loss on sale of equipment Income before taxes $7 (4) Required information 4 2 Using the information from Part 1, along with an analysis of the remaining batance sheet accounts. prepare a statement of cash flows for this year. (List ony deduction in cash and cash outflows os negotive amounts.) Pert 2 of 2 Answer is complete but not entirely correct. 333 polens