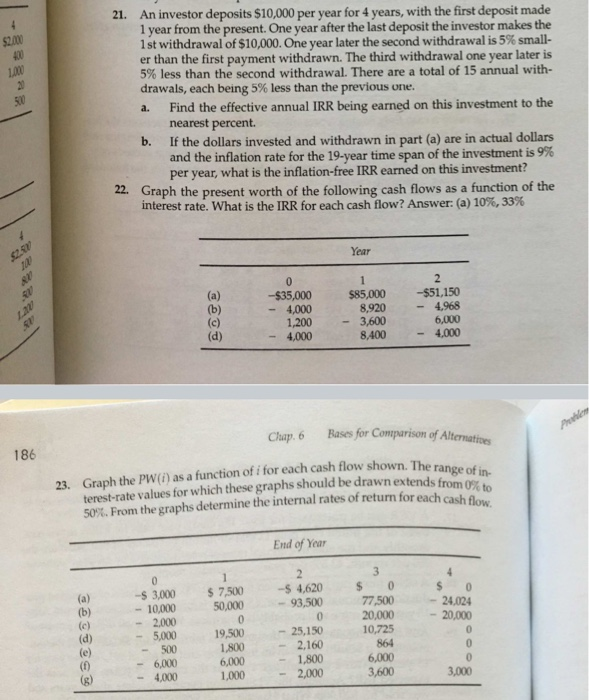

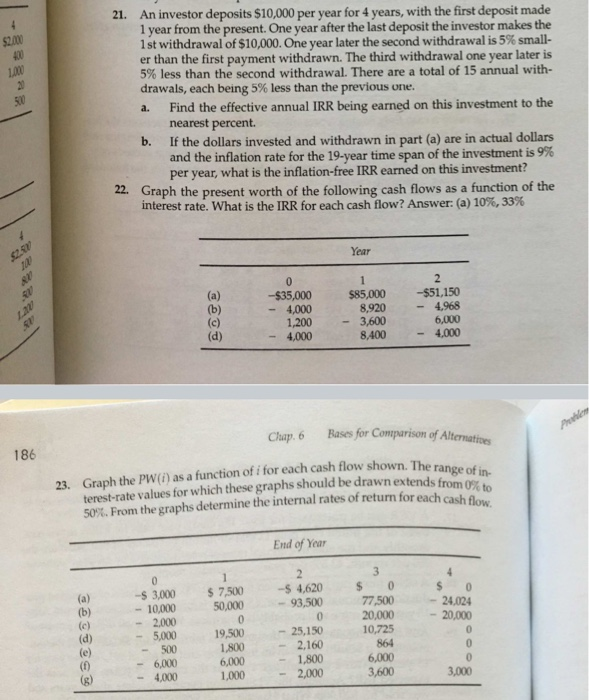

4 $2.000 1.000 20 5 21. An investor deposits $10,000 per year for 4 years, with the first deposit made 1 year from the present. One year after the last deposit the investor makes the 1st withdrawal of $10,000. One year later the second withdrawal is 5% small- er than the first payment withdrawn. The third withdrawal one year later is 5% less than the second withdrawal. There are a total of 15 annual with- drawals, each being 5% less than the previous one. Find the effective annual IRR being earned on this investment to the nearest percent b. If the dollars invested and withdrawn in part (a) are in actual dollars and the inflation rate for the 19-year time span of the investment is 9% per year, what is the inflation-free IRR earned on this investment? 22. Graph the present worth of the following cash flows as a function of the interest rate. What is the IRR for each cash flow? Answer: (a) 10%, 33% a. + Year V (a) 0 -$35,000 4,000 1,200 4.000 1 $85,000 8,920 3,600 8.400 2 -$51,150 4.968 6,000 4,000 @ (d) Clap. 6 Bases for Comparison of Alternatives 186 23. Graph the PWD) as a function of i for each cash flow shown. The range of in- terest-rate values for which these graphs should be drawn extends from 0%" 50%. From the graphs determine the internal rates of return for each cash flow End of Year (a) (b) (c) (d) 11 0 -S 3.000 10,000 2.000 5,000 500 6,000 4,000 1 $ 7,500 50,000 0 19,500 1.800 6,000 2 -4,620 93,500 0 - 25,150 2,160 1,800 2,000 3 0 77,500 20,000 10,725 864 6,000 3,600 $ 24.024 20,000 0 0 0 3,000 1 1 1 1 1,000 4 $2.000 1.000 20 5 21. An investor deposits $10,000 per year for 4 years, with the first deposit made 1 year from the present. One year after the last deposit the investor makes the 1st withdrawal of $10,000. One year later the second withdrawal is 5% small- er than the first payment withdrawn. The third withdrawal one year later is 5% less than the second withdrawal. There are a total of 15 annual with- drawals, each being 5% less than the previous one. Find the effective annual IRR being earned on this investment to the nearest percent b. If the dollars invested and withdrawn in part (a) are in actual dollars and the inflation rate for the 19-year time span of the investment is 9% per year, what is the inflation-free IRR earned on this investment? 22. Graph the present worth of the following cash flows as a function of the interest rate. What is the IRR for each cash flow? Answer: (a) 10%, 33% a. + Year V (a) 0 -$35,000 4,000 1,200 4.000 1 $85,000 8,920 3,600 8.400 2 -$51,150 4.968 6,000 4,000 @ (d) Clap. 6 Bases for Comparison of Alternatives 186 23. Graph the PWD) as a function of i for each cash flow shown. The range of in- terest-rate values for which these graphs should be drawn extends from 0%" 50%. From the graphs determine the internal rates of return for each cash flow End of Year (a) (b) (c) (d) 11 0 -S 3.000 10,000 2.000 5,000 500 6,000 4,000 1 $ 7,500 50,000 0 19,500 1.800 6,000 2 -4,620 93,500 0 - 25,150 2,160 1,800 2,000 3 0 77,500 20,000 10,725 864 6,000 3,600 $ 24.024 20,000 0 0 0 3,000 1 1 1 1 1,000