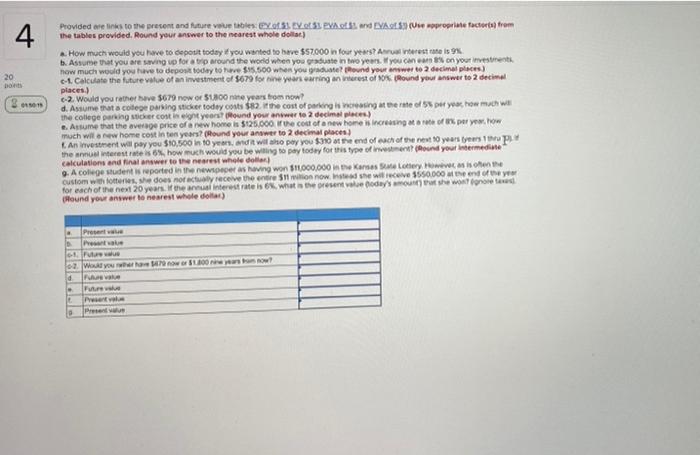

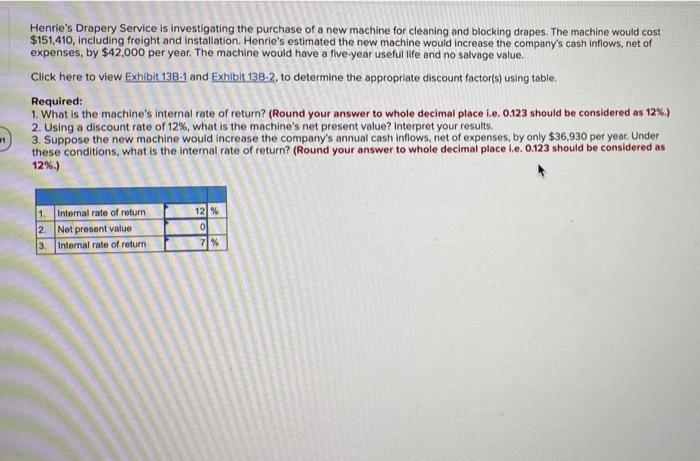

4 20 Com . Provided are so the present and future value tiene el vot s PVA 2 and EVA (Une apropriate factors from the tables provided. Round your answer to the nearest whole dollar) How much would you have to deposit today you wanted to have $57000 in four years? Arrestate is 9% to. Assume that you are saving up for a trip around the world when you graduate into years, you can earn on your investment how much would you have to deposit today to have $45.500 when you wound your answer to 2 decimal places) 1. Calculate the future value of an investment of 5679 for nine years earringan rest of tox Round your answer to 2 decimal places.) -2. Would you rather have $679 now or 180 years from now? d. Assume that a college Darling stiker today costs $82, the cost of parking is creasing at the rate of persona the college parking sercontinent years Round your answer to 2 decimal places) Assume that the average price of a new home is $125.000 if the cost of a new home increase of peryw.how much wil new home cost in ten years? (Round your answer to 2 decimal places) An investment will pay you $10,500 in 10 years, and it wilho pay you $3101 the end of each of the next 10 years yes 1 the annual interest rate is 6% how much would you be willing to pay today for this type of investment Cound you intermediate calculations and final answer to the nearest whole do 9. A college student is reported in the newer as having won 511,000,000 in Kansas Se Loterys is one custom w fotter, she does not receive the entire Simon now. she will receive 350.000 Neend of the ye for each of the next 20 years, the interest rate is what is representa oday's ON she wont grote Hound your answer to nearest whole dollar) Presente . Pure we Wo your how 100 d PV Future Part Prep Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $151,410, including freight and installation. Henrie's estimated the new machine would increase the company's cash inflows, net of expenses, by $42,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view Exhibit 138-1 and Exhibit 138-2, to determine the appropriate discount factor(s) using table Required: 1. Who is the machine's internal rate of retur? (Round your answer to whole decimal place .e. 0123 should be considered as 12%) 2. Using a discount rate of 12%, what is the machine's net present value? Interpret your results. 3. Suppose the new machine would increase the company's annual cash inflows, net of expenses, by only $36,930 per year. Under these conditions, what is the internal rate of return? (Round your answer to whole decimal place le 0123 should be considered as 12%.) 1 1. Internal rate of return 2 Not present value 3 Internal rate of return 12% 0 71%