Answered step by step

Verified Expert Solution

Question

1 Approved Answer

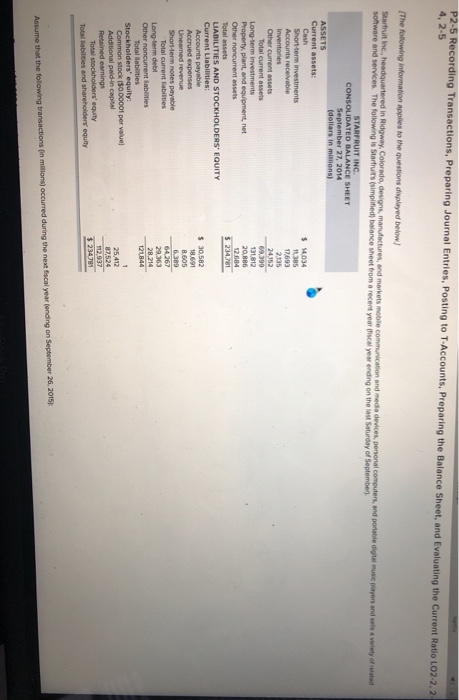

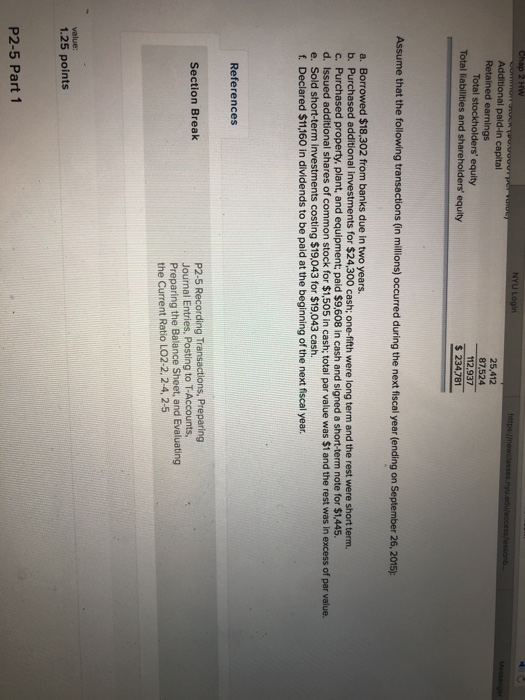

4, 2-5 in Ridgway 27, 2014 135 Other current assets Other Total assets $ 30,582 2 HW NYU L 25,412 87,524 112,937 $ 234,781 Retained

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started