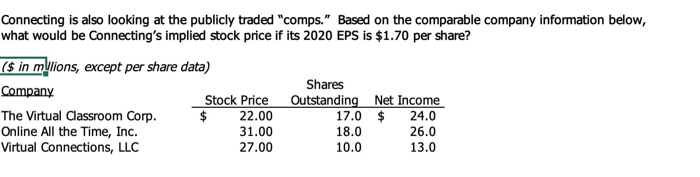

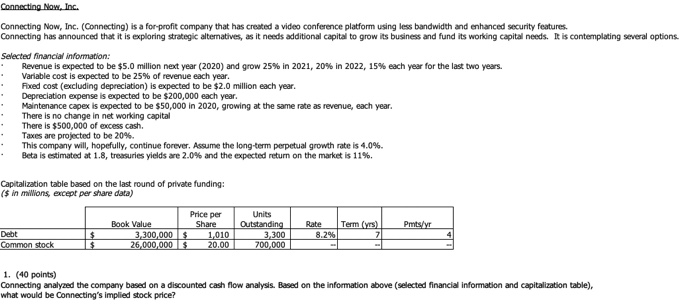

4. ( 20 points) Connecting has also been approached by Online All the Time, Inc. (Online) about a possible business combination in which Online would purchase Connecting. Assume the pre-merger (fair value) Connecting is approximately $14 million, excluding debt. Online believes that combining the companies could generate the following after-tax benefits/costs: additional revenue of $5 million, $1.5 million of severance and termination fees, and $5 million of additional cost saving. Assume the market is fairly valuing Online at $558 million. 4a. What is the pro forma value of the combined firm (including Connecting's debt)? 4b. What is the most (per share) that Online should pay to Connecting's Shareholders? 4c. What is the least (per share) that connecting's Shareholders should accept? 4d. Please list 1 pro and 1 con Connecting's Management Team should consider before entering into this transaction. 5a. What are 2 conditions that must be satisfied to make this capital structure decision irrelevant? 5b. What are 2 ways a company could distribute excess cash to its shareholders? 5c. What is the difference between a horizontal and vertical merger? Connecting is also looking at the publicly traded "comps." Based on the comparable company information below, what would be connecting's implied stock price if its 2020 EPS is $1.70 per share? ($ in mllions, except per share data) Company Stock Price The Virtual Classroom Corp. $ 22.00 Online All the Time, Inc. 31.00 Virtual Connections, LLC 27.00 Shares Outstanding Net Income 17.0 $ 24.0 26.0 10.0 13.0 18.0 3. (5 points) What is your recommended price per share based on 1 & 2 above, and why? Connecting Now, Inc. Connecting Now, Inc. (Connecting) is a for-profit company that has created a video conference platform using less bandwidth and enhanced security features. Connecting has announced that it is exploring strategic alternatives, as it needs additional capital to grow its business and fund its working capital needs. It is contemplating several options Selected financial information: Revenue is expected to be $5.0 million next year (2020) and grow 25% in 2021, 20% in 2022, 15% each year for the last two years. Variable cost is expected to be 25% of revenue each year. Fixed cost (excluding depreciation) is expected to be $2.0 million each year. Depreciation expense is expected to be $200,000 each year. Maintenance capex is expected to be $50,000 in 2020, growing at the same rate as revenue, each year. There is no change in net working capital There is $500,000 of excess cash. Taxes are projected to be 20%. This company will hopefully, continue forever. Assume the long-term perpetual growth rate is 4.0% Beta is estimated at 1.8, treasures yields are 2.0% and the expected return on the market is 11%. Capitalization table based on the last round of private funding: ($ in millions, except per share data) Term (vs) Pmtsdyr Price per Share $ 1.010 $ 20.00 Book Value 3,300,000 26,000,000 Units Outstanding 3.300 700,000 Rate 8.2% Debt Common stock $ 1. (40 points) Connecting analyzed the company based on a discounted cash flow analysis. Based on the information above (selected financial information and capitalization table), what would be connecting's implied stock price? 4. ( 20 points) Connecting has also been approached by Online All the Time, Inc. (Online) about a possible business combination in which Online would purchase Connecting. Assume the pre-merger (fair value) Connecting is approximately $14 million, excluding debt. Online believes that combining the companies could generate the following after-tax benefits/costs: additional revenue of $5 million, $1.5 million of severance and termination fees, and $5 million of additional cost saving. Assume the market is fairly valuing Online at $558 million. 4a. What is the pro forma value of the combined firm (including Connecting's debt)? 4b. What is the most (per share) that Online should pay to Connecting's Shareholders? 4c. What is the least (per share) that connecting's Shareholders should accept? 4d. Please list 1 pro and 1 con Connecting's Management Team should consider before entering into this transaction. 5a. What are 2 conditions that must be satisfied to make this capital structure decision irrelevant? 5b. What are 2 ways a company could distribute excess cash to its shareholders? 5c. What is the difference between a horizontal and vertical merger? Connecting is also looking at the publicly traded "comps." Based on the comparable company information below, what would be connecting's implied stock price if its 2020 EPS is $1.70 per share? ($ in mllions, except per share data) Company Stock Price The Virtual Classroom Corp. $ 22.00 Online All the Time, Inc. 31.00 Virtual Connections, LLC 27.00 Shares Outstanding Net Income 17.0 $ 24.0 26.0 10.0 13.0 18.0 3. (5 points) What is your recommended price per share based on 1 & 2 above, and why? Connecting Now, Inc. Connecting Now, Inc. (Connecting) is a for-profit company that has created a video conference platform using less bandwidth and enhanced security features. Connecting has announced that it is exploring strategic alternatives, as it needs additional capital to grow its business and fund its working capital needs. It is contemplating several options Selected financial information: Revenue is expected to be $5.0 million next year (2020) and grow 25% in 2021, 20% in 2022, 15% each year for the last two years. Variable cost is expected to be 25% of revenue each year. Fixed cost (excluding depreciation) is expected to be $2.0 million each year. Depreciation expense is expected to be $200,000 each year. Maintenance capex is expected to be $50,000 in 2020, growing at the same rate as revenue, each year. There is no change in net working capital There is $500,000 of excess cash. Taxes are projected to be 20%. This company will hopefully, continue forever. Assume the long-term perpetual growth rate is 4.0% Beta is estimated at 1.8, treasures yields are 2.0% and the expected return on the market is 11%. Capitalization table based on the last round of private funding: ($ in millions, except per share data) Term (vs) Pmtsdyr Price per Share $ 1.010 $ 20.00 Book Value 3,300,000 26,000,000 Units Outstanding 3.300 700,000 Rate 8.2% Debt Common stock $ 1. (40 points) Connecting analyzed the company based on a discounted cash flow analysis. Based on the information above (selected financial information and capitalization table), what would be connecting's implied stock price